Concerns Grow Among Tenants and Employees Amid Uncertainty

Some Major Retailers Mentioned as Potential Acquirers

Network Overlap and Sale Price Emerge as Key Variables

"We will be open until June 24. Thank you for your patronage."

A beauty brand located in a Homeplus store in Seoul recently posted a sign informing customers of its upcoming closure. As rumors spread among some tenant store owners that this Homeplus branch may soon shut down, more and more stores are closing one after another. One tenant store owner shared, "I've been running my business here for seven years, but after hearing that Homeplus is not doing well, I decided not to renew my contract."

Another tenant also stated that they plan to operate only until August before relocating their store. The owner of a restaurant brand explained, "Sales have dropped by about 30% compared to last year," adding, "Most store owners are now working directly in the store themselves, replacing part-time workers to cut labor costs."

A store located in a Homeplus branch in Seoul has posted a notice that it will cease operations this month. Photo by JaeHyun Park

A store located in a Homeplus branch in Seoul has posted a notice that it will cease operations this month. Photo by JaeHyun Park

Naver, Hanwha, and GS Mentioned as Acquisition Candidates

Homeplus, which has entered court receivership, has filed a "pre-approval M&A (merger and acquisition) plan" with the court in an effort to avoid liquidation and continue its rehabilitation. This has heightened concerns and anxiety among tenants and Homeplus employees about their future.

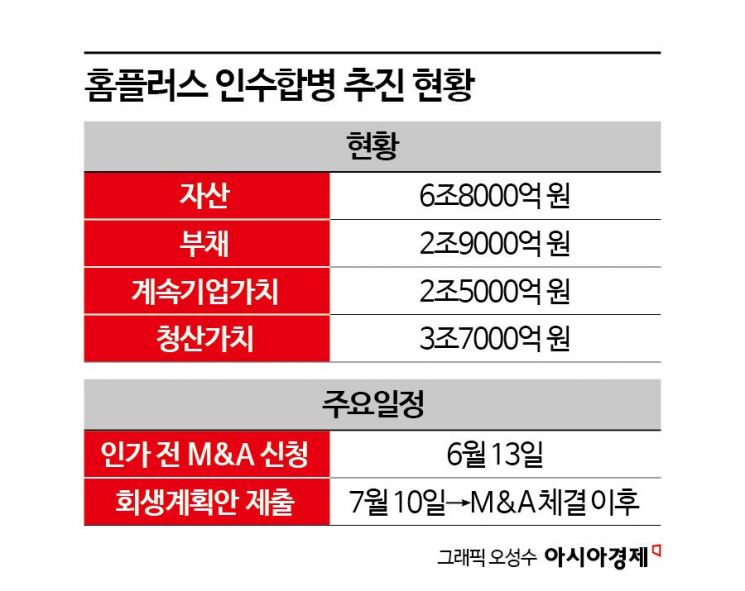

According to industry sources on June 17, Homeplus submitted the pre-approval M&A application to the court on June 13, citing the results of a three-month investigation conducted by Samil PwC, the court-appointed examiner. The investigation found that Homeplus's liquidation value exceeded its going-concern value (the present value of surplus cash flows generated from operations over the next 10 years).

According to the examiner's report, Homeplus's liquidation value was set at 3.7 trillion won, which is 1.2 trillion won higher than its going-concern value of 2.5 trillion won. If the court approves this, the deadline for submitting Homeplus's rehabilitation plan, originally set for July 10, will be postponed until after a new owner is found. Homeplus expects the court's approval to be granted soon.

In the investment banking (IB) industry, large companies related to distribution, such as Naver, GS, and Hanwha, are being mentioned as potential candidates interested in acquiring Homeplus. Among them, Naver launched its AI-based shopping service, Naver Plus Store (Neflus), in March, strengthening its commerce business. This platform also operates a quick commerce service called "Jigeumbaedal," which delivers products ordered online to customers within one hour, and has brought in large supermarkets, SSMs (super supermarkets), and convenience store operators as tenants. Homeplus and Homeplus Express (an SSM) products can also be ordered through Jigeumbaedal.

An industry insider explained, "Neflus is utilizing the wide range of products held by existing offline distribution channels through partnerships, treating them as if they were its own logistics centers," adding, "If Naver acquires Homeplus, it can build a distribution and logistics infrastructure that spans both online and offline, going beyond a platform that simply facilitates online purchases and deliveries."

Homeplus was the first major hypermarket in Korea to launch an online business and fresh food delivery in 2002. Nearly 90% of its 126 stores nationwide have dedicated spaces for product receiving, storage, packaging, and logistics services. These spaces enable immediate supply of fresh and key products to store shelves and allow for rapid fulfillment of online orders flowing into hypermarkets and SSMs. As of February, Homeplus's online sales exceeded 1.5 trillion won, accounting for over 20% of its total annual sales of 7 trillion won?the highest proportion in the industry.

Hanwha is also considered a likely candidate, as Kim Dongseon, Executive Vice President of Hanwha Galleria and the third son of Hanwha Group Chairman Kim Seungyeon, has been actively pursuing M&As in the distribution and food sectors. Under his leadership, Hanwha recently acquired a 58.62% stake in the group catering company Ourhome, bringing it into the Hanwha Group, and has aggressively launched food service brands in burgers, pizza, and ice cream.

GS Retail, which operates GS25 convenience stores and GS The Fresh (an SSM), is also counted among the M&A candidates, as it reportedly received an acquisition proposal last year when Homeplus considered selling its supermarket division. As of last year, GS The Fresh had 531 stores, ranking first in the industry. If it acquires Homeplus, which operates about 300 supermarkets, its sales network would expand dramatically. However, unlike GS The Fresh, which operates over 70% of its stores as franchises, Homeplus Express runs nearly 80% of its stores directly, posing a strategic challenge. Issues such as cannibalization (overlapping stores in the same trade areas) and the succession of employees may also arise.

Key Issues: Partial Sale and Price Negotiations

For the same reasons, it is also analyzed that competitors such as Emart and Lotte Mart may find it difficult to join the acquisition race. An industry insider said, "Many of the Homeplus and Homeplus Express stores overlap with competitors' trade areas," adding, "If a partial sale is pursued for stores with strong sales or those not operated by other competitors, negotiations could be considered." Homeplus, however, maintains its stance of selling both its hypermarket and supermarket divisions together.

There is also speculation that e-commerce companies interested in fresh food distribution, such as Coupang and AliExpress, may join the acquisition race, but these companies have not shown any particular response so far.

Orina Oh, a researcher at LS Securities, noted, "Existing rival distribution companies have faced significant performance pressure due to prolonged sluggish domestic demand, the penetration of online channels, and the overall improvement in delivery standards. As a result, they are focusing on restructuring underperforming businesses and are avoiding aggressive expansion. Therefore, it is more likely that an acquirer will emerge from outside the traditional distribution sector."

Another key issue is the sale price. MBK Partners, a private equity (PE) firm and the largest shareholder of Homeplus, acquired the company for 7.2 trillion won in 2015 through a buyout deal aimed at resale. However, due to domestic market stagnation and the decline of offline retail, it has failed to sell the company for ten years. The current M&A is structured so that a new acquirer becomes the largest shareholder through the issuance of new shares. The funds from the acquirer will be used to repay rehabilitation claims and other obligations. MBK has announced that if this M&A is successful, it will write off 2.5 trillion won worth of Homeplus common shares at no cost, taking on the loss. Additionally, Homeplus expects to reduce related costs by having reached agreements or being close to agreements to adjust rent and contract terms with 48 out of its 68 leased stores.

A Homeplus official stated, "Compared to the past, when we set sale prices conservatively in consideration of market conditions, we expect to be more flexible this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.