News of KDB's Hanwha Ocean Stake Sale Triggers Group-wide Weakness

Hanwha Ocean Drops Over 12% ... Price Correction Seen as Inevitable for Now

Hanwha Aerospace Q1 Earnings Expected to Provide Rebound Momentum

The upward momentum in Hanwha Group stocks, which had been driven by the defense and shipbuilding sectors this year, has come to a halt. News of Korea Development Bank's plan to sell its stake in Hanwha Ocean led to a simultaneous decline in group stocks. The first-quarter earnings of Hanwha Aerospace, scheduled to be announced on April 30, are expected to serve as a catalyst for a rebound in group stocks.

According to the Korea Exchange on April 30, Hanwha Ocean closed at 78,500 won on the previous day, down 12.09%. After rising to the 91,000 won range on April 25, Hanwha Ocean's stock price fell sharply for two consecutive days, dropping below the 80,000 won mark. Along with this, Hanwha Systems fell by 7.09%, Hanwha by 3.76%, Hanwha Engine by 3.05%, Hanwha Aerospace by 2.18%, and Hanwha Vision by 1.50%.

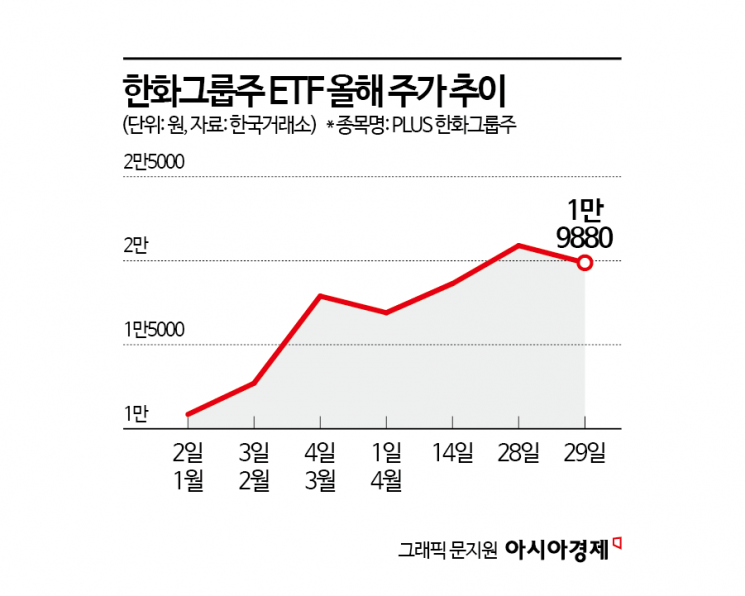

With the group stocks falling together, the Hanwha Group ETF also weakened. On the previous day, the PLUS Hanwha Group ETF closed at 19,880 won, down 4.61%. Since the beginning of the year, the PLUS Hanwha Group ETF had risen by 89.24%, with the stock price recently exceeding 20,000 won, but it fell back below 20,000 won due to this decline.

On April 28, Korea Development Bank began demand forecasting to sell its stake in Hanwha Ocean through a block deal (after-hours bulk trading). Korea Development Bank currently holds a 19.5% stake in Hanwha Ocean, amounting to 59,738,211 shares.

It appears that a price adjustment in Hanwha Ocean's stock is inevitable for the time being. Byun Yongjin, a researcher at iM Securities, stated, "From a stock price perspective, the overhang burden of the 19.5% stake will inevitably weigh on the stock for the time being," and downgraded his investment rating on Hanwha Ocean from 'buy' to 'hold.' Um Kyunga, a researcher at Shin Young Securities, also commented, "Due to profit-taking by major shareholders, a price adjustment is inevitable for now."

However, there are also opinions that, since fundamentals such as earnings improvement remain valid, the price adjustment should be viewed as an opportunity to increase holdings. Lee Jaehyuk, a researcher at LS Securities, said, "Although the phased stake sale by major shareholders is expected to act as a short-term burden on investor sentiment for Hanwha Ocean, the strong trend of profit improvement, a solid order environment, and expectations for expansion in the North American merchant and special ship business remain valid," recommending, "Actively seek opportunities to increase holdings during adjustments." Lee Jini, a researcher at Daishin Securities, also pointed out, "Although a short-term price adjustment is inevitable, the earnings-based growth momentum in the shipbuilding industry remains valid."

Attention is focused on whether the first-quarter earnings of Hanwha Aerospace, to be announced on this day, can serve as a catalyst for a rebound in group stocks. Hanwha Aerospace has risen 147.78% since the beginning of the year, leading the strength among group stocks with the largest increase among KOSPI-listed companies. According to financial information provider FnGuide, the first-quarter earnings consensus (average of securities firms' forecasts) for Hanwha Aerospace is sales of 4.7995 trillion won, up 159.67% year-on-year, and operating profit of 501.9 billion won, up 1,241.98%. The securities industry expects Hanwha Aerospace's results to exceed market expectations. Jang Namhyun, a researcher at Korea Investment & Securities, stated, "Hanwha Aerospace's first-quarter sales are expected to reach 5.5141 trillion won and operating profit 568.5 billion won, exceeding the consensus by 15.2% and 13.2%, respectively." Jung Dongho, a researcher at Mirae Asset Securities, estimated, "Hanwha Aerospace's first-quarter sales and operating profit will exceed consensus by 33% and 14%, respectively," analyzing that "the main drivers for exceeding consensus are increased deliveries of Cheonmu to Poland, a solid exchange rate, and the effects of operating leverage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.