Foreign Investors Net Buy 3 Trillion Won in KOSPI This Month

Reducing Defense and Nuclear Stocks, Increasing Semiconductors

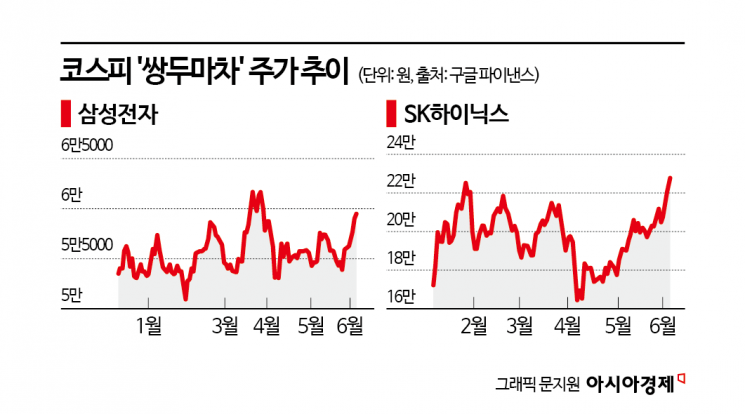

Changes are being detected in the portfolios of foreign investors who have been driving the defense industry stock rally since the beginning of the year. Following the presidential election, these investors have poured approximately 3 trillion won into the KOSPI and are now betting more than 1 trillion won on semiconductor giants Samsung Electronics and SK Hynix, signaling a shift in leadership among rally-driving stocks.

According to the Korea Exchange on June 10, Samsung Electronics and SK Hynix closed the previous day at 59,800 won (up 1.18%) and 229,000 won (up 2%), respectively. Both stocks surpassed the 60,000 won and 230,000 won marks at one point during intraday trading. SK Hynix reclaimed the "230,000-nix" title for the first time in about a year since July last year.

The strength of the KOSPI's "two engines" can be attributed to the return of foreign investors. While foreigners sold off 14.5 trillion won worth of KOSPI stocks from the beginning of the year through last month, they became net buyers of 2.1 trillion won in just two days immediately after the presidential election, and purchased another 980 billion won on this day, propping up the index. From January to May, top net buying by foreigners was concentrated in defense and nuclear power stocks such as Hanwha Aerospace, Korea Electric Power Corporation, Doosan Enerbility, NAVER, and LIG Nex1. However, in June, SK Hynix and Samsung Electronics together saw net purchases of 1.145 trillion won, taking the top two spots.

Lee Seungwoo, a researcher at Eugene Investment & Securities, noted, "Samsung Electronics currently has a low price-to-book ratio (PBR) and the risk of a price decline is relatively low. SK Hynix also faces the possibility of greater-than-expected earnings volatility in the second half, but even considering these risks, the current stock price is excessively low." He also pointed out that increased demand for memory pre-purchasing from clients due to tariff uncertainties and reduced DDR4 production, which is driving up DRAM prices, are both positive factors for these two companies.

There is continued optimism about whether foreign buying will persist, largely because the won-dollar exchange rate has been stabilizing downward. Jung Dawoon, a researcher at LS Securities, explained, "If we simplify the relationship between the won-dollar exchange rate and the foreign shareholding ratio in the KOSPI to a linear one, a 1-won decrease in the exchange rate increases the shareholding ratio by 0.0079%. If the current exchange rate drops to 1,330 won per dollar, foreigners' shareholding ratio in the KOSPI could further expand by 0.565 percentage points to 31.865%."

However, some caution that the stock market may enter a cooling-off period due to short-term overheating, and warn against excessive chase buying. Cho Joonki, a researcher at SK Securities, said, "While additional gains are possible with the influx of positive news, the current index range is a short-term shooting zone with a low risk-reward ratio. It is important to note that any correction could result in a larger-than-expected decline."

The fact that the KOSPI has entered a technical bull market (up 20% from its low) also lends weight to the short-term correction view. Heo Jaehwan, a researcher at Eugene Investment & Securities, commented, "Except for certain periods such as the 2011-2012 European debt crisis and COVID-19, the KOSPI's upward momentum has typically stalled after rising 20-30% from its low. Recently, the KOSPI has risen 22.6%. The likelihood of further sharp gains is gradually decreasing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.