Abel to Be Recommended as Next CEO at Board Meeting on the 4th

Buffett: "I Won't Sell Berkshire Shares Even After Retirement"

Criticizes Trump Administration: "Trade Should Not Be Used as a Weapon"

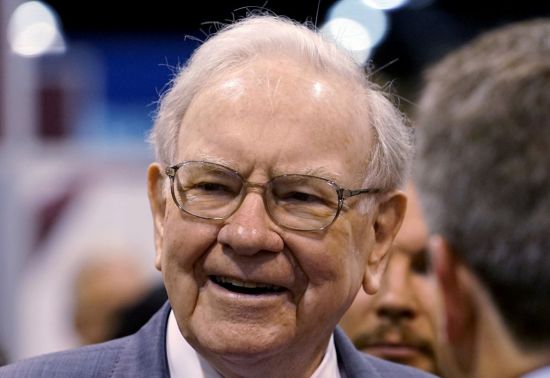

Warren Buffett, the legendary American investor known as the "Oracle of Omaha," announced that he will retire at the end of this year from Berkshire Hathaway (hereafter Berkshire), which he has led for the past 60 years as chairman and CEO.

On May 3 (local time), at Berkshire's annual shareholders meeting held in Omaha, Nebraska, Buffett stated that he would recommend Greg Abel, vice chairman of Berkshire's non-insurance business, as the next CEO at the board meeting on May 4, and that he would retire at the end of this year. Buffett had previously designated Abel as his successor in 2021.

Buffett reassured shareholders that even after his retirement, he has no plans to sell a single share of Berkshire stock, describing his decision as an "economic decision" based on his belief that Abel will lead Berkshire even better.

At the 60th annual shareholders meeting held that day, Buffett expressed a negative view on President Donald Trump's tariff policies, stating, "Trade should not be used as a weapon."

He emphasized the principle of a free trade market, saying, "The more prosperous other countries in the world become, it does not harm us; we will also prosper together with them." "We should seek to trade with the entire world, do what we do best, and let other countries do what they do best."

Regarding the stock market, which experienced a sharp drop last month, Buffett shared his experience of running Berkshire, recalling times when the company's stock price was halved in a short period even though there were no problems with the company itself. He commented, "This is not a dramatic bear market or anything like that. This is just a part of the stock market." He also advised not to respond emotionally to market downturns or get overly excited during bull markets, as declines are common in the stock market.

When asked whether the long-term impact of the US Department of Government Efficiency (DOGE), headed by Tesla CEO Elon Musk, on the US economy would be positive or negative, Buffett replied, "Bureaucracy is surprisingly widespread and highly contagious." Despite legal controversies, DOGE is conducting government restructuring to reduce bureaucratic inefficiency and wasteful spending.

Regarding government deficit reduction measures, he said, "(The fiscal deficit) is not sustainable," but added, "It's not something I want to do, but I think it's something that must be done. Congress does not seem to be doing it."

While discussing the impact of future technologies on Berkshire's business, Buffett also expressed concerns about weapons of mass destruction, including nuclear weapons. He said, "It's a dynamic world. And unfortunately, what we should be most worried about is that we have learned how to destroy the world," adding, "There are eight countries that can destroy the world, and probably a ninth will emerge. Among these nine countries, or at least some of them, there are leaders who, in my view, are far from perfect."

Targeting North Korean leader Kim Jong Un, Buffett remarked that there is a man in North Korea who might do anything if someone criticizes his hairstyle, questioning, "Why does North Korea need nuclear weapons?"

This year, Buffett's views drew particular attention due to economic uncertainty caused by President Trump's tariff policies, and a record 19,700 people attended the event held the day before the shareholders meeting.

Berkshire recorded an operating profit of $9.6 billion (about 13.4 trillion won) in the first quarter of this year. This figure is a 14% decrease compared to $11.2 billion in the first quarter of last year, mainly due to deteriorating performance in its core insurance business and foreign exchange losses. Berkshire's cash and cash equivalents increased from $334.2 billion at the end of last year to $347.7 billion (about 487 trillion won) at the end of the first quarter this year.

In its earnings report, Berkshire explained that changes in international trade policies and tariffs could negatively affect the company's operating profit and the value of its investment assets, adding that for now, it cannot reliably predict the impact of such changes on its financial statements.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.