The issuance volume of asset-backed securities (ABS) in the first quarter of this year decreased by more than 40%. The end of Korea Housing Finance Corporation's Special Bogeumjari Loan led to a reduction in the issuance of mortgage-backed securities (MBS). In addition, improved conditions in the bond market reduced the demand for funding through securitization by specialized credit finance companies.

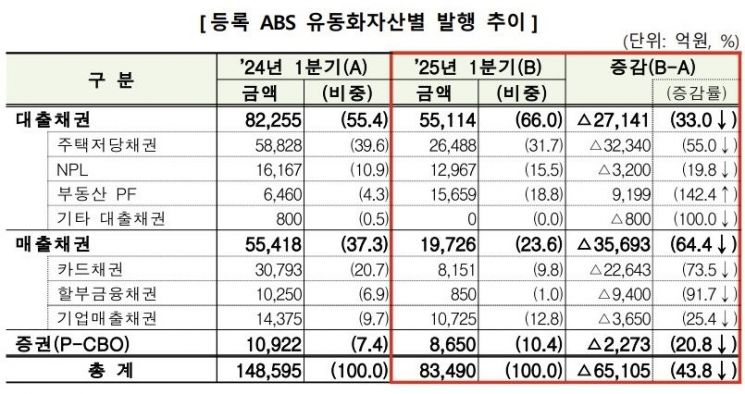

On April 28, the Financial Supervisory Service announced that the registered ABS issuance amount in the first quarter of this year was 8.349 trillion won, a decrease of 6.5105 trillion won (43.8%) compared to the same period last year. ABS refers to securities issued using illiquid assets such as real estate, accounts receivable, and mortgage loans as collateral.

By asset holder, Korea Housing Finance Corporation recorded 2.6488 trillion won, a decrease of 3.234 trillion won (55.0%) compared to the same period last year. The termination of the policy finance product Special Bogeumjari Loan in January last year had an impact. The MBS issuance amount in the first quarter was 2.6 trillion won, down 3.2 trillion won from the same period last year.

For financial companies, the issuance volume dropped sharply by 3.8 trillion won (55.6%) to 3.6018 trillion won, due to a significant decrease in ABS issuance based on card receivables and installment finance receivables by specialized credit finance companies, as well as a reduction in non-performing loan (NPL)-backed ABS issuance by banks.

The reduction in issuance was most pronounced among specialized credit finance companies. Improved conditions in the bond market, such as a decline in specialized credit finance company bond rates, led to a decrease in demand for funding through securitization by these companies. In the first quarter, ABS issuance by specialized credit finance companies was 900 billion won, down 3.3 trillion won compared to 4.2 trillion won in the same period last year.

In contrast, the issuance volume by general corporations increased by 555 billion won (26.6%) to 2.6385 trillion won, due to the expansion of ABS issuance backed by real estate project financing (PF) related to public support for private rental and reconstruction projects.

The Financial Supervisory Service explained, "ABS issuance backed by real estate PF increased due to the securitization of housing reconstruction and mixed-use facility development projects."

By asset type, both loan receivables and accounts receivable saw significant decreases. For loan receivables, ABS issuance backed by real estate PF increased. However, due to a sharp decline in MBS issuance, the figure dropped by 2.7141 trillion won (33.0%) year-on-year to 5.5114 trillion won. For accounts receivable, the amount plunged by 3.5693 trillion won (64.4%) to 1.9726 trillion won, due to a decrease in ABS issuance based on card receivables and installment finance receivables.

As of the end of last month, the outstanding balance of all registered ABS stood at 251 trillion won, down 7.4 trillion won (2.9%) from 258.4 trillion won in the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)