Mortgage Rates Fall for Second Month

Spread Between Lending and Deposit Rates Widens for Seventh Consecutive Month

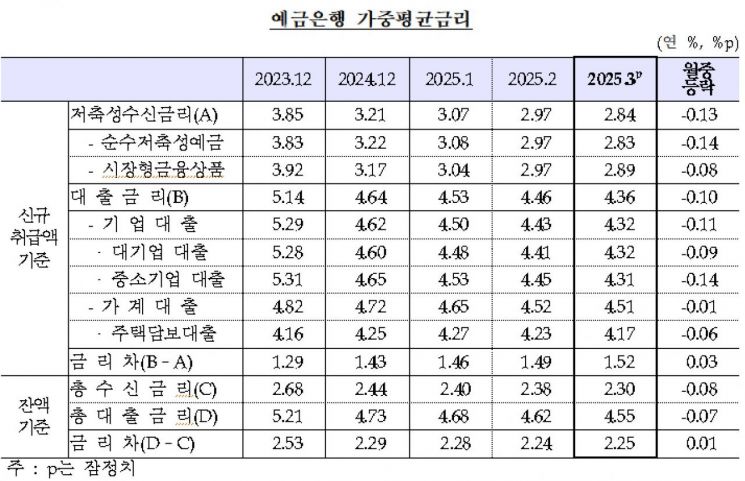

The average interest rate on mortgage loans offered by banks fell for the second consecutive month, dropping to the 4.1% range.

However, as the interest rates on savings deposits-including time deposits and installment savings-declined even more sharply, the spread between lending and deposit rates (lending rate minus savings deposit rate) widened for the seventh consecutive month.

According to the weighted average interest rates for financial institutions in March, released by the Bank of Korea on April 30, the interest rate on newly issued mortgage loans at deposit banks last month was 4.17% per annum, down 0.06 percentage points from the previous month.

The mortgage loan rate had risen to 4.27% in January this year but has been on a downward trend for two consecutive months since February. Specifically, the fixed-rate mortgage loan rate fell by 0.07 percentage points to 4.15%, while the variable-rate mortgage loan remained steady at 4.25%.

Kim Minsoo, head of the Financial Statistics Team 1 at the Bank of Korea's Economic Statistics Department, explained, "The decline in mortgage loan rates is due to a slight drop in benchmark rates such as five-year bank bonds in March, as well as the effect of banks lowering their additional interest margins since January, which is being reflected with a time lag."

He added, "The variable-rate mortgage loan rate may differ by bank depending on the benchmark rate (such as short-term bank bonds or COFIX). Unlike COFIX or three- and six-month bank bonds, the one-year bank bond rate actually rose by 0.01 percentage points, which contributed to the mortgage loan rate remaining unchanged in some cases."

However, the overall household loan rate, including mortgages, only edged down by 0.01 percentage points from the previous month to 4.51%. Jeonse deposit loan rates fell by 0.1 percentage points to 3.99%, and general unsecured loan rates dropped by 0.02 percentage points to 5.48%. This marks the fourth consecutive month of decline since December last year.

Corporate loan rates fell by 0.11 percentage points from the previous month to 4.32% per annum, as short-term market rates declined. The rate for large corporations dropped by 0.09 percentage points to 4.32%, and for small and medium-sized enterprises, it fell by 0.14 percentage points to 4.31%. Kim explained that the lower rate for SMEs compared to large corporations was due to some banks offering preferential rates to SMEs, and that the Bank of Korea's policy-based financial support loans, which have been in effect since February, also had some impact.

The average interest rate on savings deposits (based on new deposits) was 2.84%, down 0.13 percentage points from the previous month, as time deposits and similar products saw rate reductions. This marks a six-month downward trend since October last year (3.37%). Specifically, the rate for pure savings deposits, mainly time deposits, fell by 0.14 percentage points to 2.83% per annum. The rate for market-type financial products, such as certificates of deposit (CDs), dropped by 0.08 percentage points to 2.89%.

The lending-deposit rate spread (based on new deposits) widened by 0.03 percentage points from the previous month to 1.52 percentage points, marking the seventh consecutive month of expansion since September last year (1.22 percentage points). The spread based on outstanding balances also widened by 0.01 percentage points to 2.25 percentage points compared to the previous month.

Kim explained, "The slight decline in household loan rates was due to an increased proportion of higher-interest unsecured loans and a decreased proportion of lower-interest mortgage and jeonse deposit loans." He added, "The widening of the spread based on outstanding balances was partly due to some fixed-rate products taken out during the very low interest rate period five years ago (during the COVID-19 pandemic) now being converted to variable rates."

The proportion of fixed-rate household loans fell by 3.9 percentage points from the previous month to 57.9%. This was due to the proportion of fixed-rate mortgages dropping to 88.9%, marking a reversal after three months.

Meanwhile, deposit rates at non-bank financial institutions also declined across the board: mutual savings banks (-0.12 percentage points), credit unions (-0.07 percentage points), mutual finance institutions (-0.11 percentage points), and community credit cooperatives (-0.07 percentage points). As for lending rates (general loans), mutual savings banks (-0.37 percentage points) and community credit cooperatives (-0.35 percentage points) saw decreases, while credit unions and mutual finance institutions each saw increases of 0.01 percentage points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)