Manufacturing BSI Hits Lowest Level Since COVID-19

Domestic Demand, Exports, and Investment Sluggish for 11 Consecutive Months

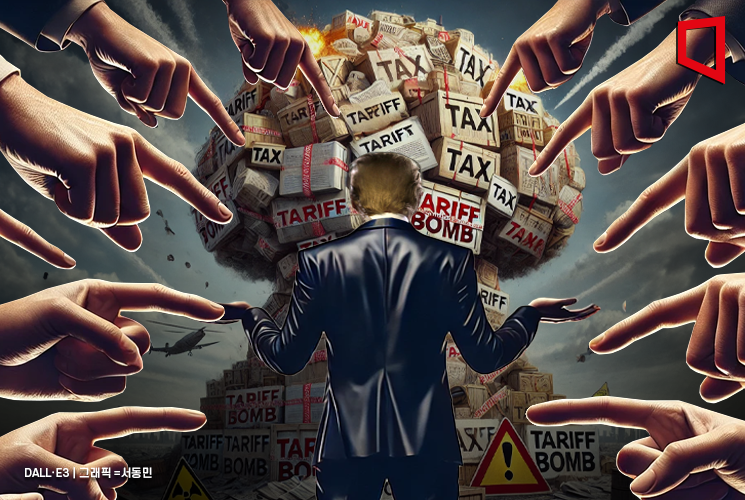

Corporate economic sentiment continues to remain subdued. This is attributed to increased trade uncertainty triggered by the 'tariff war' initiated by the Trump administration, as well as heightened volatility in key price variables such as exchange rates. In particular, the Business Survey Index (BSI) for manufacturing companies has reached its lowest level since the COVID-19 period.

The Korea Economic Research Institute announced on the 22nd that, based on a survey of the top 600 companies by sales, the BSI outlook for May this year was recorded at 85.0. The BSI uses 100 as the baseline: a figure above 100 indicates a 'positive economic outlook' compared to the previous month, while a figure below 100 indicates a 'negative economic outlook.'

The BSI for May fell by 3 points compared to the previous month (88.0). This decline is analyzed to be influenced by increased volatility in key price variables such as global tariffs and exchange rates. This marks a two-month consecutive decline, showing that the weakened corporate sentiment since the beginning of the year has yet to recover. The actual BSI for April was recorded at 86.4. The actual index has remained sluggish for 39 consecutive months since February 2022 (91.5), indicating a prolonged downturn in corporate performance.

The BSI by sector for May is expected to show simultaneous weakness in both manufacturing (79.2) and non-manufacturing (90.8) industries. Notably, the manufacturing BSI has hit its lowest level in four years and nine months since August 2020 (74.9), during the height of the COVID-19 pandemic. The non-manufacturing BSI has also shown a sluggish trend for five consecutive months since January this year (84.9).

Among the 10 detailed manufacturing sectors, only pharmaceuticals (125.0) and food, beverages, and tobacco (107.1) are expected to perform well. The remaining eight sectors are anticipated to experience deteriorating business conditions. The Korea Economic Research Institute assessed that, amid the prolonged downturn in core industries such as petrochemicals and steel, and the expansion of global trade risks, corporate sentiment is being dampened across most manufacturing sectors.

Among the seven detailed non-manufacturing sectors, leisure, accommodation and food services (142.9), and transportation and warehousing (107.7) are projected to see improved business conditions. The other five sectors are expected to remain sluggish. The Korea Economic Research Institute stated, "Except for the 'leisure, accommodation and food services' and 'transportation and warehousing' sectors, which are expected to benefit from the May holiday season, negative sentiment was dominant."

By segment, the BSI outlook for May was negative across all categories. Domestic demand (87.2), exports (89.1), and investment (87.2) have all shown simultaneous weakness for 11 consecutive months since July last year. In particular, the export BSI fell below the 90 mark for the first time since September 2020 (88.5), due to increased uncertainty stemming from U.S. tariff policies.

Lee Sangho, Head of the Economic and Industrial Division at the Korea Economic Research Institute, stated, "International trade uncertainty is greatly increasing due to U.S. tariff policies and countermeasures by major countries." He added, "It is necessary to stabilize corporate sentiment by promoting investment and providing tax support for key export industries such as semiconductors, petrochemicals, automobiles, and steel."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)