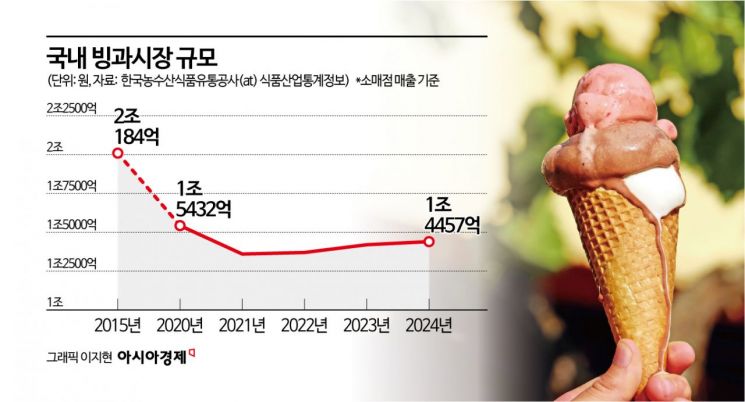

Shrunk to 1.4457 Trillion Won Last Year

Sales Decline Due to Falling Child Population and Diversification of Dessert Alternatives

Binggrae and Lotte Wellfood Turn Their Attention Overseas

The domestic ice cream market has entered a period of stagnation. The market, which surpassed 2 trillion won a decade ago, has recently shrunk to the mid-1 trillion won range and continues to struggle. Several factors have contributed to the freeze in the ice cream market: a decline in the child population, who are the main consumers of ice cream; reduced demand due to the expansion of coffee shops; and a diversification of dessert alternatives. Ice cream companies are now seeking breakthroughs in overseas markets, as global consumer interest in K-ice cream rises amid worldwide heatwaves and the influence of the Korean Wave.

According to food industry statistics from the Korea Agro-Fisheries & Food Trade Corporation (aT) on June 13, last year’s domestic ice cream industry sales (retail basis) totaled 1.4457 trillion won, a 28.4% decrease compared to ten years ago.

Shrunk by 28% in Ten Years... Decline in Child Population Proves Fatal

The domestic ice cream market has been on a downward trend since peaking at 2.0184 trillion won in 2015. The market size shrank by more than 30% over six years: 1.9619 trillion won in 2016, 1.6837 trillion won in 2017, 1.6292 trillion won in 2018, 1.4252 trillion won in 2019, 1.5432 trillion won in 2020, and 1.3653 trillion won in 2021. Since 2022, the market has shown slight growth, but the increase has remained in the 1% range, leading to a consensus that the market has reached a plateau.

The stagnation in the ice cream market is primarily due to a decline in the infant and youth population, the main consumer group, as a result of low birth rates. According to the 'e-Nara Indicators' operated by Statistics Korea, the child population, which stood at 8,961,805 in 2015, fell below 8 million to 7,928,907 in 2019. Last year, the figure dropped further to 6,876,330, breaking the 7 million mark.

Another contributing factor is the recent trend of prioritizing health, which has impacted demand for ice cream products high in sugar. As the number of children per household decreases, parents have become more selective about what their children consume, leading to reduced purchases of ice cream products.

The increase in coffee shops has also played a role, with 'iced Americano' emerging as a popular post-meal dessert alternative to ice cream. Unlike ice cream, iced Americano is easier to store and does not melt, making it a quintessential summer beverage. The abundance of alternative desserts such as bread, cake, chocolate, and bingsu has also contributed to declining demand for ice cream.

An industry insider explained, "The number of children and teenagers, who are the largest consumer group, continues to decrease, so there is little expectation for improvement in market conditions. With the diversification of dessert alternatives, it has become a difficult market in which to survive."

The influx of imported ice cream is also intensifying competition. Previously, imported products were less accessible to consumers due to higher prices compared to domestic brands. However, with more '1+1 promotions' on imported products at convenience stores and the continued rise in domestic product prices, the price gap between domestic and imported ice cream is narrowing. Last year, Haagen-Dazs, a leading imported ice cream brand, ranked third in market share after Bungeo Samanco and Together. Imported brands are now achieving higher rankings than domestic favorites like Merona and World Cone.

K-Ice Cream Expands Overseas

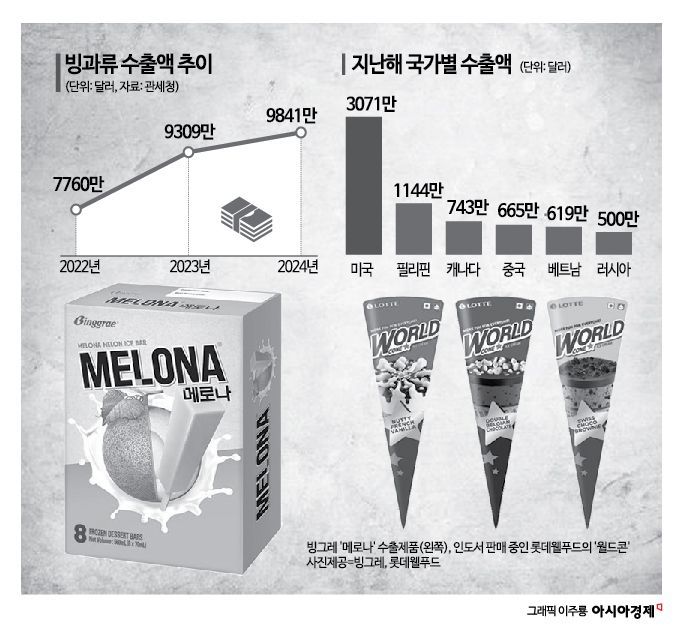

Nevertheless, domestic ice cream is performing well in overseas markets. As global interest in Korean culture intensifies, the status of Korean ice cream abroad continues to rise. According to the Korea Customs Service, last year’s domestic ice cream exports reached a record high of $98.41 million (about 140.4 billion won), a 5% increase from the previous year. There are even projections that this year’s export value will surpass $100 million for the first time.

Binggrae and Lotte Wellfood, the 'big two' in the domestic ice cream market, are also focusing their efforts on overseas markets rather than the domestic market.

Binggrae is concentrating on growth in the United States. Since entering Costco in 2016, Binggrae has expanded its market share and now accounts for about 70% of the Korean ice cream market in the United States. The company also plans to increase its presence in Europe. In response to the European Union’s restrictions on dairy exports, Binggrae has launched 'Plant-Based Merona,' made with plant-based ingredients, which is receiving positive feedback not only in Europe but also in North America and Australia. In addition to its signature melon flavor, Binggrae plans to introduce a variety of flavors tailored to local tastes, including strawberry, mango, and coconut.

Lotte Wellfood is focusing on the Indian market. In 2017, the company acquired Havmor, the leading ice cream brand in western India, to target the local market. 'Crunch,' which began sales in India in March, achieved sales of 1 billion won within three months of its launch, marking a successful debut. Crunch is a localized version of the 'Pig Bar.' Lotte Wellfood’s Indian ice cream subsidiary posted sales of 46.1 billion won in the first quarter of this year, a 34% increase from 34.3 billion won in the same period last year. With the new Pune plant now operational, the company expects its Indian subsidiary’s sales to increase by more than 15% year-on-year. The Pune plant currently has nine production lines, and Lotte Wellfood plans to expand this to sixteen lines by 2028.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.