Woongjin Thinkbig and Other Korean Education Companies Accelerate Expansion into the Middle East

Low Median Age and 100 Million Students Signal Explosive Growth Potential

Similar Language and Culture, but Legal and Regulatory Barriers Remain by Country

Domestic education companies are increasingly turning their attention to the Middle East. As the outlook for growth in the domestic education market dims due to low birth rates and a declining school-age population, these companies are looking to the Middle East as a breakthrough. Middle Eastern countries are focusing on education and talent development as part of their 'post-oil' strategies, and interest and demand for remote learning and edtech have grown significantly since the COVID-19 pandemic.

According to the industry on May 15, Woongjin Thinkbig, the education affiliate of Woongjin Group, signed an exclusive distribution agreement on May 1 with Qatar's Dakaken Group for the augmented reality (AR)-based reading solution 'ARpedia' in Saudi Arabia, Qatar, and Egypt. The contract guarantees a minimum annual sale of $425,000 (approximately 600 million won). Woongjin Thinkbig had previously signed a distribution agreement with a Jordanian company and is currently working to supply the science learning solution 'AR Science Lab' to the Ministry of Education in Oman.

Other companies, in addition to Woongjin, are also accelerating their entry into the Middle East with edtech solutions. Visang Education signed a contract in 2020 with Qatar's Candidzone to supply the smart learning program for young children, 'Wings.' AI edtech company Icecream Media formed a strategic partnership with Saudi edtech company Classera in June last year, and industry peer Gurumi showcased products such as 'Gurumi AI EDU' at 'GITEX GLOBAL 2024,' the largest IT exhibition in the Middle East, held in Dubai, United Arab Emirates (UAE) in October of the same year, as part of its efforts to penetrate the market.

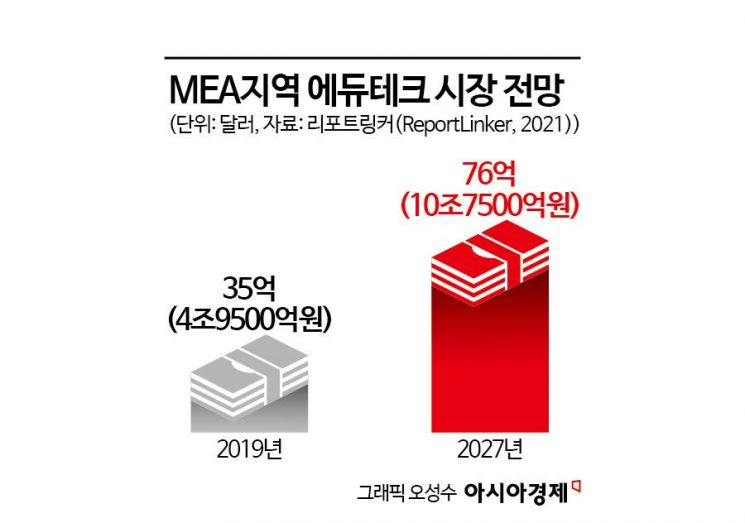

This trend is interpreted as the result of the convergence between Middle Eastern countries' strategies to move away from oil dependency and the growth potential of the education market. According to U.S. market research firm ReportLinker, the edtech market in the Middle East and Africa (MEA) is expected to grow from $3.5 billion (4.95 trillion won) in 2019 to more than $7.6 billion (10.75 trillion won) by 2027.

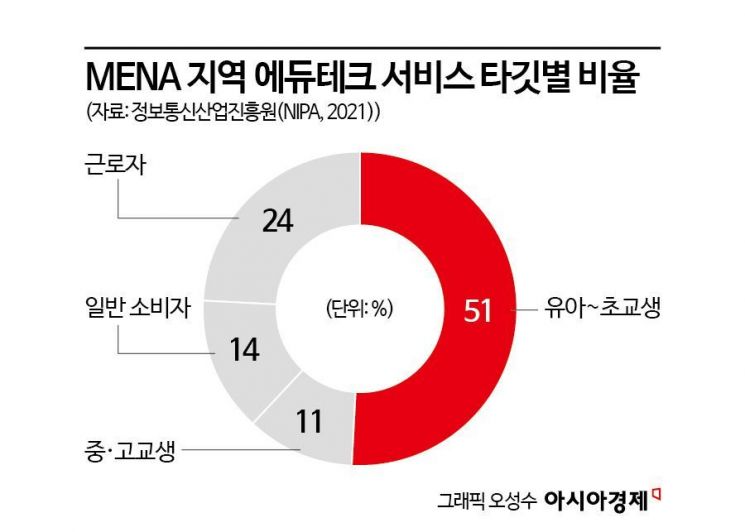

In particular, the Middle East and North Africa (MENA) region has a high proportion of young people and a large child population, creating a favorable environment for edtech growth. As of 2021, the median age is 23.9 years in Egypt, 29.8 years in Saudi Arabia, 32.8 years in the UAE, and 33 years in Qatar, all lower than the OECD average of 39.9 years and Korea's 43.4 years. UNESCO estimates the number of students in this region at about 100 million, and the high number of young parents means there is also a large proportion of preschool and elementary school children. Since COVID-19, the spread of online education and the proliferation of smart devices have led to the active emergence of local edtech startups such as Kareem and Souq.

Saudi Arabia, regarded as a leading country in the Middle Eastern edtech market, announced its national development strategy 'Saudi Vision 2030' in 2016 and is pursuing an economic transition to prepare for the post-oil era. Education and talent development are among the key tasks, and the country is working to overcome its reliance on foreign high-tech talent by promoting digital transformation and building a knowledge-based economy. Notably, Korea is included among the five key partner countries in this plan, expanding opportunities for domestic edtech companies.

The UAE considers education as 'true wealth' and is making intensive investments in education using assets accumulated from oil. In the 'UAE Centennial 2071' announced in 2017 to prepare for the 100th anniversary of the country's founding, the importance of future-oriented education was emphasized. In 2022, the country established an Education Accreditation Authority to manage educational outcomes as part of its education reform roadmap. Last year, the UAE allocated 16% of its total federal budget?a significant portion?to education, continuing its large-scale investments. As a result, the UAE's illiteracy rate was 1.9% as of 2021, the lowest in the Middle East. Other countries, including Qatar, are also pursuing national-level education reforms.

However, despite linguistic and cultural similarities across the Middle East, significant differences in legal systems and regulations among countries are cited as challenges to entering the edtech market. A Woongjin Thinkbig representative stated, "Localization efforts will be carried out together with local partners," adding, "We plan to develop an Arabic version through future partnerships and use it as a bridgehead to further expand our market presence."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)