Maximum SME Sales Raised from 150 Billion Won to 180 Billion Won

Small Enterprise Limit Increased from 12 Billion Won to 14 Billion Won

The Ministry of SMEs and Startups announced on May 1 that it has prepared a revised plan for the sales criteria for SMEs to promote the corporate growth ladder, and finalized it through the Economic Ministers' Meeting.

The sales criteria for SMEs, which were established in 2015, have not reflected the cumulative inflation over the past 10 years. As a result, some companies have lost their SME status simply due to increased sales caused by rising production costs. When a company exceeds the SME threshold based solely on higher sales, regardless of its actual growth, it becomes ineligible for various benefits such as tax reductions, public procurement, and government support programs.

To support the stable growth of companies, the Ministry formed a task force in April last year with academic and industry experts, including the Korea Development Institute (KDI), the Korea Small Business Institute, and the Korean Economic Association. Together, they established the principles and criteria for adjusting the SME scope and prepared the revised plan after gathering feedback from the SME sector.

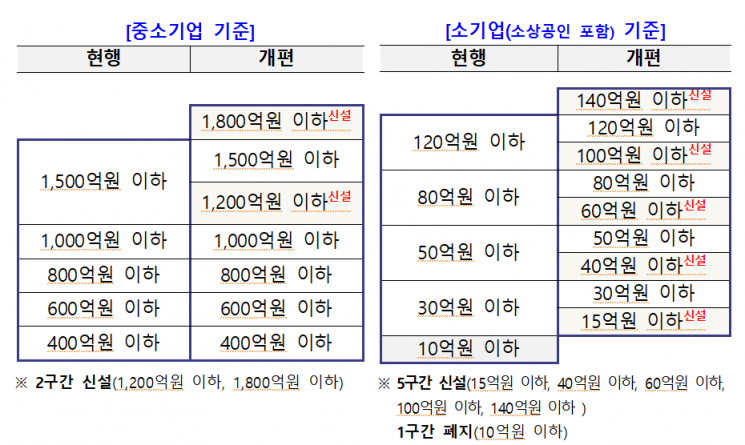

The revised plan raises the maximum sales threshold for SMEs from 150 billion won to 180 billion won and increases the number of sales brackets from five to seven, expanding the upper sales limit for each industry by 20 to 30 billion won. For small enterprises, which serve as the basis for defining micro-enterprises, the maximum sales threshold will be raised from 12 billion won to 14 billion won, and the number of sales brackets will increase from five to nine, with the upper sales limit for each industry rising by 500 million to 2 billion won.

Under the revised plan, the sales thresholds have been raised for 16 out of 44 SME industries and for 12 out of 43 micro-enterprise industries. As a result, of the total 8.04 million SMEs, approximately 5.73 million companies (63,000 medium-sized enterprises and 5.667 million small enterprises) in the affected industries will be able to stably receive benefits such as tax reductions, public procurement, and government support programs.

The revision comprehensively analyzed the distribution of companies within each industry, the appropriateness of the current sales thresholds, industry-specific inflation rates, changes in SME graduation rates, and nominal growth rates. It also fully considered industry feedback and took into account unique characteristics that distinguish certain industries from others.

For example, in the primary metal manufacturing industry, the international prices of imported non-ferrous metals such as aluminum, copper, and nickel (LME) have risen by more than 60% since 2015. The burden of rising costs has been further exacerbated by increasing metal prices due to demand for building artificial intelligence (AI) data centers. In the automobile manufacturing industry, difficulties are anticipated due to the 25% item-specific tariff imposed by the United States, and the shift from single-item manufacturing to module assembly has resulted in increased sales without changes in profitability.

Oh Youngju, Minister of SMEs and Startups, stated, "With this revision, the issue of SMEs losing their status due to simple inflation will be resolved, allowing small companies to grow stably and making the corporate growth ladder more robust." She added, "It will also help SMEs struggling with challenges such as securing export price competitiveness amid strengthened U.S. tariffs and the deterioration of the global raw material supply chain."

She further noted, "Since the principles and criteria for the scope revision were established through consensus with experts, academia, and the SME sector, we expect that future reviews of the scope criteria, conducted every five years, will improve predictability and on-site acceptance."

The Ministry plans to announce the proposed revision to the Enforcement Decree of the Framework Act on Small and Medium Enterprises containing these changes next month, and to implement it in September after updating the 'Online SME Verification System'.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.