Financial Services Commission, Police, and Private Sector to Establish Guidelines for Suspected Fraudulent Accounts

Allowing "One Exchange-Multiple Banks" Real-Name Accounts for Virtual Assets

Calls for Strengthening MyData Operators' Role in Sunshine Loan Promotion

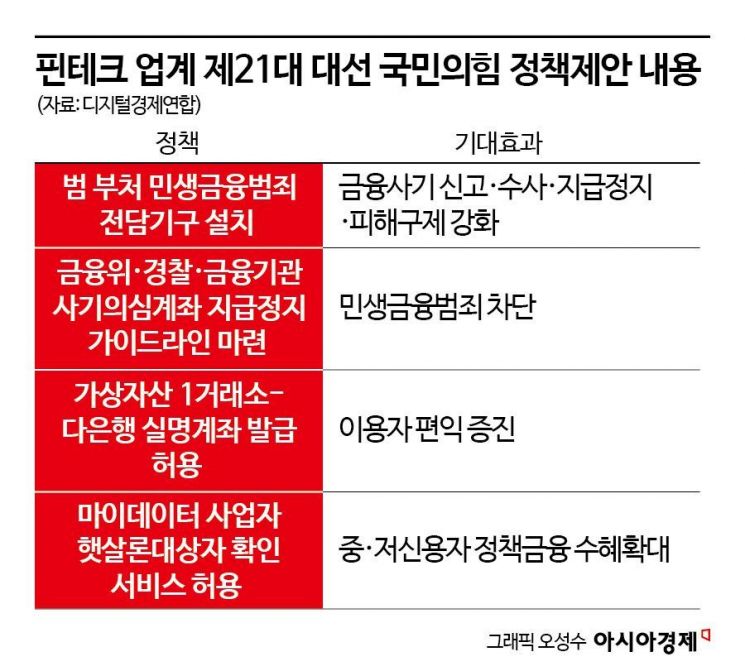

The fintech (finance + technology) industry has called on the camp of Kim Moonsoo, the People Power Party's presidential candidate for the 21st presidential election, to strengthen policies against financial crimes affecting people's livelihoods, following a similar request made to Lee Jaemyung, the Democratic Party candidate. The industry emphasized that establishing a pan-governmental task force under the Prime Minister dedicated to financial crimes impacting everyday citizens is essential. They argued that systematically managing the entire process?from reporting, investigation, payment suspension, to victim relief?would enable a swift response to increasingly sophisticated and novel financial crimes.

Kim Moonsoo, the presidential candidate of the People Power Party, is appealing for support from citizens on May 16 at Euneungjeongi Culture Street in Jung-gu, Daejeon. 2025.5.16 Photo by Kim Hyunmin

Kim Moonsoo, the presidential candidate of the People Power Party, is appealing for support from citizens on May 16 at Euneungjeongi Culture Street in Jung-gu, Daejeon. 2025.5.16 Photo by Kim Hyunmin

According to the financial sector on May 19, the fintech industry will submit this proposal at the "Digital Economy Alliance?Kim Moonsoo People Power Party Candidate Election Committee Policy Agreement Ceremony" to be held at 10:30 a.m. that day at the National Assembly in Yeouido, Seoul. The event is expected to be attended by Kim Sanghoon, head of policy for the People Power Party's election committee, Kang Minkook, secretary of the National Assembly's Political Affairs Committee, Choi Hyungdoo, secretary of the Science, ICT, Broadcasting, and Communications Committee, and the presidents of seven associations that are part of the alliance. The alliance consists of seven ICT associations, including the Korea Fintech Industry Association (KOFIA).

First, the industry requested that the People Power Party establish a pan-governmental task force dedicated to financial crimes affecting people's livelihoods. In addition, they pointed out that the urgent priority is to amend the Telecommunications Fraud Victim Compensation Act to comprehensively assess the current status of new types of fraud.

On a practical level, the industry proposed that the Financial Services Commission, the police, and financial institutions establish guidelines for suspending payments on accounts suspected of fraud. The associations noted that financial crimes affecting ordinary citizens are rapidly increasing and diversifying, but because responsibility is scattered among different agencies such as financial authorities and the police, a prompt response is difficult. In particular, in the case of new types of financial fraud such as secondhand transaction scams, there are currently no legal provisions or even guidelines for suspending payments on suspected accounts, so banks are managing these cases based on their own internal rules.

The industry also requested improvements to the regulatory framework for virtual assets. They urged the government to lift the "one exchange?one bank" rule, which has recently become a hot topic in the financial sector. According to the industry, under the current Act on Reporting and Use of Certain Financial Transaction Information, operators of KRW-based virtual asset exchanges must obtain real-name deposit and withdrawal accounts from banks. The problem is that, due to the implicit enforcement of the "one exchange?one bank" rule, the five KRW-based virtual asset exchanges?Gopax, Bithumb, Upbit, Korbit, and Coinone?must terminate their contracts with their existing partner banks if they change to a new partner bank.

The industry proposed allowing a single exchange to enter into real-name account issuance contracts with two or more banks. They argued that permitting a "one exchange?multiple banks" system would eliminate the need for virtual asset users to open multiple bank accounts, and would also prevent secondary damages such as service outages caused by traffic surges in the event of financial incidents.

Furthermore, the industry requested that regulations be relaxed to allow MyData (personal credit information management business) operators to provide eligibility verification services for applicants of the Sunshine Loan program. This has been a long-standing demand of the industry, and the same request was made at a policy agreement ceremony with the Democratic Party on May 15.

According to the industry, the Sunshine Loan, a policy finance product for low-income individuals, is available to those with an annual income of 35 million won or less and a credit score in the bottom 20 percent. However, even if mid- and low-credit individuals apply for loans through financial platforms, they cannot determine whether they are eligible for the Sunshine Loan, resulting in many being forced to take out high-interest loans.

The industry asked the People Power Party to establish regulations that would allow MyData operators to verify whether an applicant is eligible for the Sunshine Loan and to notify them accordingly. If such regulations are established, fintech companies will be able to notify eligible users about the service through in-platform messages in cooperation with the Korea Inclusive Finance Agency. This would mean that more low-income individuals could access low-interest policy funds, reducing their interest burden.

An industry representative said, "Financial fraud is becoming increasingly sophisticated, so it is essential to establish not only stricter penalties but also an organization and legal framework to comprehensively manage the entire process from reporting to victim relief. Easing regulations on virtual assets is also crucial?not only to reduce consumer inconvenience but also to prevent financial incidents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.