Inverse 2X KOSPI ETFs Rank at the Bottom in Returns

Caution Urged on Short Positions Amid Rising Honeymoon Rally Expectations

With expectations for a "honeymoon rally" in the domestic stock market rising following the establishment of the new government, the returns of inverse investment products have taken a direct hit. Experts are leaving open the possibility of a correction in overheated policy beneficiary stocks in the short term, but are also advising caution against betting on a decline in the index.

According to the financial investment industry on June 5, the domestic stock market surged across the board the previous day amid anticipation for the launch of the new administration. In particular, the KOSPI settled above the 2,770 mark, entering a technical bull market, which is defined as a rise of more than 20% from the previous low (2,293.70). However, the rise in the index immediately translated into losses for inverse investors. Led by "RISE 200 Futures Inverse 2X (-5.85%)," major domestic inverse exchange-traded funds (ETFs) all plunged more than 5%, ranking at the bottom in ETF returns for the day.

All of these are so-called "double inverse" ETFs that track the daily return of the KOSPI 200 futures index at -2 times, making them one of the favorite products among individual investors. For example, the "KODEX 200 Futures Inverse 2X" ETF has ranked first in net purchases, with individual investors buying 294.2 billion won worth from May 1 to June 2. A securities firm official pointed out, "This rally is being driven not by political theme stocks related to the leading candidate, but by policy beneficiary stocks mentioned as part of the new administration's pledges," adding, "It is a time to be cautious about making bearish bets trying to time a market correction."

Although downside risks remain in the market, such as the United States raising tariffs on foreign steel and aluminum products from 25% to 50%, the securities industry is presenting rosy outlooks for the "Samcheonpi" (KOSPI reaching 3,000). Lee Kyungmin, a researcher at Daishin Securities, said, "With the implementation of strong economic stimulus and industrial policies by the new government, the growth drive is expected to strengthen," predicting, "The KOSPI will enter the 3,000 era just by normalizing valuations as it escapes from undervalued territory."

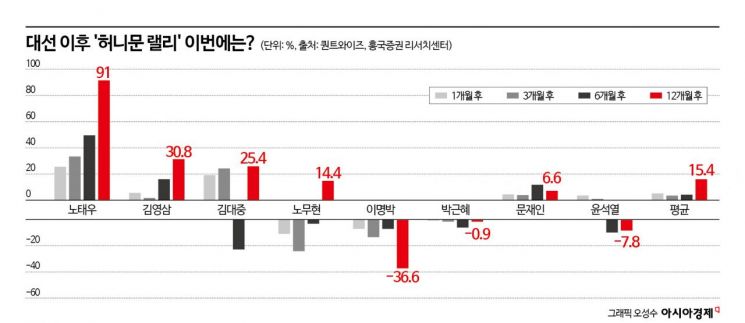

Empirical data also supports this optimism. According to Heungkuk Securities Research Center, in the eight presidential elections held since 1987, when the president began to be elected by direct vote, the average one-month gain for the KOSPI was 4.7%. One year after the election, the KOSPI rose by an average of 15.4%. As the Lee Jaemyung administration is starting at a relatively low valuation level compared to previous governments at their inception, there are expectations that a "honeymoon rally" (a stock market surge at the beginning of a new administration) could occur this time as well.

However, there are also warnings that anticipated beneficiary sectors such as renewable energy, construction, holding companies, and securities have already risen sharply, with these gains already priced into the market. Hwang Junho, a researcher at SangSangIn Securities, said, "With much of the so-called 'Lee Jaemyung trade' already priced in, investors should consider the possibility of catalysts fading due to uncertainty over whether pledges will be fulfilled, rather than expecting further gains," adding, "Ultimately, what determines the market's direction is not major domestic events themselves, but whether there are policies to confirm Korea's fundamental economic growth potential in response to external events."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)