Sake Imports Up 20% Year-on-Year as of April, Set to Hit All-Time High

Strong Interest in Japanese Culture and Experiences Drives Sake Consumption

Japanese-Style Bars Create Synergy with Japanese Beer

While the domestic alcoholic beverage market remains sluggish due to the ongoing economic downturn and weak consumer demand, imports of sake (Nihonshu, Japanese-style rice wine) are rising sharply. Sake is winning over consumers with its high quality and diversity, backed by the strong popularity of Japanese culture and cuisine.

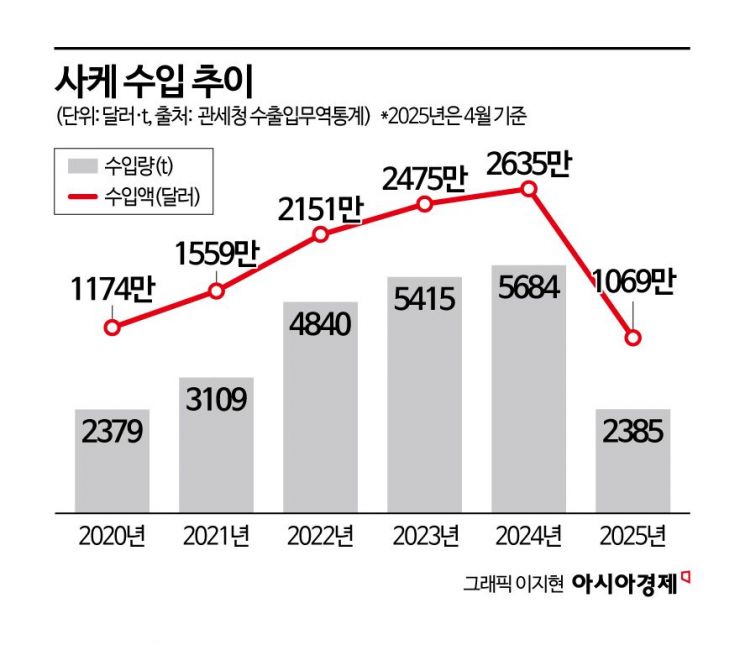

According to export and import trade statistics from the Korea Customs Service as of April 30, this year's sake import value stood at $10.69 million (approximately 15 billion won), up 19.4% from the same period last year ($8.95 million). Sake imports, which reached $11.74 million in 2020 when the home-drinking trend began during the COVID-19 pandemic, have increased every year since. Notably, even last year, when most imported alcoholic beverages struggled, sake imports continued to grow, reaching a record high of $26.35 million. This year, the figure is expected to surpass $30 million for the first time.

The growth in import volume is even steeper. By April this year, the volume of sake brought into Korea reached 2,385 tons, a 22.6% increase compared to the same period last year (1,949 tons). The import volume, which was 2,379 tons in 2020, exceeded 3,000 tons in 2021 and 4,000 tons in 2022, and jumped to 5,684 tons last year, marking a 2.5-fold increase over four years. This year, imports are expected to surpass 6,000 tons.

As sake imports rise, importers are also seeing improved performance. Nihonshu Korea, the largest sake importer in Korea, recorded sales of 24.9 billion won last year, a 14.7% increase from the previous year. Operating profit during the same period rose 7.6% to 7.1 billion won. Nihonshu Korea imports and sells popular brands such as Dassai, which saw sales grow about fivefold in 2023 compared to 2020. The company reports that sales have been increasing by 30-40% annually.

The recent increase in domestic sake demand is largely attributed to the overall rise in interest in and exposure to Japanese culture. In particular, as more travelers visit Japan, the experience of Japanese food and drinks abroad is leading to repeated consumption after returning home, steadily boosting demand. According to the Korea Tourism Organization, 8.82 million Koreans visited Japan last year, up 26.7% from the previous year and setting a new record. In the first quarter of this year, 2.51 million Koreans visited Japan, a 7.2% increase from the same period last year, and the number is expected to surpass last year's record.

Improved accessibility to sake is also contributing to the expansion of demand. A Nihonshu Korea representative explained, "With the increase in sake specialty stores and the growth of online sales through smart ordering, it has become easier to access sake in Korea than before. In addition, information about the types, brewing processes, and flavors of sake is spreading through various channels, helping to establish its image as a premium drink."

Furthermore, the fact that sake is a category with a high consumption rate in entertainment venues such as bars and restaurants is another reason why related companies are increasing imports. Generally, alcoholic beverages yield higher margins when sold in the entertainment sector. For importers, while a high proportion of home consumption helps expand overall sales, they prefer sales in the entertainment sector due to the higher margins. The recent surge in sake's popularity has prompted importers to be more proactive in sake sales and marketing, which is also related to the high proportion of sales in high-margin entertainment channels.

The tendency of Japanese-style izakayas and omakase restaurants (chef’s choice multi-course meals) to exclusively serve Japanese alcoholic beverages for optimal pairing and atmosphere is also helping to increase sake consumption. Industry insiders also note that the recent rise in demand for Japanese beer is creating a synergy effect with sake.

The popularity of sake in the domestic alcoholic beverage market is expected to continue for the time being. Although sake still lags behind major categories in terms of absolute scale, there is ample room for growth, and gradually diversifying consumer preferences suggest that demand will continue to expand. In particular, the domestic food service industry's strong preference for Japanese cuisine is expected to support stable demand growth, according to industry sentiment.

However, some point out that a mass-market hit product is needed for the market to sustain its growth. An industry official said, "Although the popularity of sake in Korea is rising, it still remains a minor category within the overall market. To expand its reach, a product with broad popular appeal must emerge." The official added, "In addition, to preserve the unique flavors of certain types such as Namazake (unpasteurized sake), which require refrigerated distribution, the industry must also address the challenge of fierce competition for refrigerator showcase space with other alcoholic beverages."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)