U.S. Pushes for Nuclear Power... Era of the Global Nuclear Power "Big Three"

Hyundai Engineering & Construction Secures the Largest Pipeline for Large-Scale Nuclear and SMR Projects

DL E&C, Samsung C&T, and Daewoo E&C Also Targeting the Global Market

"Structural Growth for Years"... Securities Industry Expands "Buy" Recommendations

With U.S. President Donald Trump recently signing an executive order explicitly calling for the restart of large-scale nuclear power plants and the development of next-generation small modular reactors (SMRs), it is expected that private nuclear power projects will begin in earnest. Following Europe, the United States has also announced a policy to expand nuclear power, prompting the securities industry to issue "rosy outlooks," calling this an "opportunity for Korean construction companies equipped with both technological expertise and construction experience."

On May 27, Hanwha Investment & Securities researchers Song Yurim and Kim Yerim stated, "The global nuclear power plant order market is being reorganized into a three-way competition among the United States, France, and Korea," adding, "Korea has a highly competitive pricing structure and a strong ability to meet delivery deadlines, giving it a high likelihood of securing actual orders." They particularly noted, "Hyundai Engineering & Construction has secured the world's largest nuclear power pipeline among single companies."

Hyundai Engineering & Construction is considered the biggest beneficiary of the "nuclear renaissance." The company is expanding its global order opportunities in both large-scale nuclear power plants and SMRs. After winning the contract for facility upgrades at Unit 1 of the Cernavoda Nuclear Power Plant in Romania, the company is expected to launch the full-scale engineering, procurement, and construction (EPC) project for Units 7 and 8 of the Kozloduy Nuclear Power Plant in Bulgaria in the second half of this year. This project is valued at approximately $7 billion (about 9.5 trillion won). Hyundai Engineering & Construction is targeting the European nuclear market through a strategic partnership with Westinghouse. In the SMR sector, the company is preparing a demonstration project for the SMR-300 in Palisades, Michigan, in collaboration with Holtec. Construction is scheduled to begin in the fourth quarter of this year. This will be the first SMR ever built in U.S. history.

DL E&C is also investing in X-energy in the United States to keep pace with the spread of SMRs. Domestically, the company is internalizing EPC and construction technologies for the i-SMR demonstration project. Samsung C&T has invested in NuScale Power in the United States and is currently conducting the front-end engineering design (FEED) for the construction of six SMRs in Romania. Daewoo E&C is participating as a construction partner in the bid for the new Dukovany Nuclear Power Plant in the Czech Republic, led by Korea Hydro & Nuclear Power, and has secured construction capabilities for the Korean APR1000 and APR1400 nuclear technologies.

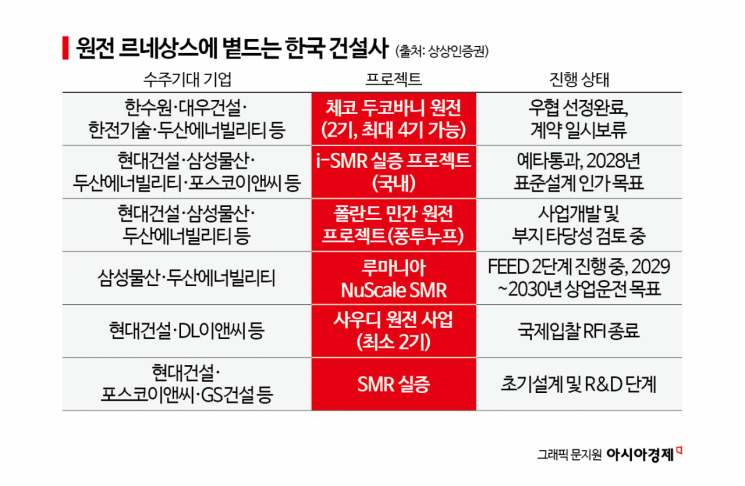

Kim Jinbeom, a researcher at SangSangin Investment & Securities, said, "The nuclear EPC market has entered a normalization phase, and major Korean construction companies have already established both technological and policy foundations," adding, "Hyundai Engineering & Construction, DL E&C, Daewoo E&C, and others are highly likely to secure actual orders in Europe, the Middle East, and the United States." According to a SangSangin Investment & Securities report, major projects in which Korean companies are participating include the Dukovany Nuclear Power Plant in the Czech Republic, two new nuclear power plants in Saudi Arabia, new nuclear power plants in Bulgaria, the Pontnuf private nuclear power plant in Poland, the NuScale SMR project in Romania, and the domestic i-SMR demonstration project.

The securities industry emphasizes that this nuclear cycle is not just a short-term theme but a structural growth trend likely to continue for several years. Park Sera, a researcher at Shin Young Securities, stated, "Nuclear power is a fixed axis in the energy transition structure, not a short-term issue, and SMRs in particular will serve as a core mid-to-long-term export strategy," adding, "Because the nuclear power order industry reflects expectations ahead of actual performance, stock prices are likely to respond in earnest from now on."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.