Amid signs of overheating in political theme stocks, the Financial Supervisory Service and the Korea Exchange have launched a joint response.

On May 14, the Financial Supervisory Service and the Korea Exchange announced that, due to the continued rise in volatility of political theme stocks, they held a working-level meeting the previous day.

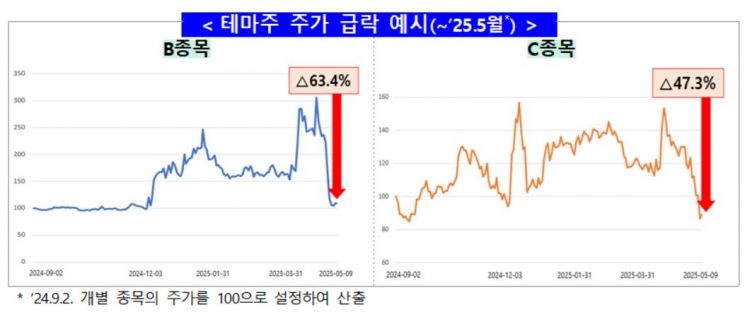

According to financial authorities, more than two-thirds of political theme stocks (out of 60 stocks) have dropped over 30% from their peak prices. Notably, most of the losses have been incurred by individual investors, who account for 86.9% of trading in political theme stocks. An analysis of individual investors' trading profits and losses over the past month showed losses in 42 stocks.

The Financial Supervisory Service emphasized, "In cases where the theme related to a particular politician disappears, there have been actual instances where stock prices are cut in half almost instantly," adding, "There is significant concern about investor losses from momentum trading in such stocks."

Political theme stocks are particularly difficult to predict and highly volatile, raising concerns about unfair trading practices and investor harm. In response, the Financial Supervisory Service and the Korea Exchange have agreed to strengthen joint monitoring and investigations.

First, the Financial Supervisory Service and the Korea Exchange will establish a collaborative system among investigative agencies to expand information sharing and concentrate market surveillance and investigative resources. Monitoring of political theme stocks will also be intensified. This includes targeting abnormal trading activities such as the creation and dissemination of false rumors about politicians via social media to induce momentum trading, collusive trading to attract orders, price fixing at the upper limit, spoofing orders, high-priced buying, and consecutive small-lot orders.

The Korea Exchange plans to strengthen preventive measures and market surveillance. This will involve requesting preventive actions for political theme stocks, designating them as market alert stocks, and demanding disclosure inquiries to prevent excessive price increases. In addition, the exchange will conduct planned surveillance for market-disrupting activities related to political theme stocks and prioritize reviewing accounts suspected of unfair trading.

The Financial Supervisory Service will immediately launch investigations if unfair trading related to political themes is detected. The agency also plans to take strict action to block further illegal activities and to address rumor-mongering, dissemination, abnormal order placement, and other market-disrupting behaviors.

The Financial Supervisory Service and the Korea Exchange stated, "Political theme stocks are often overvalued due to rumors and speculative demand," and explained, "It is virtually impossible to predict sharp price fluctuations and time trades accordingly, which can result in significant losses for individual investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.