Tariffs Extended to Steel Derivative Finished Products

Urgent Review of Supply Chain and Production Base Strategies

Government Exploring Possibility of Negotiations with the U.S.

The United States has decided to impose high tariffs of up to 50% on home appliances containing steel parts, such as refrigerators and washing machines, putting the domestic appliance industry on high alert. As of last year, the export value of Korean-made refrigerators and washing machines to the U.S. reached 3 trillion won. Major companies such as Samsung Electronics and LG Electronics are urgently reviewing their supply chain restructuring and production base operation strategies to prevent export setbacks, while the government is also exploring the possibility of negotiations with the U.S.

On June 12 (local time), the U.S. Department of Commerce announced in the Federal Register that it has designated a total of about 10 home appliances?including refrigerators, washing machines, dryers, dishwashers, freezers, ovens, ranges, and food waste disposers?as "steel derivative products," and will impose high tariffs of 50% based on steel content value starting June 23. The tariffs will be applied based on the import price of steel parts and will be uniformly enforced regardless of the country of production or brand.

Samsung Electronics and LG Electronics operate washing machine production plants in the U.S., but key items such as refrigerators are still exported from factories in Korea and Mexico. If this measure is implemented, it is expected that additional costs will be incurred for a significant portion of shipments.

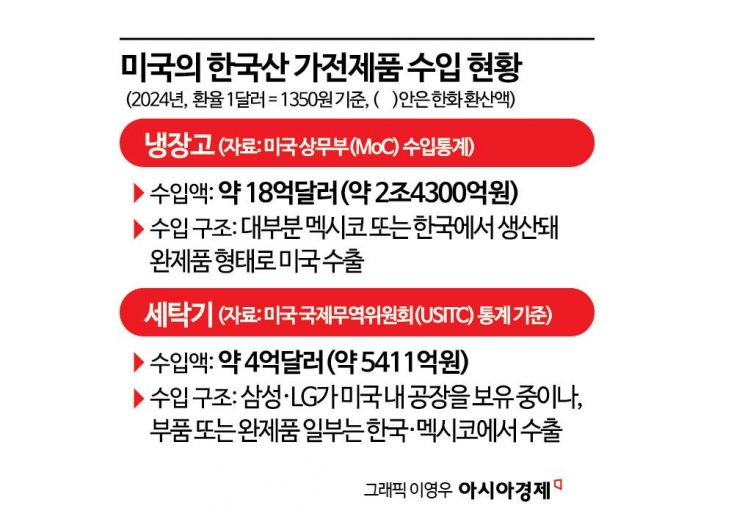

According to the U.S. International Trade Commission (USITC), the value of imports of Korean-made washing machines to the U.S. in 2024 was approximately $407.9 million (about 551.1 billion won). For refrigerators, U.S. Department of Commerce statistics estimate that the value of imports from Korea in the same year was about $1.8 billion (about 2.43 trillion won). Both items have a high market share for Korean products in the U.S., and the industry believes that export setbacks due to these high tariffs are inevitable.

The domestic appliance industry is reviewing multiple response scenarios to this measure, including adjusting the country of origin by using U.S.-made steel, strengthening export strategies focused on premium products, expanding production within the U.S., and negotiating for exemptions through the government. The industry believes that some measures can be implemented in the short term, but there are many variables, such as practical limitations in supply chain adjustments and raw material procurement.

An appliance company official said, "Even if finished products are manufactured in the U.S., most steel-containing parts still have to be imported, so it is realistically difficult to respond. Countermeasures can only be prepared if policy changes are predictable, but currently, uncertainty is only increasing."

An electronics industry official stated, "With the tariff hike, cost burdens may increase, so we are also considering adjusting future production and shipping strategies. We are reviewing various options to minimize the impact."

Experts pointed out the need for companies to adopt a 'premium strategy' and for the government to pursue 'tariff-free negotiations.' Jang Sangshik, head of the International Trade and Commerce Research Center at the Korea International Trade Association, said, "In addition to using U.S.-made steel and expanding local production, companies need to lower steel content by using new materials and enhance non-price competitiveness such as eco-friendliness and energy savings. In particular, the only way forward is to move toward premium products through smart home and artificial intelligence (AI) integration." He added, "The government should note that the U.S. recently granted a tariff-free quota to Mexico and strive to obtain a similar tariff-free quota for Korean steel and derivatives. Increasing the use of Mexican steel is also an option, as there are many Korean appliance production bases in Mexico."

In the past, the Trump administration imposed a 25% tariff on steel under Section 232 of the Trade Expansion Act. At that time, in 2018, Korea was granted an exemption on the condition of an export volume quota. Since the current measure expands the scope of tariffs to finished products, the prevailing analysis is that the possibility of exemptions is low. The industry is paying attention to the recent U.S. decision to grant a tariff-free quota for Mexican steel and believes that Korea should seek similar negotiations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)