Market Expected to Double from 400 Billion to 800 Billion Won

Fastest Growth Among Beverage Segments

High-Protein Drinks with 40g Content Now Available

A fierce competition is underway in the domestic food industry over the ready-to-drink (RTD) beverage market containing protein. While the beverage market?including white milk, processed milk, and fermented milk?has contracted due to the impact of low birth rates, the protein beverage market has experienced rapid growth. Protein beverages were previously considered drinks for muscle recovery after exercise or for dietary management, but recently, consumption has expanded across all age groups. With advancements in technology leading to the release of high-protein-content beverages, the market is diversifying, fueling expectations for significant growth potential.

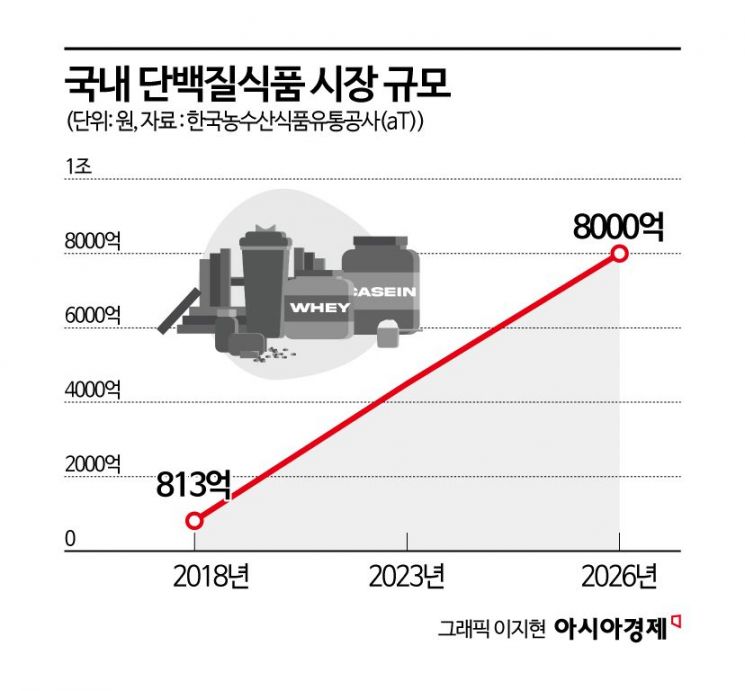

According to the Korea Agro-Fisheries & Food Trade Corporation (aT) on June 16, the domestic protein market, which was valued at 81.3 billion won in 2018, grew approximately sixfold to 450 billion won in 2023. By 2026, it is projected to reach 800 billion won, representing a 77.8% increase from 2023.

The most notable trend is in the beverage market. Until before the COVID-19 pandemic, protein beverages were mainly consumed for muscle recovery after exercise or for dietary management. Recently, however, the age range of consumers has broadened. Protein beverages are known to provide a prolonged sense of fullness and to increase basal metabolic rate, making them effective for weight loss and management. People in their 20s and 30s often consume protein beverages as a replacement for breakfast, while those in their 50s and 60s use them as an alternative protein source to meat. Among all beverage categories, protein beverages are considered the fastest-growing segment.

Maeil Dairies was the first to enter this market. In 2018, Maeil Dairies launched 'Selex,' opening the protein beverage market. In 2021, the company even established Maeil Health Nutrition as a separate corporation to focus on the Selex business. Since its launch, cumulative sales of Selex have reached 441.2 billion won.

Subsequently, in 2020, Ildong Foodis quickly followed as a latecomer by launching 'Haimune.' Other companies also introduced a variety of protein beverages, including Binggrae's 'The:Danbaek,' Namyang Dairy's 'Takefit,' Daesang Wellife's 'Mymeal,' and Orion's 'Dr. You PRO.' The number of protein beverages sold at convenience stores increased from only about 10 in 2020 to nearly 60 today. Convenience store chains have also launched their own private brand (PB) protein beverages. CU, for example, has been selling three types of protein shakes (chocolate, injeolmi, and milk tea) since this year. Each of these products contains more than 20 grams of protein.

The two leading products in the market are Ildong Foodis's 'Haimune Protein Balance' and Namyang Dairy's 'Takefit.' While some analysts argue that the protein market is reaching saturation, the market is expected to continue growing as improvements are made to the texture and taste, which have been pointed out as drawbacks.

Whereas products with protein content in the 10-gram range used to dominate the market, recently, high-protein beverages containing around 40 grams have been released, indicating a diversification of the market.

Orion became the first in the industry to launch a product containing 40 grams of protein with 'Dr. You PRO Protein Drink 40g Choco' in July last year. Forty grams of protein is equivalent to the amount found in two chicken breasts or 6.5 eggs, meeting 73% of the recommended daily protein intake. The Dr. You PRO 40g product surpassed cumulative sales of 1.8 million units within four months of its launch and reached approximately 2.5 million bottles in about six months, demonstrating strong performance. Among domestic protein beverages, the product with the highest protein content is Namyang Dairy's 'Takefit Monster.' One bottle (350 ml) of Takefit Monster contains 43 grams of protein, which is 78% of the recommended daily amount for adults (55 grams).

An industry official said, "While sales of infant formula and milk are declining due to low birth rates, the health-pleasure trend is expected to continue for some time. As a result, not only dairy companies but also food and beverage companies are focusing on protein beverages. There is consistent demand for functional products, and as the unique taste and texture of protein beverages are improved to make them easier to swallow, the market will continue to intensify."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)