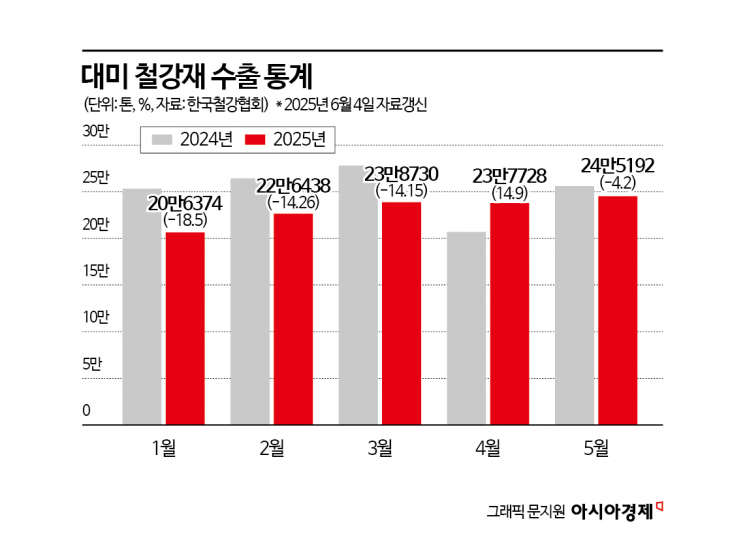

May Exports Reach 245,192 Tons, Down 4.2% Year-on-Year

Cumulative Exports Since March Also Down 2.6% Compared to Last Year

"We Withstood 25%, But 50% Destroys Profitability"

Trump Pushes Ahead with Tariff Hike... Industry Pins Hopes on Government Negotiation Skills

Last month, South Korea's steel exports to the United States decreased by nearly 5% compared to a year earlier. Since the United States imposed a 25% tariff on imported steel and related derivatives on March 12, exports have not plummeted, but a clear, albeit slight, downward trend has emerged. On top of this, concerns are growing that the decline in exports could become even more pronounced in the second half of the year, as the Donald Trump administration doubled the tariff rate to 50% starting from June 4.

According to the Korea Iron and Steel Association on June 6, South Korea's steel exports to the United States last month amounted to 245,192 tons, a 4.2% decrease from the same month last year (256,044 tons). The cumulative export volume for the three months from March to May, after the 25% tariff was imposed, totaled 721,650 tons, down 2.6% from the same period last year (741,061 tons). While exports have not dropped sharply, a gradual downward trend is clearly being observed.

Industry insiders attribute the initial maintenance of export levels after the tariffs to "delays in shipment and inertia from fulfilling existing contracts." However, the situation has now changed. This is because, starting at 1:01 p.m. on June 4 (Korea time), the Trump administration raised the tariff rate on steel and related derivatives imported into the United States from 25% to 50%.

Lee Jaeyoon, a research fellow at the Korea Institute for Industrial Economics and Trade, told this newspaper, "During the period of the 25% tariff, the prevailing outlook was that exports would only see a limited decrease of around 5%," but added, "If the tariff rate rises to 50%, profitability itself will be undermined, making a sharp drop in exports inevitable." He also commented, "High value-added products may be relatively less affected, but if end-use industries such as automobiles contract, overall steel demand will inevitably decrease," adding, "The overall export environment will become even more challenging."

In fact, according to a report by the IBK Economic Research Institute, if the U.S. steel tariff rises to 50%, South Korea's steel exports to the United States are expected to decrease by 24% based on a simple calculation. Given that South Korea exported 2.81 million tons of steel to the United States last year, this means a reduction of 680,000 tons in export volume. Even high value-added steel products, which are in high demand in the U.S. market, are not immune. This is because the same tariffs are being imposed on items such as automotive steel sheets and oil country tubular goods. As U.S. automobile demand declines, there is a possibility that import demand will naturally shrink as well.

The steel industry is placing virtually all its hopes on the government's role. The United States is South Korea's largest export market, accounting for about 13.1% ($4.34686 billion) of the country's steel export value ($33.282 billion) as of last year. An industry official said, "The industry is watching to see the direction of the new government that took office following the June 3 presidential election," adding, "With the change in administration, we hope the government's response capabilities will be somewhat strengthened." A representative from the Korea Iron and Steel Association also stated, "We plan to form a one-team with the government to actively respond to trade negotiations with the U.S.," adding, "We are jointly preparing response strategies to minimize damage to the industry."

The industry plans to minimize losses by cooperating with the government's negotiation team and to restructure its export portfolio to focus on strategic items that are difficult to substitute in the U.S. market. Since the United States imported about 28 million tons of steel annually as of last year, the industry believes it will be difficult to replace this volume with increased domestic demand alone, and thus intends to develop export strategies centered on items with supply shortages. In addition, some companies are reportedly considering diversifying export destinations to Europe or expanding local production in the United States. An industry official said, "We could withstand a 25% tariff, but a 50% tariff virtually means a halt to exports," adding, "There is a red flag for performance in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.