Key Assumptions in May's Revised Economic Outlook

US Base Tariff of 10% and Item-Specific Tariff of 25% Largely Maintained

10% Item-Specific Tariffs on Semiconductors and Pharmaceuticals Imposed in Second Half

Economic Sentiment Improves as Domestic Uncertainties Ease

Early May Supplementary Budget of 13.8 Trillion Won Expected to Boost Domestic Demand

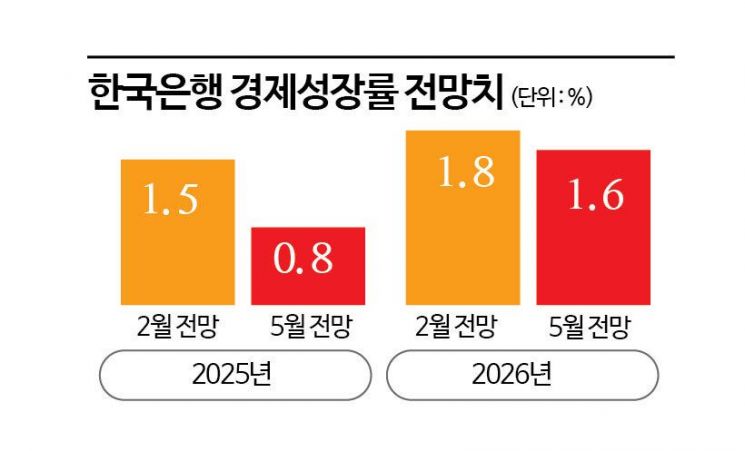

The Bank of Korea, in its revised economic outlook released on May 29, projected South Korea's economic growth rate for this year at 0.8%. This figure is significantly lower than the previous forecast of 1.5% made in February.

The Bank of Korea explained that the main assumptions behind this revised outlook are: the reflection of strengthened U.S. tariff policies; a recovery in economic sentiment due to easing domestic uncertainties; and the effect of the 13.8 trillion won supplementary budget introduced in early May to stimulate domestic demand.

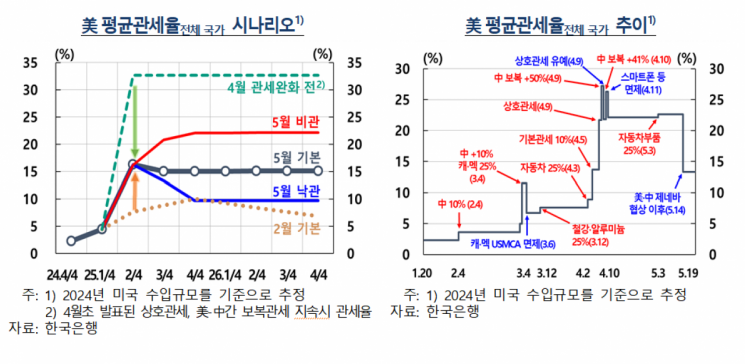

Regarding U.S. tariff policy, the Bank of Korea assumed that the current levels?base tariff of 10% and item-specific tariffs of 25%?will generally be maintained, taking into account recent tariff negotiations among major countries such as the United States, the United Kingdom, and China. It also assumed that item-specific tariffs of 10% would be imposed on certain products such as semiconductors and pharmaceuticals in the second half of the year. A Bank of Korea official stated, "Compared to the assumptions made in February, we have reflected the fact that U.S. tariff policy has become more stringent. The number of countries affected has expanded, and tariff rates have also increased." However, the official explained that, compared to early April when mutual tariffs were announced and U.S.-China retaliatory measures intensified, the current assumptions reflect a somewhat eased situation.

Changes in domestic conditions were also reflected. A Bank of Korea official said, "We assumed that economic sentiment would improve as domestic uncertainties eased, despite high external uncertainties. In terms of government stimulus, we took into account the effect of the 13.8 trillion won supplementary budget introduced in early May to boost domestic demand."

Q2 Growth Forecast: 0.8% to 0.5%... Construction Slump + Slow Consumption Recovery

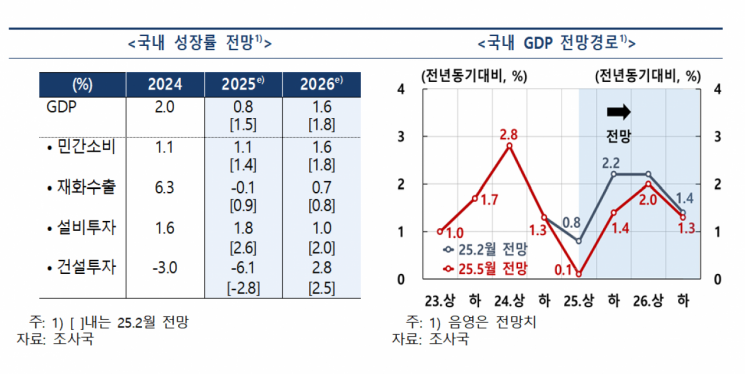

The downward revision of this year's real GDP growth rate to 0.8% was driven by several factors: prolonged sluggish domestic demand due to delayed recovery in economic sentiment and a slump in the construction sector; and increased downward pressure on exports due to deteriorating trade conditions.

By quarter, domestic demand worsened in the first quarter, resulting in negative growth of -0.2%. While a rebound is expected in the second quarter, growth is projected to reach only 0.5%, falling short of the initial forecast of 0.8%, due to continued weakness in construction and slow recovery in consumption. A Bank of Korea official explained, "This adjustment reflects the unusual combination of weakened economic sentiment amid both domestic and external uncertainties, as well as temporary factors such as construction site accidents, adverse weather, and large-scale wildfires."

From the second half of the year onward, the Bank of Korea expects that interest rate cuts and the effects of the supplementary budget will continue, leading to a recovery in economic sentiment and improvement in domestic demand. Regarding exports, a Bank of Korea official said, "Although recent trade tensions have somewhat eased due to mutual tariff suspensions and U.S.-China tariff negotiations, the high tariff rates and uncertainty in the negotiation process will cause export growth to fall short of previous projections and show a slowing trend."

The growth forecast for next year was lowered from 1.8% in February to 1.6%. While growth is expected to improve, led by domestic demand, the continued impact of deteriorating trade conditions is projected to limit growth to 1.6%, below the initial expectations.

This year's consumer price inflation rate is expected to remain at 1.9%, the same as the previous forecast. This is due to upward factors such as price increases for processed foods, dining out, and university tuition for some services, being offset by downward factors such as weak demand pressure and falling international oil prices. The core inflation rate was revised up by 0.1 percentage points to 1.9% from the previous forecast of 1.8%. A Bank of Korea official projected, "Consumer price inflation will hover near 2% in the first half of the year, but is expected to fall to the upper 1% range in the second half as the impact of falling international oil prices grows."

Current Account Surplus Forecast Raised to $82 Billion..."Imports to Fall More Than Exports Despite Lower Customs Exports"

The current account surplus is expected to reach $82 billion, exceeding the February forecast of $75 billion. A Bank of Korea official said, "The goods balance surplus is projected to widen compared to the previous forecast, as customs exports are expected to decline due to the impact of U.S. tariffs, but imports are projected to fall even more sharply due to lower oil prices and sluggish domestic demand." As for the primary income balance, the surplus is expected to increase, mainly driven by dividend income, given the continued rise in overseas securities investments by Korean residents. However, the possibility of increased imports from the United States during negotiations was cited as a potential downside risk for the current account surplus.

The number of employed persons is expected to increase by 120,000, slightly above the February forecast of 100,000. While employment in construction and manufacturing is projected to decline due to weak construction investment and U.S. tariff policy, public administration and health and welfare jobs are expected to exceed initial projections significantly, thanks to government employment measures. However, a Bank of Korea official noted, "Despite increases in public administration and health and welfare jobs, private sector employment is decreasing, and the rise in employment is being driven by low-wage, short-term public sector jobs. Therefore, the overall employment situation is still considered weak."

Major forecasting institutions have also sharply revised down their growth outlooks for South Korea compared to February. The median and lower quartile forecasts for this year's growth by major investment banks and market participants are 0.9% and 0.7%, respectively, down 0.7 percentage points and 0.8 percentage points from the February forecasts of 1.6% and 1.5%. For consumer price inflation, the median forecast remains unchanged at 2.0% compared to February.

Future growth paths remain highly uncertain due to factors such as the progress of trade negotiations, the pace of recovery in economic sentiment, and conditions in the global financial markets. Bank of Korea Governor Rhee Changyong said at a press conference following the interest rate decision, "Uncertainty over the future growth path remains high, with both upside and downside risks present. Rapid and smooth resolution of trade negotiations with major countries and additional stimulus measures by the new government could serve as upside factors, while prolonged trade conflicts and additional item-specific tariffs could act as downside risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.