BOK Issue Note: Characteristics and Implications of Housing Price Expectations

When Expectations for Housing Price Increases Rise, Actual Prices Also Go Up After Eight Months

Interest Rate Cuts Stimulate Expectations... Easing Household Loan Regulations Leads to Greater Increases

"Cooperation with Authorities Is Essential to Prevent Overheating of Expectations During Rate Cuts"

Amid a recent upward trend in housing price expectations, the Bank of Korea has analyzed that if macroprudential policies?such as household loan regulations?are eased alongside interest rate cuts, expectations could be significantly stimulated. Conversely, if regulations are tightened, the effect is greatly diminished. Since the expectation that housing prices will rise has a real impact on actual housing prices, experts point out that close coordination with macroprudential policies is essential to curb such sentiment.

According to the Bank of Korea's "BOK Issue Note: Characteristics and Implications of Housing Price Expectations," released on June 15, the Housing Price Expectation Index quantifies how much people expect housing prices in Korea to change over the next year compared to the present. A 1% increase in the index means that people who previously thought prices would remain unchanged have now revised their expectations to anticipate a slight rise. This index, published monthly by the Bank of Korea, hit a low of 99 in February this year before rebounding, reaching 111 in May.

This study was conducted by Kim Wooseok, Senior Researcher; Hwang Indo, Director; and Lee Jaewon, President of the Economic Research Institute at the Bank of Korea.

The Bank of Korea stated that once housing price expectations rise, they tend to increase significantly and the upward cycle is prolonged. According to their own calculations, the coefficient of variation?which shows the relative volatility compared to the average level?was 2.05, more than ten times higher than that of inflation expectations (0.18). Persistence was measured at 0.9, indicating a high level of persistence as the value approaches 1.

The study also found that these expectations have a direct impact on actual housing prices. Analyzing the correlation between housing price expectations and actual price increases from 2013 to 2025, the Bank of Korea found that when a shock to expectations occurred, real housing prices rose rapidly, reaching a maximum increase of 0.43% after seven months.

Kim Wooseok, Senior Researcher at the Monetary and Financial Research Division at the Bank of Korea Economic Research Institute and author of the report, explained, "In addition to actual increases in housing prices, we have observed expansions in consumption and household loans. These factors interact and ultimately lead to higher inflation. Although GDP also rises, after three to four months, household debt and housing prices outpace actual GDP growth, which is not a desirable situation from a financial stability perspective." He emphasized the need to manage housing price expectations, as they negatively affect not only housing prices but also the Korean economy as a whole.

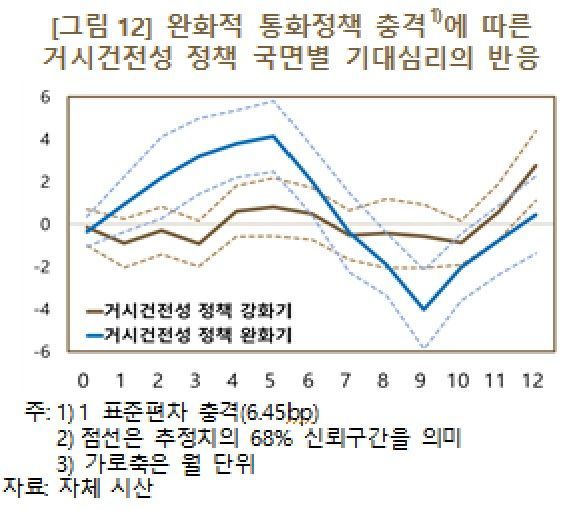

In particular, the study confirmed that housing price expectations stimulated by interest rate cuts (monetary policy) can either strengthen or weaken depending on the intensity of macroprudential policies such as household loan regulations. The Bank of Korea examined how borrower-centered household loan regulations affect expectations, finding that when macroprudential policies are eased and interest rates are cut, expectations rise sharply.

Conversely, when macroprudential policies are tightened, interest rate cuts have little effect. Kim explained, "If the two policies move in opposite directions, expectations do not form a clear trend, and the signaling effect weakens. The key finding is that if macroprudential policies move in the opposite direction to interest rates during a rate-cutting cycle, expectations are somewhat subdued."

In fact, the Bank of Korea's simulations showed that if the surge in expectations that occurred in the early to mid-2020s had not happened for two years, the increase in housing prices would have been halved (from 24% to 11%), and the rise in the household loan-to-GDP ratio would have been reduced by about one-third (from 7.6 percentage points to 4.9 percentage points).

The Bank of Korea emphasized, "To manage housing price expectations, monetary policy and macroprudential policy must be properly coordinated. For example, if interest rates are cut, it is necessary to strengthen macroprudential policies as a complementary measure to avoid stimulating housing price expectations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.