Sharp Slowdown in U.S. Growth...

Europe and Japan Also Sluggish

Weak Dollar Trend Expected to Continue into Next Year

Oil Prices Expected to Remain Around $65

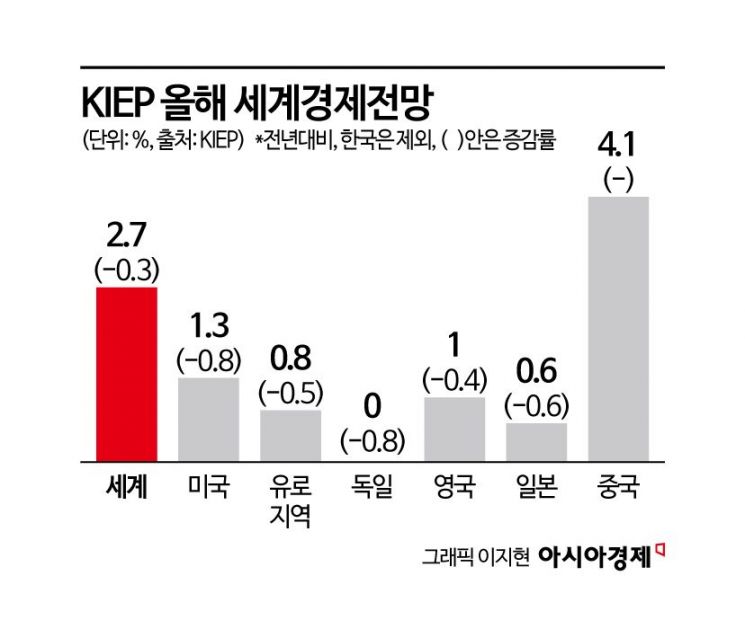

The Korea Institute for International Economic Policy (KIEP), a state-run research institute, has forecast the global economic growth rate for this year at 2.7%. This is a decrease of 0.3 percentage points from the previous projection and marks the lowest level since the dot-com bubble burst, the global financial crisis, and the COVID-19 pandemic. The outlook suggests that a combination of factors?including increased uncertainty stemming from U.S. tariff policies, a resurgence of inflation, changes in monetary policies across countries, and debt crises?will collectively restrain global economic growth.

In its "2025 Global Economic Outlook" report released on the 13th, KIEP stated, "While U.S. growth will slow significantly, the economies of Europe and Japan are also expected to remain somewhat sluggish," adding, "The global economy is projected to record a growth rate 0.5 percentage points lower than last year." This figure is 0.3 percentage points lower than KIEP's previous projection of 3.0% announced in November last year.

KIEP noted, "The global economy faces a situation where the possibility of inflation re-accelerating due to higher import prices from tariffs, surging energy prices, and supply chain disruptions cannot be ruled out, and there is significant uncertainty regarding the future path of interest rate policies by major central banks." The institute also identified the accumulation of debt during the previous low-interest-rate environment and still-high asset prices as vulnerabilities in the financial sector, describing these as weak links in the global economy.

Sharp Slowdown in U.S. Growth... Europe and Japan Also Sluggish

KIEP's downward revision is primarily due to its focus on a sharp slowdown in U.S. growth. The United States is expected to achieve only 1.3% growth, as heightened uncertainty from aggressive tariff policies and deteriorating economic sentiment lead to significant slowdowns in consumption and investment. The 1.3% growth rate is a downward adjustment of 0.8 percentage points from the previous forecast.

In Europe, the economy is expected to continue its sluggish growth at 0.8%, similar to last year, due in part to Germany?the region's largest economy?recording 0% growth. The United Kingdom is also projected to post a 1.0% growth rate, as increased trade uncertainty dampens exports and investment. In Japan, the impact of the tariff war is expected to limit growth to a low 0.6%, as exports slow and corporate investment contracts.

As for China, which has a significant impact on the global economy, KIEP projects a 4.1% growth rate, despite the government's aggressive stimulus measures. This is due to downward pressures such as the ongoing trade war with the United States and a slump in the real estate market.

Weak Dollar Trend Expected to Continue into Next Year

The dollar is expected to maintain a weak trend in the second half of this year and into next year, due to the anticipated slowdown in the U.S. economy and the possibility of interest rate cuts.

KIEP stated, "With inflationary pressures caused by U.S. tariff policies and concerns over economic slowdown making it more difficult for the Federal Reserve to manage monetary policy, the market is anticipating around three rate cuts within this year." The institute added, "President Trump has described a strong dollar as a 'disaster for U.S. manufacturing,' indicating a high likelihood of pursuing a weak-dollar exchange rate policy. This could involve various measures, such as designating currency manipulators, strengthening currency clauses in FTAs, or implementing agreements like the Mar-a-Lago deal."

However, KIEP noted that volatility is expected to persist, as demand for the dollar as a safe-haven asset could temporarily increase in the event of heightened geopolitical risks or the conclusion of trade negotiations with key trading partners.

The won-dollar exchange rate is expected to remain volatile at a high level in the first half of the year due to the impact of U.S. tariff and exchange rate policies, but is projected to gradually stabilize in the second half as U.S. interest rate cuts and progress in tariff negotiations become more likely.

Factors that could push the exchange rate higher include the Trump administration's designation of currency manipulators, renewed pressure to renegotiate the Korea-U.S. FTA, and prolonged trade disputes leading to sluggish exports. On the other hand, the possibility of pursuing a Mar-a-Lago agreement was cited as a factor that could push the exchange rate lower.

KIEP also noted that if tariff risks are eased through progress in trade negotiations and exports improve due to a recovery in the semiconductor sector, upward pressure on the won could increase.

KIEP did not provide a specific exchange rate forecast. Major international investment banks project that the won-dollar exchange rate will move around 1,460 won at the end of the first half of this year, falling to 1,450 won in the third quarter and 1,438 won in the fourth quarter.

Oil Prices Expected to Remain Around $65

As for international oil prices, KIEP expects them to remain lower than last year due to weak demand and increased production. The average international oil price this year is projected at $65.17 per barrel for West Texas Intermediate (WTI) crude. This is similar to the forecasts of the Energy Information Administration (EIA, $63.88) and the International Monetary Fund (IMF, $66.94).

KIEP forecasts that international oil prices will continue to decline after next year, maintaining a downward trend over the medium to long term. The institute stated, "Oil demand is expected to remain weak due to downward pressure on the global economy from the U.S.'s aggressive tariff policies and stagnant growth in China's oil demand, while oil supply is expected to remain strong as OPEC Plus shifts to increased production and non-OPEC Plus countries continue to ramp up output."

However, KIEP emphasized, "Given the recent increase in uncertainties related to oil prices and the growing number of factors contributing to this uncertainty, it is important to focus on reducing exposure to oil price volatility in the near term rather than on the overall trend."

KIEP identified risk factors in various regions of the Middle East, as well as U.S. sanctions against Russia and Iran, as potential upward pressures on oil prices. The institute also analyzed that various policies of the Trump administration have complex and uncertain effects on oil prices. While aggressive tariff policies act as a downward factor by reducing overall demand, a weak dollar is traditionally a factor that pushes oil prices higher.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)