Share of Seoul Apartment Purchases by People in Their 20s and 30s Drops to 33.2% in April

Down 5 Percentage Points from 38.2% in January

Home Prices Rising Too Fast for Even Maximum Loans to Keep Up

As apartment prices rise, cases of people giving up on purchasing apartments despite borrowing to the maximum are increasing. Getty Images

As apartment prices rise, cases of people giving up on purchasing apartments despite borrowing to the maximum are increasing. Getty Images

Lee Hyunsu (34), who runs a cafe in Seongdong-gu, Seoul, recently gave up on buying a home after attempting "Yeongkkeul" (borrowing to the utmost limit). With a wedding planned for April next year, he had intended to purchase a 59-square-meter apartment in Haengdang-dong, within the same district. However, every time he went to inspect properties, prices had risen, and recently, the price jumped by more than 100 million won, making it completely out of reach. Having lived in Seongdong-gu for over ten years, he could not imagine leaving, and wanted to stay close to his business, so he decided to save more money. He said, "After discussing with my girlfriend, we decided to continue living in our current officetel even after getting married." However, he also expressed concern, saying, "I'm worried that the pace of apartment price increases is steeper than what we can save together, and that we might regret it if this turns out to have been the cheapest time to buy."

Recently, the proportion of home purchases by people in their 20s and 30s?often referred to as the "Yeongkkeul-jok" (those borrowing to the limit)?has been gradually declining. As home prices have risen to levels that cannot be covered even with loans, more young people are giving up on buying altogether. Despite this, apartment prices continue to climb, further reducing the likelihood that they will be able to buy a home in the future. Calls for the government to create a housing ladder for young people are growing stronger.

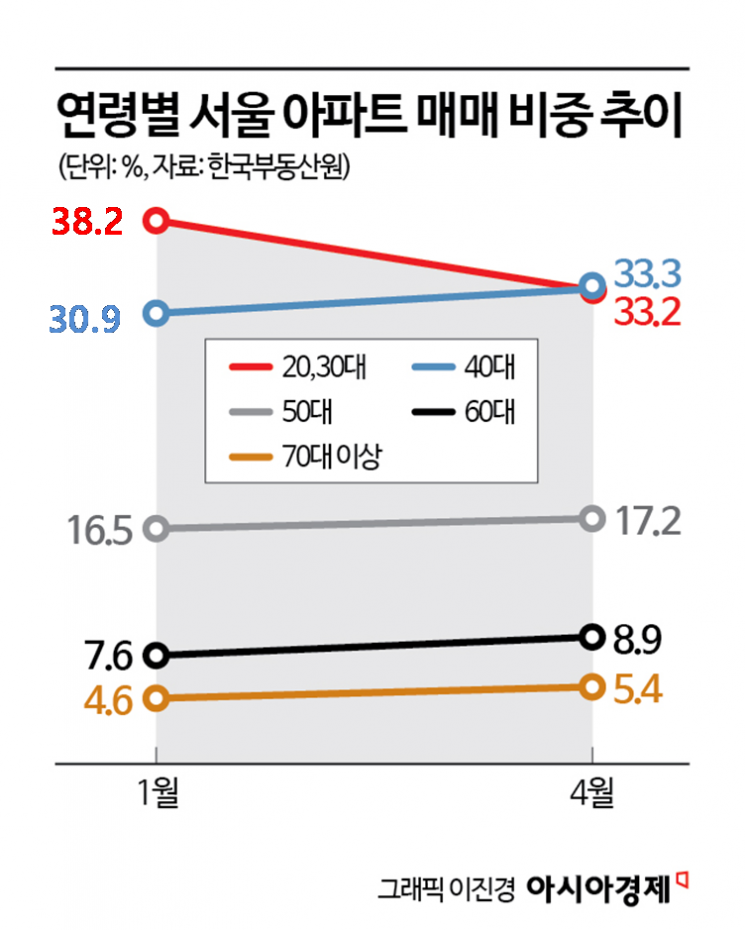

According to the Korea Real Estate Board on June 19, the share of apartment purchases in Seoul by people in their 20s and 30s fell from 38.2% in January this year to 33.2% in April. This is 2.2 percentage points lower than the 35.4% recorded in April last year, and is also the lowest figure so far this year.

The situation is different from a year ago. Last year, people in their 20s and 30s were actively buying apartments in Seoul. In January 2024, their share of apartment purchases in Seoul was 34.7%, which rose to the 38% range within a year. These were people trying to buy before prices rose even further, often by borrowing to the maximum. As a result, home mortgage loans increased by 57.1 trillion won last year, up from 45.1 trillion won in 2023.

As they had hoped, home prices did rise last year, but the increase was so sharp that it became difficult to keep up. As even borrowing to the limit was no longer enough, the proportion of purchases by this group began to decline. According to the apartment price index, the cumulative increase in Seoul from January to April was 1.41%, the highest in the country, surpassing even Sejong's 0.87%, which had drawn attention due to the relocation of the presidential office during the impeachment and presidential election period. The cumulative increase from January to May reached 1.95%, suggesting that the decline in the share of purchases by people in their 20s and 30s will become even more pronounced as apartment prices continue to rise.

The proportion of middle-aged and older buyers of Seoul apartments has naturally increased. In particular, the share among those in their 40s rose the most significantly, increasing from 30.9% to 33.3% between January and April this year?a rise of 2.4 percentage points. The share among those in their 50s also edged up from 16.5% to 17.2%. For those in their 60s and 70s and above, the shares rose from 7.6% to 8.9% and from 4.6% to 5.4%, respectively.

Experts explain that the decline in the share of apartment purchases by people in their 20s and 30s, who have relatively less financial capacity compared to middle-aged buyers during periods of rising apartment prices, is inevitable. However, they suggest that policy support for young people is needed as it is becoming increasingly difficult for them to buy homes. Kwon Youngsun, team leader at Shinhan Bank's Real Estate Investment Advisory Center, said, "The younger generation has to rely on gifts or loans to buy apartments, but as prices rise, it becomes increasingly difficult to purchase." He added, "Given the government's limited budget, it seems desirable to focus policy direction on supporting young people, who are vulnerable in terms of housing." He also stated, "The most realistic solution is to continue supplying homes at reasonable prices to people in their 20s and 30s, who are giving up on buying during periods of rising apartment prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)