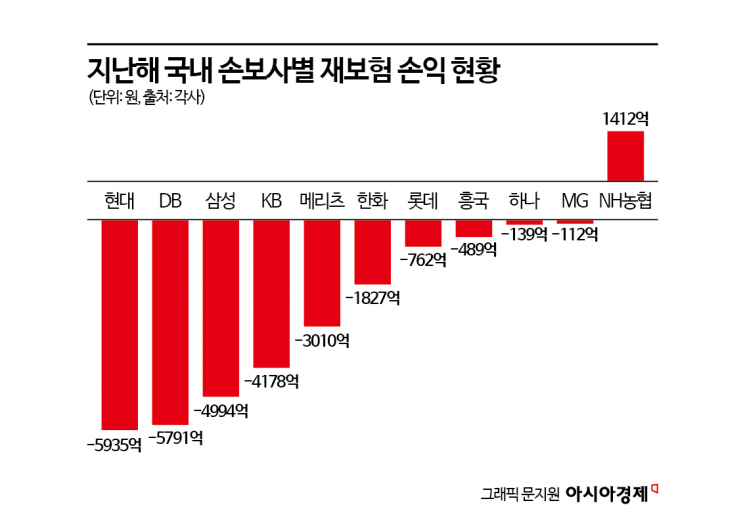

Reinsurance Deficit of 2.5825 Trillion Won for 11 Non-Life Insurers Last Year

"Impact of Increased Risks from Climate Change and Technological Advancements"

"Domestic Risks Diversified Overseas... Positive Functions as Well"

For the first time last year, the reinsurance profit and loss deficit of domestic non-life insurance companies exceeded 2 trillion won. Analysts attribute the widening deficit to increased risks stemming from climate change, such as recent fires.

According to the General Insurance Association of Korea on May 21, the reinsurance profit and loss of 11 non-life insurance companies as of the end of last year recorded a deficit of 2.5825 trillion won, an increase of more than 1 trillion won compared to the previous year’s deficit of 1.5281 trillion won. Even taking into account the change in statistical formats due to the adoption of International Financial Reporting Standards (IFRS17) in 2023 and the fact that related statistics have been compiled since 2017, this is the first time that the reinsurance profit and loss deficit has exceeded 2 trillion won.

Reinsurance is known as "insurance for insurers," in which an insurance company transfers all or part of its insurance contract liabilities to another insurer. The act of purchasing reinsurance from another insurer is called ceding, while receiving reinsurance contracts from other insurers is referred to as assuming. Reinsurance profit and loss is the sum of profits and losses from both assumed and ceded reinsurance. A reinsurance profit and loss deficit means that the insurer has paid more in reinsurance premiums to other companies than it has earned from reinsurance business.

By company, Hyundai Marine & Fire Insurance recorded the largest reinsurance profit and loss deficit last year at 593.5 billion won. This was followed by DB Insurance (-579.1 billion won), Samsung Fire & Marine Insurance (-499.4 billion won), and KB Insurance (-417.8 billion won). Only NH NongHyup Property & Casualty Insurance posted a surplus in reinsurance profit and loss, amounting to 141.2 billion won.

Industry experts cite the recent entry of the reinsurance market into a "hard market" as a key reason for the widening reinsurance profit and loss deficit. A hard market refers to a situation where demand for reinsurance exceeds supply. An insurance industry official explained, "Recently, new risks have emerged worldwide due to climate change and technological advancements, leading to increased demand for reinsurance." The official added, "As a result of these market dynamics, reinsurance premiums have risen, which has contributed to the growing reinsurance profit and loss deficits for non-life insurers."

In fact, last year, the 11 non-life insurers paid 6.4174 trillion won in ceded reinsurance service costs for general and long-term insurance to domestic and overseas reinsurers, a 4.3% increase from 6.1515 trillion won in the previous year. Globally, the risk of fires caused by climate change is increasing, as seen in the 2023 wildfires in Canada and Hawaii, the February 2023 wildfires in Chile, and the 2024 Los Angeles wildfires. In Korea, the risk of major accidents is also rising, with recent large-scale wildfires in the Yeongnam region, the Kumho Tire Gwangju plant fire, and even an aircraft disaster at the end of last year. Since it is difficult for insurers to bear such large-scale risks on their own, there is a growing incentive to use reinsurance as a means of risk diversification.

Some argue that a reinsurance profit and loss deficit is not necessarily a bad thing. This is because domestic insurers have dispersed potentially larger future risks overseas in proportion to the size of the deficit. Considering that Korean Re, the only dedicated domestic reinsurer, holds about a 50% share of the domestic reinsurance market, it is estimated that about 3 trillion won?half of the ceded reinsurance service costs paid by the 11 non-life insurers last year?was paid to overseas reinsurers. A reinsurance industry official commented, "If exposure (risk exposure amount) is concentrated in one insurer or one country, it can threaten not only the company's survival but also the national credit rating." The official added, "Dispersing risks across multiple countries is consistent with the fundamental principles of insurance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)