Domestic Stocks Achieve Top Return of 4.97% in Q1

Only Overseas Stocks in Negative Territory... Technology Shares Weaken Amid Tariff Concerns

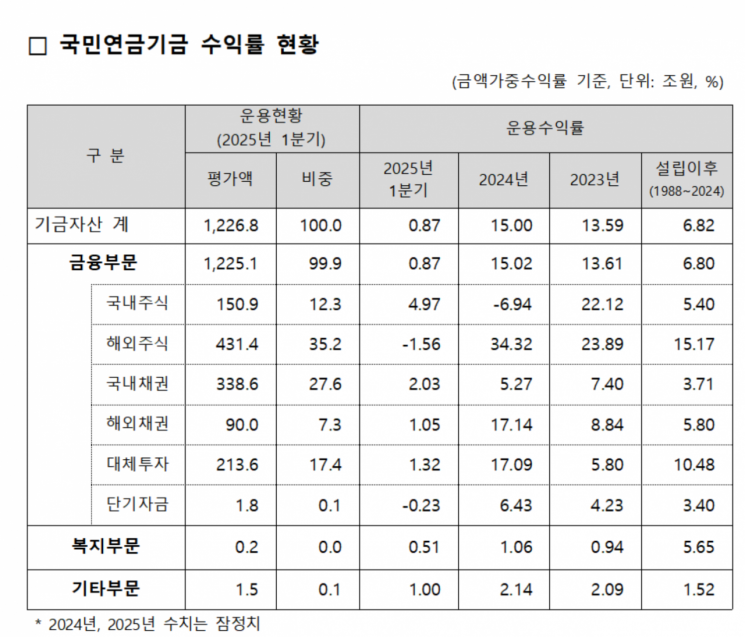

The National Pension Service recorded over 10 trillion won in investment returns in the first quarter of this year, pushing its reserve fund past 1,220 trillion won.

On May 30, the Fund Management Headquarters of the National Pension Service announced that, as of the end of March 2025, the fund's reserves totaled 1,227 trillion won.

This represents an increase of 14 trillion won compared to the end of last year. Of this, investment returns amounted to 10.6107 trillion won, with a provisional, money-weighted rate of return of 0.87%. By asset class, the rates of return were 4.97% for domestic stocks, 2.03% for domestic bonds, 1.32% for alternative investments, 1.05% for overseas bonds, and -1.56% for overseas stocks.

Domestic stocks performed well, supported by the attractiveness of undervalued share prices, favorable supply and demand conditions, and positive earnings expectations, despite ongoing international geopolitical instability.

In contrast, overseas stocks weakened, particularly among technology stocks that had been strong last year, as concerns over stagflation?marked by simultaneous economic slowdown and rising inflation?emerged amid uncertainty over U.S. tariff policy.

Market interest rates for both domestic and overseas bonds fell due to uncertainty over U.S. policy and concerns about economic slowdown, which in turn boosted bond returns. In particular, domestic bond yields benefited from the Bank of Korea's policy rate cut in February, which further lowered interest rates and resulted in solid investment returns.

For alternative investments, the rate of return reflected not only interest and dividend income, but also foreign exchange gains and losses caused by fluctuations in the won-dollar exchange rate.

Kim Taehyun, Chairman of the National Pension Service, stated, "Although global investment conditions, especially in the United States, remain challenging this year, the National Pension Service will continue to diversify its investments and make every effort to achieve both profitability and stability as a long-term investor managing the nation's retirement funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)