Bank of Korea: "Growth to Stall at 0.8% This Year"

Dual Headwinds of Domestic Contraction and Export Slowdown

Rate Cut to '2.50% Per Annum'

Heightened Recession Fears, Eased Inflationary Pressure

Further Rate Cuts Needed in Tandem with Fiscal Policy

But External-Internal Rate Gap Remains a Concern

The fear of an 'R (Recession)' has cast a shadow over the Korean economy. On May 29, the Bank of Korea drastically lowered its economic growth forecast for this year from 1.5% to 0.8%. This significant downgrade reflects expectations that, in addition to the prolonged slump in domestic demand led by weak consumption and construction, Korea's exports-a major pillar of the economy-will be hit much harder than previously anticipated due to the intensifying tariff war originating from the United States. To respond to the dual challenges of shrinking domestic demand and slowing exports, the Monetary Policy Committee of the Bank of Korea cut the base interest rate from 2.75% to 2.50% per annum.

Lee Changyong, Governor of the Bank of Korea, is striking the gavel to declare the opening of the Monetary Policy Committee plenary meeting held at the Bank of Korea headquarters in Jung-gu, Seoul on the 29th. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is striking the gavel to declare the opening of the Monetary Policy Committee plenary meeting held at the Bank of Korea headquarters in Jung-gu, Seoul on the 29th. Photo by Joint Press Corps

Bank of Korea: "Growth to Stall at 0.8% This Year"... Dual Headwinds of Domestic Contraction and Export Slowdown

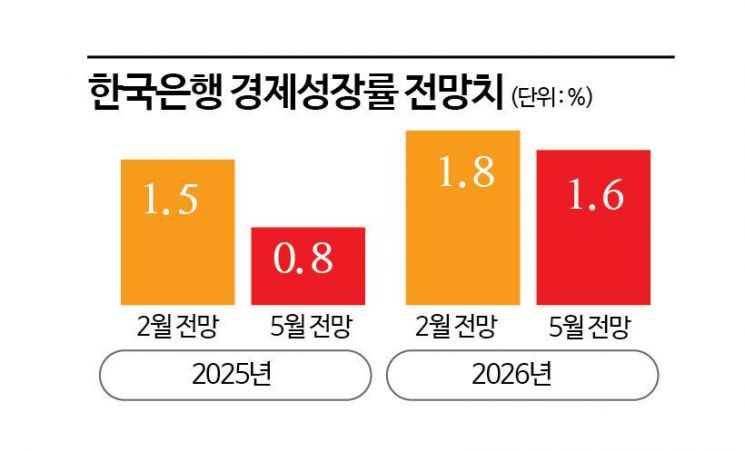

In its revised economic outlook released on this day, the Bank of Korea projected that the Korean economy would grow by only 0.8% this year. This is a dramatic reduction, nearly halving the previous forecast of 1.5% made just three months ago in February. The new figure matches the 0.8% forecasts recently published by the Korea Development Institute (KDI) and the Korea Institute of Finance, and is lower than the International Monetary Fund (IMF)'s 1.0% projection announced last month.

The downward revision by the Bank of Korea had been anticipated. After announcing a rate freeze last month, Bank of Korea Governor Lee Changyong stated at a press conference that the impact of U.S. tariff policies was greater than previously factored in, remarking, "Our February forecast was overly optimistic." The release of data showing that real GDP contracted by -0.246% in the first quarter compared to the previous quarter further increased expectations that this month's downward revision could be more drastic than initially thought.

This outcome is the result of several factors: worsening domestic demand, a deteriorating global trade environment and export slowdown due to the tariff war, and delayed recovery in industries losing ground to Chinese competitors. Moreover, the lack of a clear momentum for a rebound in the Korean economy following the first quarter's negative growth is particularly painful.

The impact of U.S.-driven tariffs is already visible in export figures. From the beginning of this month through the 20th, total exports were tallied at $32 billion (based on customs clearance), a 2.4% decrease from the same period last year. Exports to the U.S. fell by 10.6% last month and the decline widened to 14.6% this month. Automobile exports amounted to $3.1 billion, down 6.3% year-on-year. The Monetary Policy Committee predicted, "Exports are likely to experience a greater slowdown due to factors such as the imposition of U.S. tariffs."

On the domestic front, the construction investment slump that dragged down Korea's economic growth last year has continued, and the recovery in private consumption, especially in services such as accommodation and food, remains sluggish. Business investment sentiment is also subdued, prolonging the domestic demand slump. The Monetary Policy Committee assessed, "While the weakness in domestic demand will gradually ease, the pace of recovery will be slow." Lee Yoonsu, Professor of Economics at Sogang University, commented, "Trade issues are a factor, but the situation is especially dire for domestic consumption, particularly construction investment, which has significantly contributed to the deterioration in growth. Even if there is a recovery in the second to fourth quarters after the first quarter's negative growth, it will be difficult for annual growth to exceed 1%."

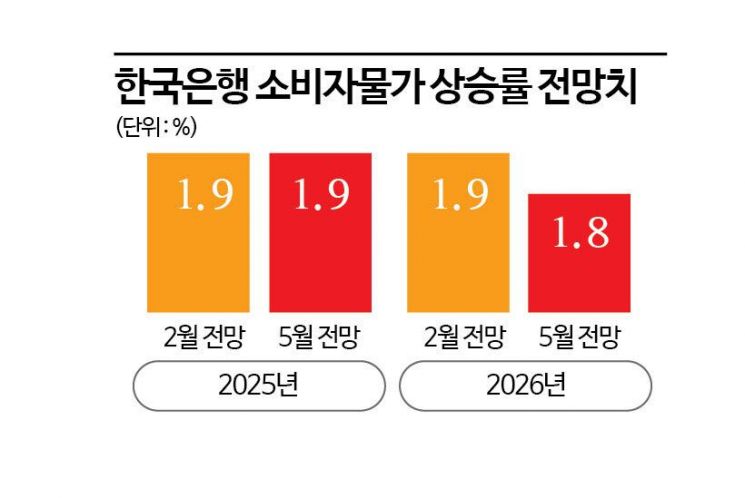

The economic growth forecast for next year was also lowered from 1.8% to 1.6%. Although a slight recovery is expected compared to this year, the growth rate is still projected to fall below the potential growth rate. If these projections hold, Korea will remain stuck in a low-growth rut for four consecutive years-1.4% in 2023, 2.0% last year, and under 2% this year and next. Analysts warn that unless a clear new growth engine is found amid worsening low birth rates and an aging population, a further decline in potential growth is inevitable. The inflation rate is expected to hover near the target of 2.0%. This year's inflation forecast remains at 1.9%, unchanged from February, while next year's forecast was trimmed by 0.1 percentage point to 1.8%, reflecting factors such as weak demand pressure and falling international oil prices.

Bank of Korea Governor Lee Changyong is presiding over the Monetary Policy Committee meeting at the Bank of Korea in Jung-gu, Seoul, on the 29th. Photo by Joint Press Corps

Bank of Korea Governor Lee Changyong is presiding over the Monetary Policy Committee meeting at the Bank of Korea in Jung-gu, Seoul, on the 29th. Photo by Joint Press Corps

Rate Cut to '2.50% Per Annum'... Heightened Recession Fears, Eased Inflationary Pressure

The Bank of Korea's Monetary Policy Committee announced at its policy meeting on this day that it had lowered the base interest rate to 2.50% per annum, a 0.25 percentage point reduction from the previous 2.75%, in line with market expectations. The committee switched to an easing cycle last October by cutting rates for the first time in three years and two months, and has now implemented a total of four rate cuts-in November last year, February this year, and again this month.

The main driver behind this month's cut is concern over low growth due to mounting downward pressure on the economy. With both exports and domestic demand-the twin engines of the Korean economy-showing warning signs and this year's growth forecast dropping into the 0% range, the case for supporting the economy through monetary easing has strengthened. While concerns remain over household debt and increased volatility in the foreign exchange market, the stabilization of inflation has created an environment in which monetary policy can focus on addressing the decline in growth.

Household debt remains a concern. Housing prices in some regions have started to rise again, and the temporary lifting of land transaction permit zones (LTPZ) in February has led to a lagged increase in household debt over the past two to three months. However, the re-expansion of LTPZ designations and the implementation of the third stage of the stress-based Debt Service Ratio (DSR) in July are expected to gradually stabilize the situation. The consumer inflation rate has recently hovered in the low 2% range, but with oil price adjustments, it is expected to decline, keeping the annual forecast at 1.9%. Although concerns about exchange rate volatility persist, the burden of the current won-dollar exchange rate level has eased, with the rate recently moving around the 1,380 won mark, down from the 1,500 won level that previously raised alarm.

Further Rate Cuts Needed in Tandem with Fiscal Policy... But External-Internal Rate Gap Remains a Concern

Experts believe that, in the short term, additional rate cuts are needed alongside the new government's expansionary fiscal policies, such as a second supplementary budget, to alleviate downward pressure on the economy. In the medium to long term, they stress the urgent need for industrial restructuring, including the development of new industries.

Kang Sungjin, Professor of Economics at Korea University, noted, "In the short term, fiscal policies such as a second supplementary budget are necessary, but with a fiscal deficit approaching 100 trillion won, the new government has limited room for further supplementary spending. The scope will be restricted." He added, "The supplementary budget should be partially allocated as a social safety net for small business owners, while the remainder should be directed toward growth drivers to accelerate industrial restructuring."

Professor Lee also stated, "If a sudden shock occurs, additional problems could arise, so in the short term, efforts to help struggling small businesses recover are necessary. However, the method of distributing funds should be carefully considered. It is questionable whether spreading money evenly is effective in revitalizing the small business sector." He emphasized that the more important issue is to instill confidence in an overall subdued atmosphere. He said, "For the economy to recover, structural reform is essential," adding, "The new government must consider medium- to long-term strategies so that new growth engines can emerge, leading to increased investment and employment, and so that the current subdued mood shifts to a perception that the economy is coming back to life."

However, the fact that this latest rate cut has widened the interest rate gap with the United States to 2.00 percentage points is a concern. Experts believe that, with the U.S. Federal Reserve expected to hold rates steady for the time being, it will not be easy for the Bank of Korea to implement additional rate cuts. According to the minutes of the May Federal Open Market Committee (FOMC) meeting released by the Fed on May 28 (local time), committee members judged that, given the heightened uncertainty in the U.S. economy due to tariff policies under the Donald Trump administration, it would be appropriate to keep the policy rate unchanged and monitor the situation carefully for now.

While many in the market expect the FOMC to cut rates in July, there is growing speculation that the move could be delayed until September. Kim Sungsoo, a researcher at Hanwha Investment & Securities, commented, "The Fed's stance is to confirm whether inflation expectations are anchored before taking action, given that uncertainty has not been resolved. It will be difficult to find answers to both conditions by the middle of the third quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.