June BSI Outlook at 94.7

Largest Increase in Recent Months Compared to May

Sluggish Outlook for Both Manufacturing and Non-Manufacturing Sectors

Business conditions for June 2025 are projected to be more negative than in the previous month. This downward trend has persisted for approximately three years since 2022, as the economic downturn continues.

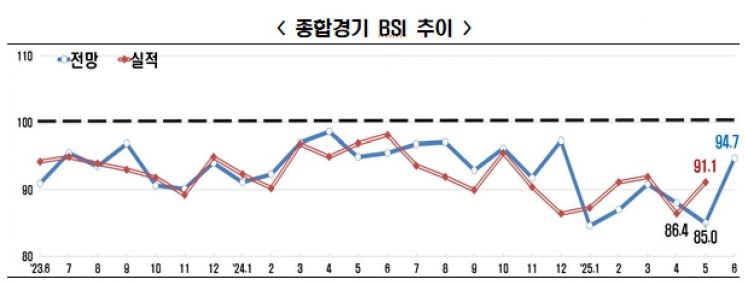

According to a survey conducted by the Korea Entrepreneurs Association on the 600 largest companies by revenue, the Business Survey Index (BSI) outlook for June 2025 was 94.7, falling below the baseline of 100. The BSI has remained below 100 for 39 consecutive months since April 2022 (99.1). A BSI above 100 indicates a positive business outlook compared to the previous month, while a BSI below 100 signals a negative outlook.

However, the June BSI figure rebounded by 9.7 points compared to May (85.0). This is the largest increase in 28 months since March 2023 (93.5).

The actual BSI for May was 91.1. Although the index has remained sluggish for 40 consecutive months since February 2022 (91.5), it rose by 4.7 points from April (86.4).

By sector, the June BSI for both manufacturing (96.0) and non-manufacturing (93.5) remained below the baseline of 100, indicating continued sluggishness. The manufacturing BSI (96.0) has stayed below 100 for 15 consecutive months since April 2024, while the non-manufacturing BSI (93.5) has remained below 100 for six consecutive months since January 2025 (84.9).

However, the manufacturing BSI for June jumped by 16.8 points from May (79.2), driven by strong performance in the electronics and telecommunications equipment sector. This is the largest monthly increase in 52 months since March 2021.

Among the 10 detailed manufacturing sectors, electronics and telecommunications equipment (123.5) and automobiles and other transportation equipment (103.0) showed positive outlooks. Four sectors?food, beverages and tobacco (100.0); wood, furniture and paper (100.0); pharmaceuticals (100.0); and general and precision machinery and equipment (100.0)?were at the baseline, while four others, including petroleum refining and chemicals, are expected to deteriorate.

In particular, the "electronics and telecommunications equipment" sector, which includes semiconductors, recorded its highest level in 15 years and 4 months since March 2010, leading the rebound in the manufacturing BSI.

The Korea Entrepreneurs Association attributed the improvement in this sector to several factors: increased inventory demand from client companies seeking to avoid tariff impacts; improved demand from PC and mobile companies following domestic demand stimulus measures in China; and a slight easing of US-China trade uncertainty. As a result, business sentiment in this sector has brightened.

Among the seven detailed non-manufacturing sectors, only wholesale and retail (101.8) showed a positive outlook. Four sectors?leisure, accommodation and food services (100.0); professional, scientific and technical services and business support services (100.0)?were at the baseline, while four others, including electricity, gas, and water supply, are expected to deteriorate.

The Korea Entrepreneurs Association explained that the sluggishness of the non-manufacturing BSI in June is due to a decline in leisure, accommodation and food services caused by the base effect from the previous month, as well as the prolonged impact of weak domestic demand, despite the positive performance in wholesale and retail.

All BSI outlooks by survey category for June were negative. Domestic demand (95.8), exports (96.4), and investment (93.0) have all remained sluggish for 12 consecutive months since July 2024.

Lee Sangho, head of the Economic and Industrial Division at the Korea Entrepreneurs Association, stated, "While US-China trade friction has eased somewhat and expectations for additional government economic stimulus are rising, particularly for a manufacturing-led recovery, structural risks remain. These include continued global trade uncertainty, weakened industrial competitiveness, and persistent domestic demand stagnation." He added, "It is essential to defend the economy through expansionary fiscal and monetary policies, respond to trade risks, and strengthen the institutional foundation to enhance corporate competitiveness in order to achieve a clear rebound in business sentiment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.