Comprehensive Response Plan for 'Supply-Production-Sales' Optimization

Record Q1 Revenue Driven by 'High Exchange Rate Effect'

Hyundai Motor Company has announced plans to establish a contingency plan and actively strengthen its local supply chain in the United States in response to the tariff policies of the Trump administration. The company outlined strategies to increase inventory levels to prepare for future uncertainties, adjust production sites by region and model, and optimize parts and logistics through the discovery of local suppliers.

On April 24, during its Q1 2025 earnings conference call, Hyundai Motor Company discussed these plans. Lee Seungjo, CFO of Hyundai Motor Company, stated, "In order to minimize the financial impact of U.S. tariffs, we launched a task force in mid-April and are devising comprehensive, mid- to long-term response measures."

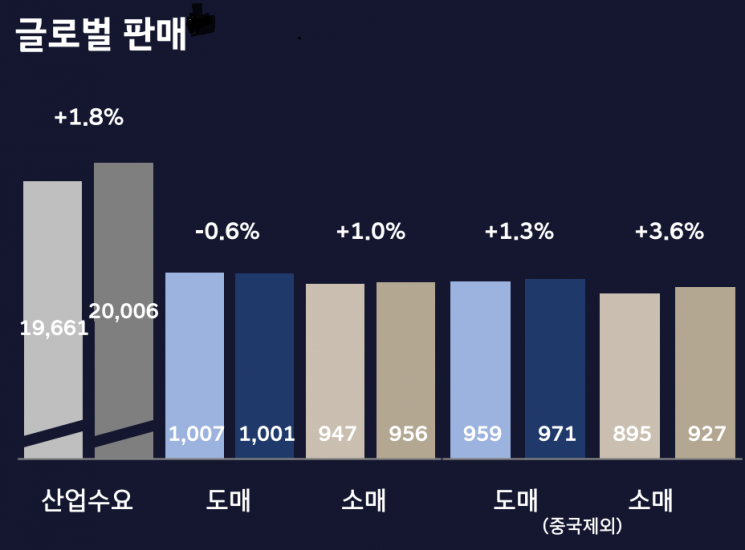

Hyundai Motor Company Global Wholesale Sales in Q1 2025. (※Dark blue indicates wholesale sales performance in Q1 2025). Provided by Hyundai Motor Company

Hyundai Motor Company Global Wholesale Sales in Q1 2025. (※Dark blue indicates wholesale sales performance in Q1 2025). Provided by Hyundai Motor Company

Comprehensive Response Plan for 'Supply-Production-Sales' Optimization

First, Hyundai Motor Company said it would develop comprehensive response measures across the entire supply chain, including not only finished vehicles but also parts and logistics. Lee explained, "We are actively seeking new local suppliers to localize parts supply," and added, "Through a fast-track process, we plan to accelerate development, quality, and production timelines and begin selecting items as soon as possible."

In the mid- to long-term, the company emphasized plans to maximize production efficiency and cost-saving know-how at its Alabama plant (HMMA) and the Metaplant America in Georgia (HMGMA). For example, Hyundai will shift production of Tucson models for the U.S. market from Kia’s Mexico plant to Alabama, while production for the Canadian market, previously handled in Alabama, will be transferred to the Mexico plant. Lee stated, "We will continue to review whether there are Korea-made vehicles exported to the U.S. whose production sites could be relocated to ensure profitability."

On the sales side, Hyundai Motor Company also presented plans to implement efficient incentive policies and optimize supply, production, and sales by hub and model. To proactively respond to tariff policies, the company increased finished vehicle inventory to the equivalent of 3.1 months by the end of March, and secured even longer inventory periods for parts. As a result, sales prices can be maintained at current levels until June, after which the company plans to operate flexibly in line with market prices.

Record Q1 Revenue Driven by 'High Exchange Rate Effect'

On this day, Hyundai Motor Company announced that its Q1 2025 revenue reached KRW 44.4078 trillion, marking the highest Q1 result in the company’s history. This represents a 9% increase compared to the same period last year. The main driver of revenue growth was the exchange rate. With the continued weakness of the Korean won, the exchange rate effect alone accounted for KRW 2.059 trillion out of the KRW 3.749 trillion year-on-year increase in Q1 revenue.

Operating profit was KRW 3.6336 trillion, up 2.1% from the same period last year. The operating margin reached 8.2%, exceeding the annual guidance presented at the beginning of the year. Despite increased incentives in overseas markets such as the U.S., sales of high value-added models like hybrids reached an all-time high. In Q1 2025, Hyundai Motor Company sold 137,000 hybrid vehicles, a 40% increase compared to the same period last year. At the same time, the strong exchange rate continued to provide a favorable environment.

Hyundai Motor Company expressed confidence in achieving its annual targets set at the beginning of the year (revenue growth rate of 3-4% and operating margin of 7-8%) through optimization of production and sales structures by hub and model, investment based on priorities, and minimizing unnecessary budgets. Lee stated, "Even during difficult times such as the COVID-19 pandemic and the semiconductor supply crisis, Hyundai Motor Company was able to turn things around by flexibly optimizing production. We will continue to thoroughly monitor, analyze, and respond to the impact of tariffs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)