KB Financial Group Research Institute Report

"Active Use of Dopamine Banking Overseas... Generation Z Enthusiastic"

"Authentic Conversations with AI Chatbots... Instant Gratification Through Rewards"

"Generation Z Has High Bank Switching Rate... Contributes to Increasing Loyalty"

There is a growing view that "dopamine banking," which has attracted attention overseas, could be an effective way to prevent the departure of Generation Z, who are known for their financial nomad tendencies. Analysts say that convenient and intuitive financial products, as well as financial services that stimulate the psychology of reward, align well with the preferences of Generation Z and help increase their loyalty.

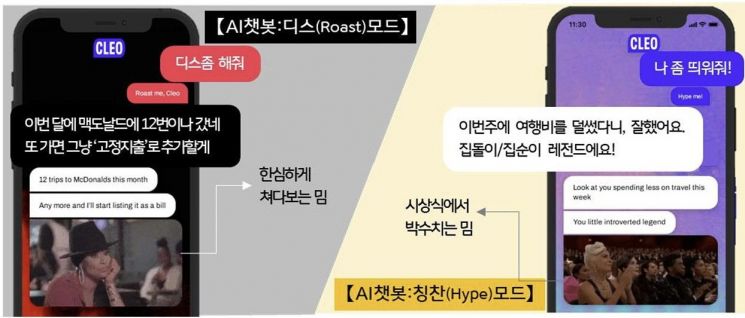

Dopamine banking success story: UK fintech company Cleo's AI chatbot "MoneyCoach." Provided by KB Financial Group Research Institute and Cleo.

Dopamine banking success story: UK fintech company Cleo's AI chatbot "MoneyCoach." Provided by KB Financial Group Research Institute and Cleo.

According to the KB Financial Group Research Institute's report, "The Rise of Dopamine Banking: Adding Enjoyment to Finance," released on May 21, dopamine banking strategies are already gaining significant popularity among Generation Z abroad, especially through fintech companies and internet-only banks.

Dopamine banking is a strategy that incorporates elements of pleasure and enjoyment?experiences that make people feel happy?into financial products and services to increase customer engagement with banking apps. The focus is on designing financial services so that, like games or shopping, customers experience enjoyment and rewards every time they use them. The report points out that this approach resonates with the characteristics of Generation Z, who are accustomed to digital environments and seek stimulation, fun, and rewards, making it an effective alternative to retain their interest.

Venmo, a mobile money transfer service in the United States, is a representative example of successfully targeting Generation Z with dopamine banking strategies. According to research by investment advisory firm Manole Capital Management, as of 2020, 90% of Generation Z were using Venmo. The app broke away from the dull image of traditional financial apps by featuring an intuitive design and dynamic visual effects, which appealed to Generation Z. By introducing emoji functions for transfers and providing real-time notifications, it also increased users' sense of instant gratification.

Cleo, a UK fintech company founded in 2016, secured 600,000 users within just 18 months of launch by targeting Generation Z with its marketing strategy. Cleo's "dopamine moment" is its AI chatbot, which offers financial advice with easy-to-understand and humorous explanations. To make coaching more engaging, Cleo introduced a "diss mode" with a sarcastic tone and a "praise mode" with an optimistic tone, depending on customer requests. The app also encouraged participation by offering "savings missions" and quizzes based on spending habits, making the experience feel like a game and receiving positive responses from users.

In contrast, major bank HSBC established a fintech venture subsidiary and invested $150 million (approximately 200 billion KRW) to launch the international remittance app "Zing" last year, but discontinued the service after just over a year due to poor performance. This was because even existing customers were required to undergo customer verification procedures again upon signing up, and fees were charged for domestic ATM withdrawals, leading to customer dissatisfaction. As a latecomer, the service lacked distinguishing features compared to competitors, and the target customer group was unclear, which only caused confusion among existing HSBC customers.

Kang Yoonjung, a researcher at KB Financial Group Research Institute, said, "Financial institutions can increase customer satisfaction and brand loyalty through dopamine banking," adding, "In particular, it could be an effective tool to prevent the departure of Generation Z, who have a high rate of switching banks and a strong tendency to use ad blockers."

Kang emphasized, "For dopamine banking to succeed, it is essential to use data and AI to provide customers with appropriate tips and nudges tailored to their circumstances. Another key factor is identifying customers' lifestyle patterns and launching services they need even before they realize it themselves." She added, "It is also important to actively incorporate feedback and regularly improve products, services, and apps to provide a fresh sense of engagement."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.