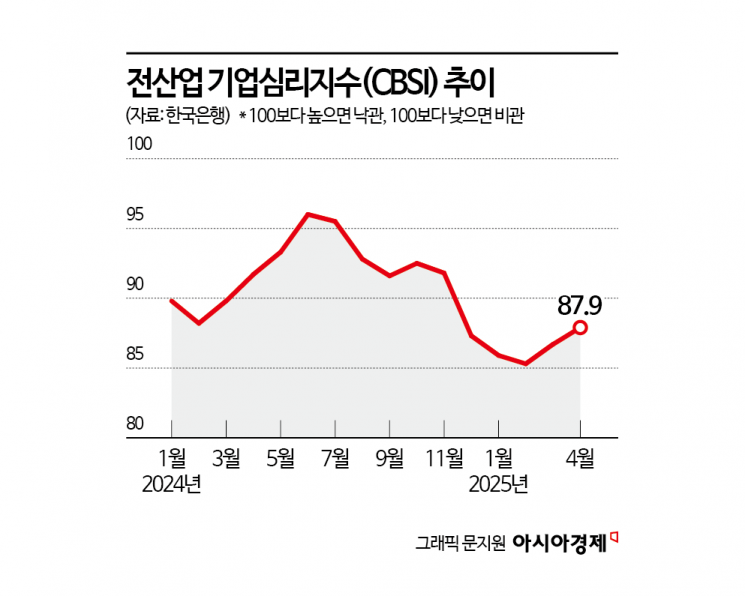

Overall Industry Business Sentiment Index at 87.9, Up 1.2 Points from Previous Month

Improvement in Some Manufacturing Sectors Like Semiconductors and Seasonal Effects in Non-Manufacturing

However, Index Remains in the 80-Point Range for Five Consecutive Months... Longest Period Since COVID-19

In April, business sentiment among companies remained clouded by uncertainty. The overall industry Business Survey Index (CBSI) showed improvement for the second consecutive month this month, as conditions in some manufacturing sectors, such as semiconductors, improved. However, it barely surpassed the level seen in December last year, when sentiment had plummeted due to the emergency martial law situation, and for the fifth consecutive month, it remained significantly below the baseline of 100, hovering in the 80-point range. This is the longest period the index has stayed in the 80s since the COVID-19 outbreak in 2020 (from February to September).

According to the "April Business Survey Results and Economic Sentiment Index (ESI)" released by the Bank of Korea on the 24th, this month's overall industry CBSI stood at 87.9, up 1.2 points from the previous month. However, it only slightly exceeded the level of 87.3 recorded in December last year, when business sentiment had worsened due to the emergency martial law situation and other factors. The CBSI is an indicator of business sentiment calculated using key indices from the Business Survey Index (BSI). A reading above 100 indicates that companies are more optimistic about the economic situation compared to the past, while a reading below 100 suggests pessimism.

Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Economic Statistics Department 1 of the Bank of Korea, stated, "Although the overall industry CBSI has risen for two consecutive months, it is still below the long-term average and has not yet reached the level seen in November last year, so it is difficult to say that business sentiment is strong." She added, "In terms of details, except for some sectors such as semiconductors, manufacturing conditions remained sluggish this month, and in the non-manufacturing sector, the improvement was partly due to seasonal factors such as the resumption of construction work in spring, so it is difficult to be overly optimistic about future trends."

The manufacturing CBSI rose by 1.2 points from the previous month to 93.1. This month, manufacturing performance improved mainly in electronic, visual, and communications equipment, fabricated metal products, and non-metallic minerals. Electronic, visual, and communications equipment benefited from increased exports as companies rushed to secure shipments before tariffs were imposed, as well as improved profitability due to rising semiconductor prices. Fabricated metal products saw better results due to increased demand from downstream industries such as shipbuilding, defense, and construction. Non-metallic minerals improved as construction starts became more active due to seasonal factors, leading to better conditions for cement and concrete companies.

The non-manufacturing CBSI also rose by 1.6 points to 84.5. Non-manufacturing performance improved mainly in construction, wholesale and retail, and arts, sports, and leisure-related service industries. Construction benefited from seasonal factors that increased the progress rate of construction work. In wholesale and retail, demand increased in the petroleum wholesale sector ahead of the decision to extend the fuel tax cut. In arts, sports, and leisure-related services, business conditions improved due to an increase in golf course users.

Many companies expect business conditions to improve in both manufacturing and non-manufacturing sectors next month. The CBSI outlook for May was 90.0 for manufacturing, up 0.1 point from the previous month, and 83.8 for non-manufacturing, up 1.4 points from the previous month.

The Economic Sentiment Index (ESI), which combines the Business Survey Index (BSI) and the Consumer Sentiment Index (CSI), rose by 0.3 points from the previous month to 87.5. The cyclical variation, which removes seasonal factors, fell by 1.0 point from the previous month to 86.0, marking the lowest level since October 2020 (84.2).

Meanwhile, this survey was conducted from the 9th to the 16th of this month, targeting 3,524 corporate entities nationwide. Of these, 3,282 companies responded, with 1,847 in manufacturing and 1,435 in non-manufacturing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.