Cost-Cutting Measures:

Selling Idle Real Estate and Reducing Business Promotion Expenses

Despite major banks posting record-breaking earnings in the first quarter of this year, they are tightening their belts. Photo by Getty Images

Despite major banks posting record-breaking earnings in the first quarter of this year, they are tightening their belts. Photo by Getty Images

Despite major commercial banks posting record-breaking earnings in the first quarter of this year, they are tightening their belts. This is due to a decline in net interest margin (NIM), a key profitability indicator for financial institutions, and a sharp rise in delinquency rates as more households and businesses are unable to repay their debts amid the economic downturn. In response, banks are implementing comprehensive cost-cutting measures to reduce selling and administrative expenses, such as cutting business promotion expenses and selling off idle branches.

According to the financial industry on May 9, Woori Bank has put eight branches up for sale just this month. The branches on the market include Jongno 5-ga Branch, Yeongdeungpo Distribution Shopping Center Branch, Daechi South Branch, Sinsa-dong Financial Center, Daejeon North Branch, Geumnam-ro Branch, Wolgok-dong Branch, and Bundang Gumi-dong Branch, totaling eight locations. As non-face-to-face transactions have become more common and in-person customers have decreased, the bank is consolidating branches and selling idle real estate to securitize assets. Previously, Woori Bank also put seven Seoul-based branches up for sale last month.

KB Kookmin Bank has also listed seven branches for sale nationwide, including in Daegu, Nonsan, and Yeosu. The plan is to secure cash by selling idle real estate assets following branch closures. Idle real estate is classified as risk-weighted assets (RWA), so disposing of these properties is a measure to increase the common equity tier 1 (CET1) ratio. However, it is rare for these properties to be sold at auction in a single attempt, so the banks are expected to face difficulties in asset securitization.

Banks are making all-out efforts to cut costs, not only by selling their largest assets?real estate?but also by reducing business promotion expenses at each branch. KB Kookmin Bank has eliminated dedicated drivers for executives at the deputy president level and above, as well as personal secretaries for executives, starting this year. Woori Bank also discontinued driver support for executive vehicles after Chairman Lim Jongryong took office. Shinhan Bank and Hana Bank do not provide executive drivers for non-sales group executives either. There is also a trend of reducing business promotion expenses allocated to each branch. An official from a commercial bank said, "Business promotion expenses allocated to each branch have been reduced by about 10 to 20 percent."

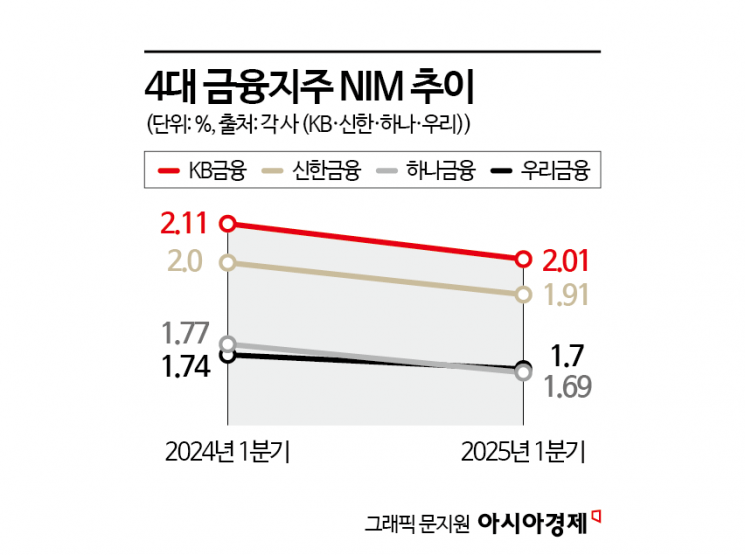

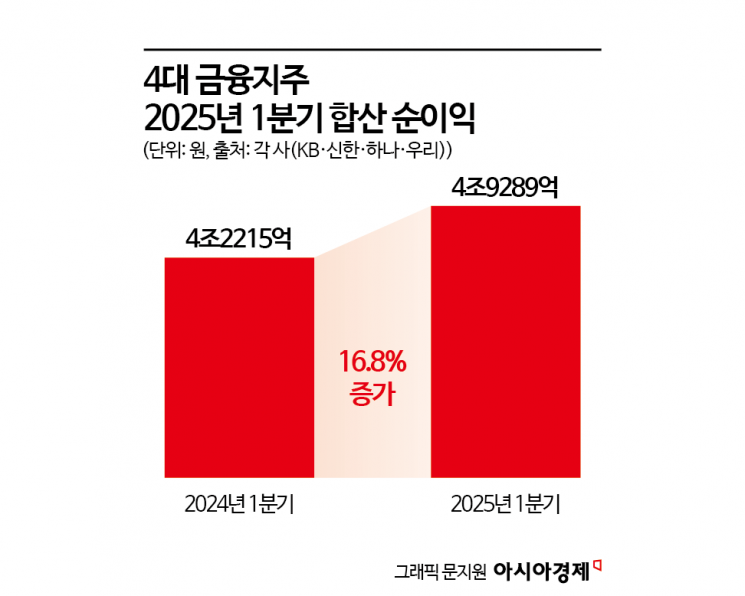

The reason banks are taking such measures despite achieving record-high results in the first quarter is that profitability is deteriorating and delinquency rates are rising. The combined net profit of the four major financial holding companies (KB, Shinhan, Hana, and Woori) in the first quarter of this year was 4.9289 trillion won, up 16.8 percent from 4.2215 trillion won in the same period last year, marking an all-time high. However, NIM, a representative profitability indicator, has declined for all four financial holding companies compared to the previous year. KB Financial Group's NIM fell from 2.11 percent in the first quarter of last year to 2.01 percent in the first quarter of this year. The same trend was seen at Shinhan Financial Group (2.0% to 1.91%), Hana Financial Group (1.77% to 1.69%), and Woori Financial Group (1.74% to 1.7%).

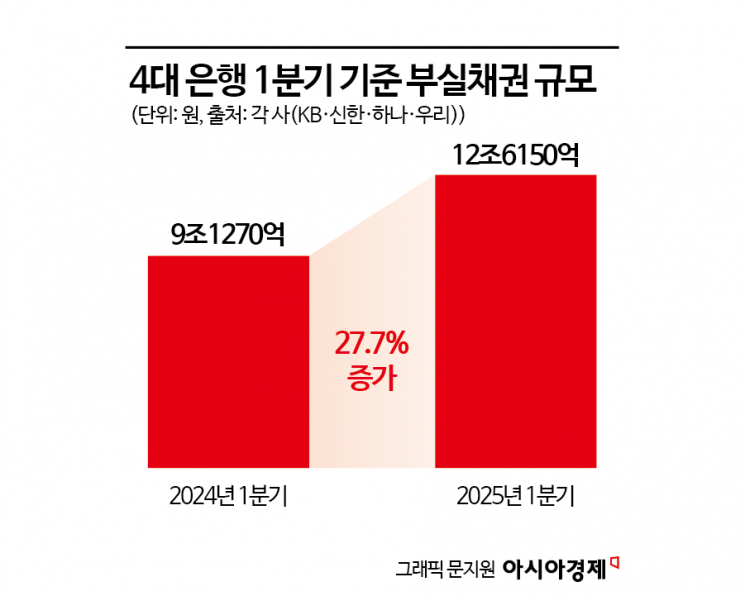

As the economic downturn has led to a surge in households and businesses unable to repay their debts, bank delinquency rates have reached their highest levels in 10 years. As of the first quarter, KB Kookmin Bank's delinquency rate on won-denominated loans was 0.35 percent, up 0.06 percentage points from the previous quarter. Both household loans (0.28 percent) and corporate loans (0.40 percent) rose by 0.01 percentage points and 0.10 percentage points, respectively, compared to the previous quarter. The corporate loan delinquency rate is at its highest level in eight years since the first quarter of 2017 (0.51 percent). Other banks are in a similar situation. Shinhan Bank's delinquency rate rose by 0.07 percentage points over the same period to 0.34 percent. The total amount of non-performing loans (NPLs) at the four major banks reached 12.615 trillion won in the first quarter, a 27.7 percent increase in just one year, setting a new record high.

An official from the financial sector said, "Considering the government's household loan management policy, the economic downturn, and the financial situation after the presidential election, it is difficult to be reassured by the first-quarter results," adding, "The scale of business promotion expenses has now been reduced even more than it was during the COVID-19 period."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)