Ten Consecutive Days of Gains, Setting New Highs Each Day

Sustained Buying by Foreign Investors and Institutions

Expectations Rise for Nuclear Power Orders and AI Data Center Opportunities

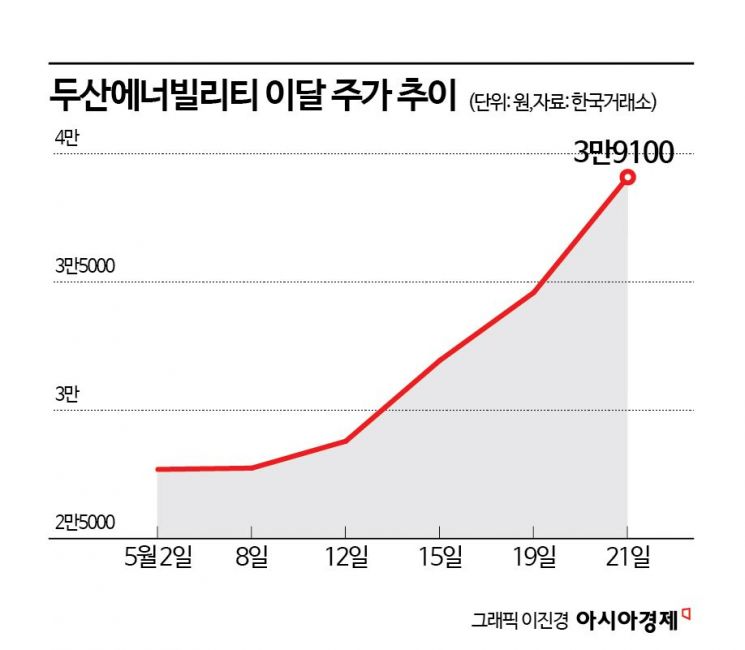

Doosan Enerbility has continued its upward momentum for ten consecutive days, hitting new record highs each day. Since the beginning of this month, the stock price has risen by 35%. The ongoing buying by foreign investors and institutions is supporting this record-breaking rally.

According to the Korea Exchange on May 22, Doosan Enerbility closed at 39,100 won, up 5.11% from the previous day. This marks ten consecutive trading days of gains since May 8. During the session, the stock reached as high as 39,300 won, setting a new 52-week high. At the beginning of this year, Doosan Enerbility was trading in the 18,000 won range, but now it is approaching the 40,000 won mark. Its market capitalization ranking has jumped more than 20 places, from 34th at the start of the year to 13th. Market capitalization has increased from around 11 trillion won to 25 trillion won.

Foreign investors and institutions are driving up Doosan Enerbility's stock price. So far this month, foreign investors have made net purchases of Doosan Enerbility shares worth 387.1 billion won, making it the second most purchased stock after SK Hynix. Institutions have also made net purchases totaling 44.8 billion won.

Although first-quarter results were weak this year, the market is focusing more on future improvement. In the first quarter, Doosan Enerbility recorded consolidated sales of 3.7486 trillion won and operating profit of 142.5 billion won. These figures represent decreases of 8.5% and 4.9%, respectively, compared to the same period last year. Moon Kyungwon, a researcher at Meritz Securities, stated, "There is no need for significant concern over the first-quarter weakness," explaining, "Most of the cost increases in the first quarter are expected to return as profit within this year through negotiations with clients and insurance companies."

In particular, expectations for new orders are serving as a driving force behind the stock's rise. Although Doosan Enerbility was a latecomer in launching gas turbines in 2019, it is now in discussions to supply gas turbines to data center developers in the United States. Jung Hyejeong, a researcher at KB Securities, commented, "Countries are increasingly adopting strategies to respond stably to rapidly growing electricity demand, especially in the United States, by relying on nuclear power and small modular reactors (SMRs) in the long term, and LNG combined cycle power plants in the medium to short term." She added, "Doosan Enerbility supplies main nuclear equipment to the American nuclear company Westinghouse, which is preparing to export large nuclear power plants not only to Eastern Europe but also to countries such as Canada, Finland, and Sweden. Doosan Enerbility is negotiating with two U.S. data center companies to supply gas turbines in 2027 and 2028, and results could come as early as the end of this year."

Lee Minjae, a researcher at NH Investment & Securities, also noted, "Opportunities for orders of both large and small nuclear reactors and gas turbines are increasing, particularly in the United States," and added, "Doosan Enerbility is planning additional facility investments for reactors and gas turbines, and the full-scale effects of expansion are expected to appear from 2028."

There is growing consensus that this is a stock with even greater potential ahead. Choi Kyuhun, a researcher at Shinhan Investment & Securities, stated, "The effects of the business portfolio transition that began one to two years ago will gradually expand starting this year," and added, "This is a stock with even more to look forward to. As the performance of growth businesses (such as large nuclear power plants, SMRs, gas turbines, steam turbines, and complex EPC projects) expands, the discount rate on valuation multiples could be reduced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.