The US, UK, and Japan: Actively Utilizing D&O to Attract Talent

Mandatory Enrollment and Corporate Indemnification Agreements Needed for Expansion

In major overseas countries such as the United States, the United Kingdom, and Japan, companies are actively utilizing Directors and Officers Liability Insurance (D&O). This is to transfer increasingly complex and diverse risks, arising from industrial development and market expansion, to insurers, thereby ensuring that management can make decisions with confidence. D&O has evolved beyond a simple insurance product and is now a key tool for recruiting talented executives both domestically and internationally.

An image depicting a global company utilizing Directors and Officers Liability Insurance (D&O) to recruit competent executives. ChatGPT

An image depicting a global company utilizing Directors and Officers Liability Insurance (D&O) to recruit competent executives. ChatGPT

The US, UK, and Japan: Governments and Companies Actively Support D&O

The first place where D&O was developed was the United States, the world's largest insurance market. In the US, following the Wall Street Crash of 1929 that triggered the Great Depression, the Federal Securities Act was enacted, strengthening the responsibilities of directors. As the scope of regulatory agencies expanded and lawsuits by shareholders or third parties became more common, Lloyd’s, the British insurance syndicate, began selling D&O to American companies, marking the product's inception.

D&O began to gain real traction in the US from the 1960s. At that time, the US government brought D&O within the legal and institutional framework. In 1968, Delaware became the first state to amend its corporate law to include D&O regulations. The following year, the Internal Revenue Service (IRS) recognized insurance premiums as a business expense, which led to rapid growth of D&O in the US. Today, every state in the US has regulations regarding D&O.

In the UK, D&O began to develop in earnest in the 1980s. The 1985 revision of the UK Companies Act stipulated that "any provision exempting or indemnifying directors from liability is void." This sparked much debate over whether it was illegal for companies to purchase D&O. Subsequently, in 1989, the UK amended the Companies Act again, introducing explicit provisions allowing companies to purchase D&O, which led to a significant increase in uptake.

In the US, UK, and Japan, companies are also actively introducing D&O through corporate indemnification agreements. The corporate indemnification system allows the company to reimburse executives for legal defense costs, such as litigation expenses, when they are sued by shareholders or third parties. It is now common for top global talent to inquire about the existence of such a system when considering joining a company. In these countries, the corporate indemnification system is used as a key means of recruiting and retaining core executives, and D&O is actively managed under this framework.

Global D&O Market Grows Rapidly... Korea Still in Its Infancy

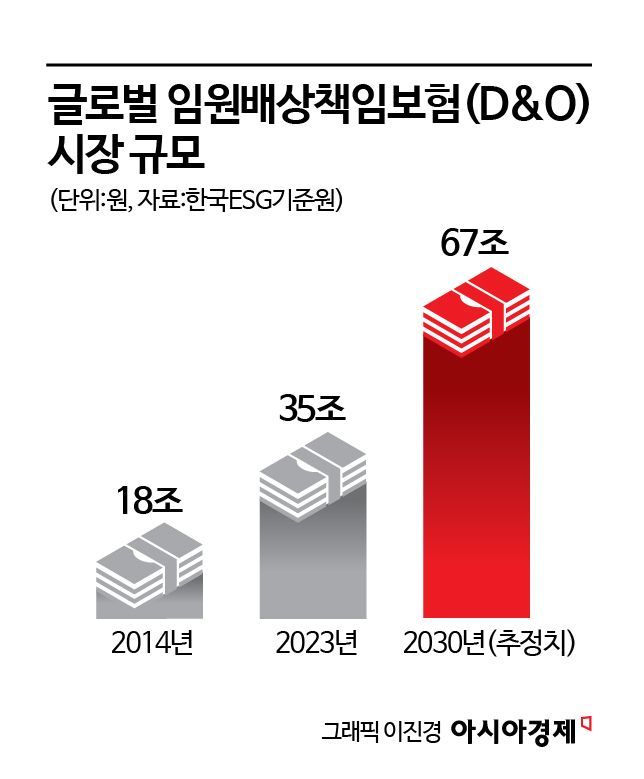

According to the Korea ESG Standards Institute, the global D&O market grew from $13.2 billion in 2014 to $25.2 billion (about 35 trillion won) in 2023, nearly doubling in nine years. The market is expected to expand further, growing at an average annual rate of 9.9% to reach $48.8 billion (about 67 trillion won) by 2030.

Interest in D&O insurance is gradually increasing in Korea as well, but compared to advanced countries such as the US and UK, the market remains at an early stage. While these countries have institutional measures in place to encourage D&O enrollment by both governments and corporations, Korea only offers guideline-level recommendations and requires disclosure of whether D&O is used. The only government-level regulations regarding D&O are the Financial Supervisory Service's "Guidelines on D&O Enrollment for Listed Companies" in 2005 and the Financial Services Commission's "Corporate Governance Report Guidelines" revision in 2023.

Due to this weak institutional foundation, Korean D&O policies are largely limited to direct translations of English-language policies from American insurers such as Chubb and AIG. This results in ambiguities in policy interpretation and ongoing disputes over claims payments when conflicts arise.

Experts point to the structural limitations of the product itself as the reason for the lack of development in Korea's D&O insurance market. The main issues cited are the narrow scope of coverage, excessive exclusion clauses, and the "claims-made" system. Since coverage is only provided if a claim is made during the policy period, the effectiveness of the insurance drops sharply if contract renewals are not smooth or notification requirements are missed.

Furthermore, there are concerns that the imported English-language wordings are based on US corporate law and thus contain many provisions that do not align with Korea's legal system and corporate practices. In fact, many analyses have found ambiguities in interpretation or structures unfavorable to policyholders in key clauses such as notification requirements, handling of defense costs, and exclusions for illegal acts. As a result, experts emphasize the need to move beyond simple translation and to develop independent Korean-language policies tailored to domestic circumstances, alongside improvements to relevant laws and regulations.

An insurance industry official said, "In Korea, there is a lack of experience or statistical data for properly designing and managing D&O contracts, so most are ceded to reinsurance. Given that D&O is a sector with significant growth potential, it is time to strengthen both the institutional foundation and insurers' own product capabilities."

Mandatory Enrollment and New Mutual Aid Associations Needed to Promote D&O

Experts unanimously agree that the government and companies should actively encourage the adoption of D&O. One representative measure is making D&O enrollment mandatory. In 2010, an attempt was made to legislate mandatory D&O enrollment for financial company executives, led by then-Democratic Party lawmaker Cho Kyungtae, but it failed. Kwon Soonil, a research fellow at the Korea Insurance Research Institute, said, "If the amendment to the Commercial Act passes, the duty of loyalty for directors will be extended to shareholders, and disputes over liability are likely to increase significantly, which could dampen corporate activity. Making D&O enrollment mandatory could be considered as a solution." Seo Jaewook, CEO of Aimbridge Partners, also said, "Among various industries, I believe mandatory D&O enrollment is particularly necessary for financial companies. With the recent introduction of the duty structure system, cases of questioning directors' responsibilities or filing lawsuits are likely to increase, and mandatory D&O enrollment can reduce the side effects of executives avoiding their positions or working only to protect themselves."

There are also suggestions to establish a mutual aid association for corporate executives related to D&O, similar to the Korea Credit Guarantee Fund. Lee Juyeol, professor of Health Administration at Namseoul University, said, "There is a need to create and operate a mutual aid association like the Korean Medical Association Medical Liability Mutual Aid Cooperative, which supports enrollment in medical malpractice liability insurance. Rather than having companies individually purchase insurance products, it would be more efficient for a mutual aid association to support insurance enrollment and related matters."

There are also recommendations for private companies to actively introduce corporate indemnification agreements, as is common in advanced countries. Kim Sunjeong, a distinguished professor of law at Dongguk University, explained, "In Japan, many people refused to become directors because of the heavy responsibilities, but the 2021 amendment to the Companies Act introduced the corporate indemnification system to address this. This reflects the Japanese government's commitment to securing global talent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.