$404.67 Billion at End of April... Down $4.99 Billion

Financial Institutions' Foreign Currency Deposits Decline After End of Quarter

National Pension Service's FX Swap Transactions Also Have Impact

Bank of Korea: "Sufficient Capacity to Respond to External Shocks"

South Korea's foreign exchange reserves decreased by nearly $5 billion in just one month. This was the result of the disappearance of the "end-of-quarter effect," which had previously led financial institutions to increase their foreign currency deposits in order to comply with the Bank for International Settlements (BIS) ratio. Foreign exchange swap transactions between the foreign exchange authorities and the National Pension Service also temporarily contributed to the decline in reserves.

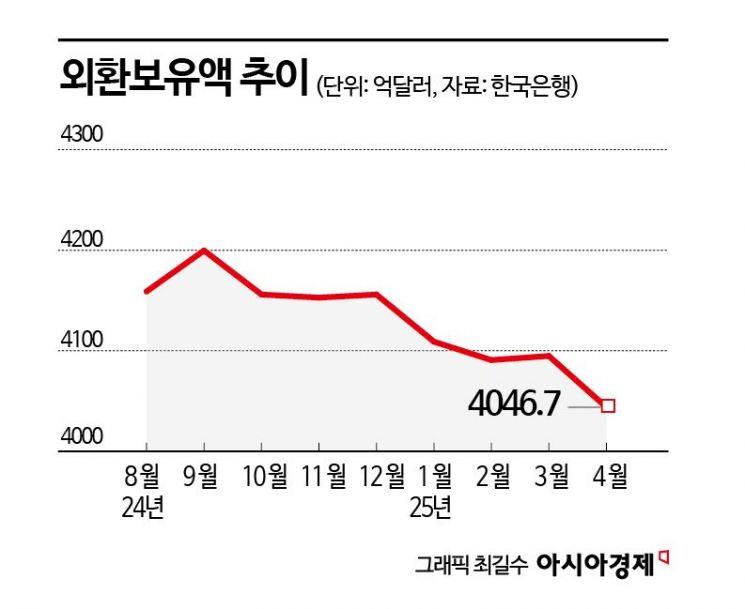

According to the Bank of Korea on May 8, South Korea's foreign exchange reserves stood at $404.67 billion as of the end of April. This represents a decrease of $4.99 billion compared to the previous month's $409.66 billion, marking the third consecutive month that reserves have remained below $410 billion.

South Korea's foreign exchange reserves reached as high as $469.2 billion in October 2021, but began to decline in 2022, influenced by the U.S. Federal Reserve's policy rate hikes. Since October of last year, the continued strength of the U.S. dollar?driven by uncertainties in U.S. trade policy under Trump and domestic political uncertainties?has prompted authorities to sell dollars to defend the exchange rate, resulting in a further decrease in reserves.

At the start of this year, reserves declined for two consecutive months in January and February, before experiencing a slight increase in March. This was due to a seasonal effect, as banks concentrated their dollar deposits at the Bank of Korea at the end of the quarter to meet BIS ratio requirements. However, with the end-of-quarter effect disappearing in April, reserves turned downward again within a month. A Bank of Korea official stated, "The decrease in financial institutions' foreign currency deposits due to the disappearance of the end-of-quarter effect was a key factor."

Foreign exchange swap transactions between the foreign exchange authorities and the National Pension Service in April were also cited as reasons for the decline in reserves. At the end of last year, when the won-dollar exchange rate surged, the Bank of Korea and other authorities, together with the National Pension Service, extended the swap contract period by one year to the end of this year and raised the limit to $65 billion. This measure was intended to minimize negative effects such as exchange rate spikes that could occur if the National Pension Service were to purchase large amounts of dollars in the spot market. A Bank of Korea official said, "Foreign exchange swap transactions with the National Pension Service temporarily reduced reserves," adding, "Since these funds will be fully returned at maturity, they will become a factor increasing reserves in the future."

In April, the U.S. Dollar Index (DXY) stood at 99.24, down 4.6% from the previous month. Among the components of the reserves, securities?which include government bonds, corporate bonds, and agency bonds?amounted to $356.5 billion, a decrease of $5.03 billion from the previous month. Securities accounted for 88.1% of total reserves. Deposits stood at $23.23 billion, down $930 million over the same period.

Some observers have expressed concern over whether reserves can maintain the psychologically significant $400 billion level, as fears of a global tariff war originating from the United States have heightened volatility in the won-dollar exchange rate.

However, the Bank of Korea explained that as of the end of April, South Korea's foreign exchange reserves were 22% of its gross domestic product (GDP), exceeding last year's OECD average of 14.9%. In terms of size, South Korea ranked 10th in the world as of the end of March. China ranked first with $3.2407 trillion, followed by Japan with $1.2725 trillion, and Switzerland with $940.8 billion.

A Bank of Korea official stated, "A strong dollar can contribute to a decline in reserves, but recently the dollar has been weakening, so the downward trend may stop. The future direction of the dollar will be an important variable for the trend in reserves."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.