Sunrun Drops 37% as Reliance on Section 48E Benefits Weighs Heavy

Residential Solar Incentives Plummet

Brokerages Cut Target Price from $9 to $4

Solar energy stocks fell across the board on May 22 (local time) after the U.S. House of Representatives passed the "One Big Beautiful Bill," a tax cut bill designed to fulfill President Donald Trump's tax cut pledges. The sharp decline was particularly pronounced in sectors related to residential solar energy, as incentives for the residential solar industry were drastically reduced.

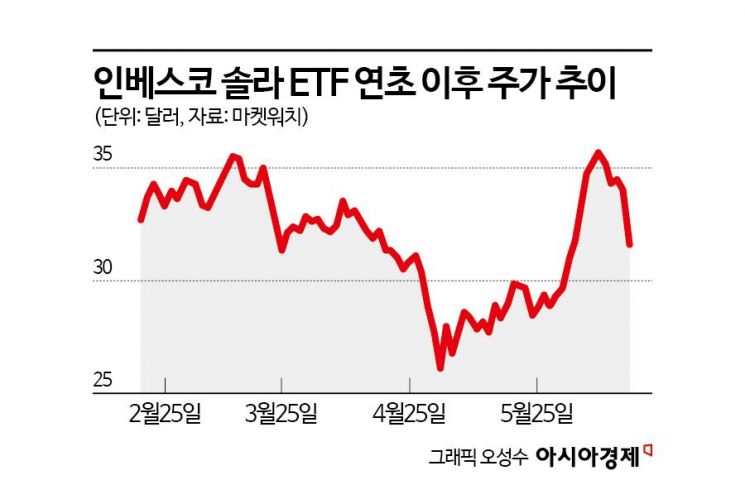

On the New York Stock Exchange, the Invesco Solar ETF, a clean energy-themed exchange-traded fund (ETF), closed at $31.44, down 7.45% from the previous session. Major holdings such as Sunrun (-37.10%), Enphase Energy (-19.63%), First Solar (-4.27%), and Nextracker (-3.13%) all saw significant declines, which in turn negatively impacted the related ETF.

The bill draft, released on May 12, included provisions to scale back clean energy incentives previously provided under President Biden's Inflation Reduction Act (IRA). Among these, the investment tax credit known as "Section 48E" was originally set to be phased out gradually. However, in the final version passed by the House, the timeline for ending subsidies for commercial clean power facilities was moved up. For commercial projects, if construction does not begin within 60 days of the bill taking effect, the benefits will no longer be available. Given the typical preparation period, this is effectively interpreted as stripping away the incentives.

According to the Financial Times, Sunrun, whose share price plummeted by more than 30% in a single day, was hit especially hard due to its high reliance on benefits from Section 48E. Sunrun is one of the largest residential solar energy service companies in the U.S., operating businesses such as solar leasing. According to U.S. financial information provider Insider Monkey and others, BMO Capital downgraded its investment rating for the company from "market perform" to "underperform" in a report released that day. The target price was also lowered from $9 to $4.

The bill, having passed the House, must now go through a Senate floor vote and be signed by the President. Jefferies equity research analysts told the Financial Times, "While some adjustments may occur in the Senate, the final budget bill released by Republicans on Wednesday is close to 'sledgehammer strikes,'" adding, "The outcome is much worse than expected." Manish Kabra, head of U.S. equity strategy at Societe Generale (SG), also stated, "There is no longer a compelling reason to own U.S. solar companies," emphasizing, "It has become clear that eliminating green subsidies is one of this administration's core objectives."

After the bill passed, President Trump urged the Senate to act quickly through his social networking service, Truth Social, stating, "This could be the most important bill in American history," and "Act now and get this bill to my desk as soon as possible."

Meanwhile, nuclear power tax credits, which are related to the nuclear industry supported by the Republican Party and a potential second Trump administration, were excluded from the cuts. Advanced manufacturing subsidies also remained unchanged.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)