Eight Deals at Nine One Hannam and The Hill in Hannam-dong...

Top Price Reaches 25 Billion Won

Apgujeong Already Surpasses Last Year's Transactions...

Reconstruction Hopes Rise

Wealthier Individuals Focus More on Real Estate...

"Lending Regulations? Not Our Concern"

Commercial Slump Fuels Ultra-High-End Demand...

"Real Estate Remains the Only Trustworthy Asset"

Apartment transactions valued at over 10 billion won, which surged last year, have become even more active this year. Despite various uncertainties?including the government's stringent lending regulations, the political turmoil from impeachment and early presidential elections, reversals of land transaction permit zones, and economic instability?the sentiment that "real estate is the only thing you can trust" is spreading, further fueling the ultra-high-end market.

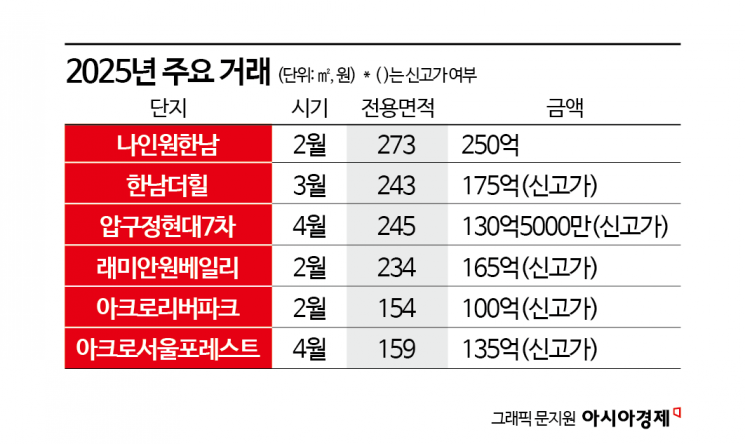

According to the actual transaction price system of the Ministry of Land, Infrastructure and Transport on May 23, there have been a total of 14 apartment transactions worth over 10 billion won from January to the previous day this year. During the same period last year, there were 9 such transactions. The demand for ultra-high-end apartments continues to rise, following last year's trend. In 2024, a record-high 23 transactions were recorded. Transactions of apartments worth over 10 billion won first appeared in South Korea in 2021, with 7 such deals that year. The number dropped to 4 in 2022, rebounded to 6 in 2023, and then surged to 23 last year.

Hannam Leads, Apgujeong and Banpo Follow

By complex, more than half?8 transactions?were completed in Hannam-dong, Yongsan-gu. Nine One Hannam, a symbol of "luxury apartments," saw 5 transactions, while Hannam The Hill accounted for 3. In February, a 273-square-meter unit at Nine One Hannam changed hands for 25 billion won, marking the highest apartment transaction price so far this year. Hannam-dong also led last year, with 11 out of 23 transactions involving apartments over 10 billion won taking place there, making it a representative area driving the ultra-high-end apartment market.

The next most active areas were Banpo-dong in Seocho-gu (2 transactions) and Apgujeong-dong in Gangnam-gu (2 transactions). Each of these areas also saw 2 transactions over 10 billion won last year. In just about five months, they have matched the annual transaction volume of the previous year. In Apgujeong-dong, a 245-square-meter unit at Hyundai 7th Complex was sold for 13.05 billion won last month, setting a new record for the highest price ever in the Apgujeong redevelopment district and drawing significant attention. Expectations for redevelopment in Apgujeong-dong are rising, with the redevelopment project set to begin in earnest next month, starting with Apgujeong District 2. Other notable ultra-high-end transactions include Acro Seoul Forest (245 square meters, 13.5 billion won) in Seongsu-dong 1-ga, Seongdong-gu, and Hyosung Villa Cheongdam 101 (226 square meters, 11.3 billion won) in Cheongdam-dong, Gangnam-gu.

Wealthier Individuals Allocate More to Real Estate... "Ultra-High-End Demand Remains Strong"

The increase in ultra-high-end apartment transactions is closely linked to the clear real estate preference among asset owners known as the "super rich." According to the "Top 1% Wealth Report" released last month by the NH Investment & Securities 100-Year Life Research Institute, real estate accounted for 79.4% of the assets held by the top 1% of wealthy individuals. This is nearly 9 percentage points higher than the average for all households (70.5%). NH Investment & Securities analyzed, "Top 1% households manage their assets with a strong focus on real estate," and added, "The proportion of non-residential real estate (55.7%) is much higher than that of residential property (23.7%), showing a significant difference compared to the overall household average (residential 42.0%, non-residential 28.5%)."

Some analysts point out that the slump in commercial real estate?such as retail and office properties?has reinforced the perception that "apartments are the only reliable investment." According to the Korea Real Estate Board, the vacancy rate for medium- and large-sized retail spaces in Seoul reached 8.93% in the first quarter of this year, up from 8.85% in the previous quarter. This means that about 1 in every 10 retail units is vacant. Even in Gangnam, a traditionally popular commercial area, several districts exceeded Seoul's average vacancy rate, including Gangnam-daero (12.55%), Nonhyeon Station (16.61%), and Sinsa Station (14.27%).

Yang Jiyeong, head of Asset Management Consulting at Shinhan Investment & Securities, explained, "The ultra-high-end apartment market is essentially a separate market akin to luxury goods. Since cash-rich individuals are at the center, transactions often occur without being affected by external variables such as lending regulations or interest rates." She added, "Ultra-high-end apartments are extremely scarce due to limited supply, and demand remains steady as they serve both as a means of asset protection and as a symbol of social status."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)