Bad Bank Expected to Boost NPL Trading

Potential for Stablecoins and Other Digital Assets to Enter the Regulatory Framework

Competition from Internet-Only Banks for Mid-Interest Rate Loans Poses Risks

With the inauguration of the Lee Jae Myung administration, the savings bank and fintech (finance + technology) sectors are expressing optimism, while the card sector is taking a more cautious approach. This is due to expectations surrounding the stimulation of non-performing loan (NPL) purchases and the legalization of virtual assets. However, the entire secondary financial sector is anxiously monitoring the possibility of lowering the current legal maximum interest rate of 20%.

President Lee Jae Myung is taking the oath of office as the 21st president at the National Assembly in Yeouido, Seoul on June 4, 2025. Photo by Kim Hyun Min

President Lee Jae Myung is taking the oath of office as the 21st president at the National Assembly in Yeouido, Seoul on June 4, 2025. Photo by Kim Hyun Min

On June 5, according to the savings bank, fintech, and card sectors, the secondary financial sector is paying close attention to three policies of the Lee Jae Myung administration: the establishment of a bad bank, the creation of an internet-only bank dedicated to mid-interest rate loans, and the legalization of virtual assets.

The savings bank sector expects that the establishment of a bad bank will play a positive role in revitalizing the trading of non-performing real estate project financing (PF) loans. A bad bank is an institution that purchases and processes bad assets and loans. Although the policy's implementing body and scope have not been specified, it is expected that the government will use fiscal resources to cover bad assets of small business owners who have struggled to repay principal and interest since the COVID-19 pandemic.

The sector's logic is that, if a bad bank is established, it will expand loan channels for financial consumers (borrowers) such as households and small business owners, and will benefit both NPL trading and lending operations. Currently, NPL buyers include specialized NPL investment companies affiliated with financial holding groups such as Hana F&I and Woori F&I, as well as subsidiaries of mutual financial institutions like the National Credit Union Federation of Korea and the National Agricultural Cooperative Federation. Subsidiaries of the Korea Federation of Savings Banks and Hyundai Alternative, part of Hyundai Motor Finance, are also expected to enter the business.

A representative of the savings bank sector stated, "There are concerns that, after the launch of the bad bank, using government funds to write off the debts of low-income individuals could lead to widespread moral hazard. However, we believe that the increase in strong NPL buyers will help activate the NPL trading market," adding, "It is impossible for the bad bank to absorb all non-performing loans from the vast group of financial consumers, including households and individual business owners, and it seems unlikely that its business model and main customers will significantly overlap with those of other NPL processing institutions."

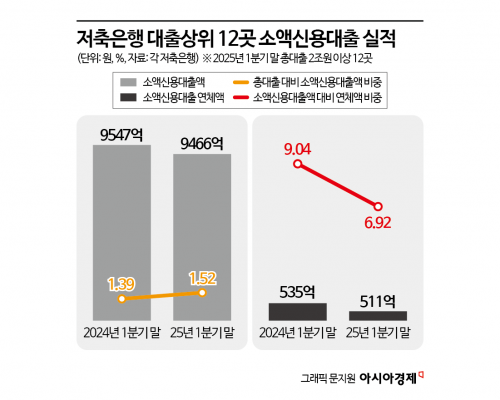

The Lee Jae Myung administration's pledge to establish an internet-only bank dedicated to mid-interest rate loans is also expected to have a positive impact on the savings banks' small-amount (under 3 million won) unsecured loan business. Recently, savings banks have been strengthening their competitiveness in the mid-interest loan market by collaborating with online investment-linked financial companies equipped with advanced artificial intelligence (AI) alternative credit assessment platforms, such as PFCT. According to the sector, as of the end of March, the total amount of small unsecured loans issued by the 12 savings banks with total loans exceeding 2 trillion won was 946.6 billion won in the first quarter, a decrease of 8.1 billion won (0.85%) from the same period last year (954.7 billion won), indicating stagnation and the need to revitalize the mid-interest loan market.

The fintech sector welcomed the Lee Jae Myung administration's policies, saying that the opportunity has arrived to resolve long-standing issues such as the issuance of stablecoins, the introduction of digital asset spot exchange-traded funds (ETFs), and the legalization of token securities (STOs). As the Democratic Party has pledged to establish a Digital Asset Agency (tentative name), the sector sees this as a golden opportunity to bring virtual assets into the institutional framework. A fintech industry representative said, "We need to monitor the pace of legislative work related to virtual assets, but our sector must also take proactive steps," adding, "We will do our best to ensure the Lee Jae Myung administration's pledges become reality."

The card sector has responded cautiously to the Lee Jae Myung administration's financial policies. This is because the establishment of an internet-only bank for mid-interest rate loans is seen as a risk for the card sector. The upper limit on private mid-interest loan rates is lower for internet banks than for card companies, which means card companies could lose unsecured loan customers. According to the Financial Services Commission, in the first half of the year, the upper limit on private mid-interest loan rates by sector was 8.16% for internet banks, 9.91% for mutual finance, 12.39% for cards, 15.50% for capital, and 17.14% for savings banks.

Meanwhile, the secondary financial sector is very concerned about the possibility of the legal maximum interest rate being lowered. Although the primary financial sector (banks) is the main target, the secondary sector is also closely watching, as it is unclear when and how the pressure for inclusive finance might affect them.

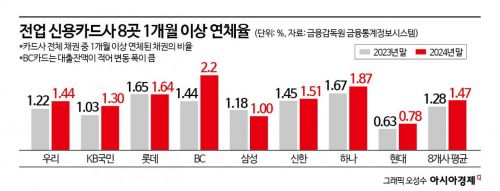

A representative of the credit finance sector said, "For the card sector, the major issue of recalculating eligible costs and lowering commission rates for small and medium-sized merchants was resolved in February, so there are currently no major issues. However, more than half of card loan and unsecured loan customers pay interest rates above 15%, so if the legal maximum interest rate is lowered to 15% as mentioned by the Democratic Party, it will become difficult for card companies to conduct loan business." Another financial sector representative pointed out, "If the legal maximum interest rate is lowered to 15%, the entire secondary financial sector's unsecured loan business will be paralyzed, and low-credit financial consumers may be driven into illegal private lending."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.