Single-digit Returns Compared to Early This Year Due to Weak Earnings

Investor Sentiment Boosted as Expectations for Second Quarter Results Become Visible

While leading domestic entertainment stocks are taking a breather, JYP Entertainment (JYP Ent.) has surged sharply on its own, drawing attention to the reasons behind this movement.

According to the Korea Exchange, on May 15, JYP Entertainment closed at 74,000 won, up 7.09% (4,900 won) from the previous day. This stands in stark contrast to SM, which dropped by more than 3% on the same day, YG Entertainment, which fell by 1.44%, and HYBE, which declined by 0.55%. Foreign investors purchased 22.6 billion won worth of shares, driving the stock price, while institutional investors also made net purchases of 18.6 billion won, making JYP Entertainment the most bought stock by institutions that day.

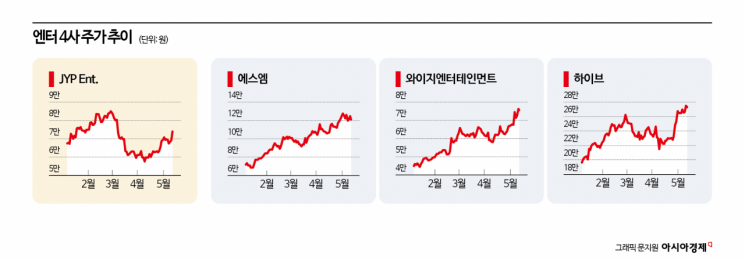

Until now, the four major entertainment companies have been identified as beneficiaries of the U.S.-originated tariff shock, leading to an upward trend in their stock prices. However, JYP Entertainment's rally did not last as long as its competitors, raising concerns among investors. Since bottoming out in September last year, YG Entertainment and SM have soared by approximately 153% and 131%, respectively, reaching new 52-week highs as of last week. HYBE also hit a new yearly high on this day. In contrast, JYP Entertainment saw a correction of about 34% after peaking in February. As of May 14, compared to the beginning of the year, HYBE had risen by 40.1%, SM by 74.0%, and YG Entertainment by 70.9%. However, JYP Entertainment, due to disappointing earnings, saw only a 2.2% increase.

However, a series of rosy outlooks from securities firms on this day reversed the mood for JYP Entertainment. Although JYP Entertainment posted lackluster results in the first quarter, with consolidated sales of 140.8 billion won (up 3.1% year-on-year) and operating profit of 19.6 billion won (down 41.6% year-on-year), expectations grew for a clear improvement starting in the second quarter.

Kim Minyoung, a researcher at Meritz Securities, explained that the weak first-quarter results were due to "an inevitable decline in album and concert sales caused by a gap in major IP activity, as well as debut costs for Kickflip and the remaining production costs for 'The Ddanddara' (1.7 billion won)." She added, "In the second quarter, the return of major artists and diversification of merchandise sales are expected to drive strong growth in MD revenue." She projected full-year consolidated sales and operating profit at 772.2 billion won (up 28.3% year-on-year) and 145.6 billion won (up 13.5%), respectively.

In fact, JYP is preparing for the return of its flagship stars, with Stray Kids' world tour (23 shows) scheduled for the second quarter and a large-scale TWICE concert later in the year. Lee Kihun, a researcher at Hana Securities, noted, "Last year, the total annual tour audience was about 2.1 million, but this year, in the second quarter alone, Stray Kids' stadium concerts in Japan and North and South America are expected to attract around 1 million attendees, with the total tour audience reaching approximately 1.4 million." He also forecast, "As tours expand into new regions, secondary rights sales, including MD, will also rise sharply." Assuming major artists make album comebacks in the third quarter, it is anticipated that both the second and third quarters will see operating profits exceeding 50 billion won per quarter, resulting in record-high earnings.

Improvement in the profitability of Blue Garage, which recorded an operating loss of 3.1 billion won last year, is also an expected positive factor. Hwang Jiweon, a researcher at iM Securities, commented, "Currently, Blue Garage is impacting overall margins due to increased commission fees and labor costs, but it plans to begin monetization by introducing a paid membership in the second half of the year." She also positively evaluated the company's plans to improve MD margins through pop-up stores centered on key IPs and strengthening its licensing business.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.