Gold Prices Soar 31% This Year, 72% Since Last Year... New Record Highs Set Daily

Investment Floods into Safe-Haven Gold Amid Uncertainty Over Trump Tariff Policies

Strong Uptrend Expected to Continue for the Foreseeable Future

As gold prices reach all-time highs, investor interest is surging, with bank gold banking balances also hitting record levels. Since the beginning of this year alone, gold prices have risen by 31% due to economic uncertainty stemming from U.S. tariff policies. In the market, the prevailing expectation is that prices will climb even higher from here.

Gold Prices Surge 31% This Year Alone, 72% Since Last Year... New Record Highs Set Daily

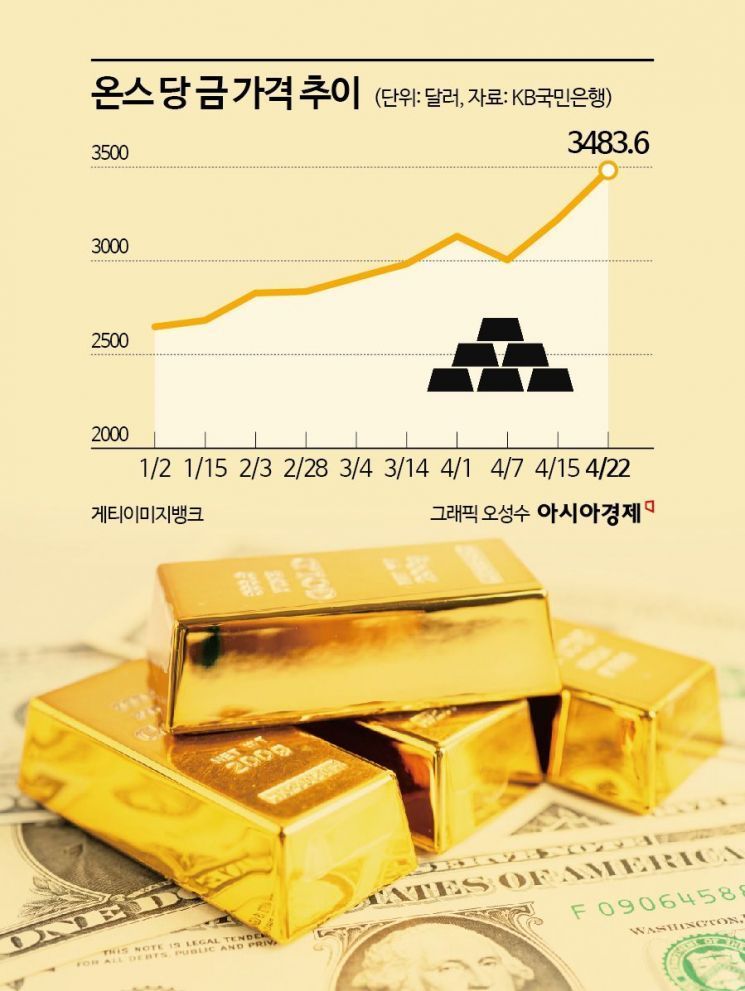

According to KB Kookmin Bank on April 23, as of the afternoon of the previous day, the price of gold per ounce reached $3,483.6, setting a new yearly high. On January 2, gold was priced at $2,647.6 per ounce, meaning it has surged by 31.5% in just four months. Since the beginning of last year, when gold was $2,022 per ounce, the price has jumped 72.2% over a year and four months. During the same period, gold has outperformed not only the domestic stock market but also the U.S. stock market in terms of returns.

As gold prices rise, investors in Korea are also flocking to gold. As of April 17, the gold banking balances at KB Kookmin Bank, Shinhan Bank, and Woori Bank reached 1.0649 trillion won, an all-time high. Gold banking is a product that allows customers to buy and sell gold through a bank account. The balances at these three banks have been hitting new records daily since the beginning of this year. Among the five major banks, Hana Bank and NH NongHyup Bank do not offer gold banking services.

Bank gold bars are also selling so well that supply cannot keep up with demand. As of April 17, gold bar sales at the five major banks amounted to 174.7 billion won, already surpassing last year's total annual sales. Monthly gold bar sales have been increasing, from 15.092 billion won in November last year, to 18.77 billion won in December, and 27.031 billion won in January this year. In February, sales soared to 88.293 billion won, leading to a shortage of gold bars at banks. A representative from a commercial bank explained, "At one point, gold bars were in such short supply that we simply couldn't sell any. Although they are available again now, demand remains very strong."

Investment in Safe-Haven Gold Surges Amid Uncertainty Over Trump Tariff Policies

Despite gold prices repeatedly reaching record highs since last year, investment continues to increase, reflecting expectations that prices will rise even further. The main reasons for the surge in gold prices include increased alternative demand due to economic uncertainty caused by U.S. tariff policies, a preference for safe-haven assets driven by expectations of interest rate cuts, and continued gold purchases by central banks in emerging economies, including the People's Bank of China. In particular, analysts point to heightened concerns over global economic instability following tariff policy announcements by U.S. President Donald Trump as a major factor behind this year's gold price rally.

Hwang Byungjin, head of research at NH Investment & Securities, commented, "Since the start of Trump's second administration, the escalation of global tariff wars and political and economic uncertainty have reinforced the possibility of monetary policy easing rather than tightening. This has repeatedly boosted the value of gold, which is a representative safe-haven and inflation-hedge asset." Choi Yechang, a researcher at SangSangIn Securities, also noted, "As trade tensions between the U.S. and China have intensified, gold prices have once again reached historical highs. China's ongoing sale of U.S. Treasury bonds and continued gold purchases are also influencing the market."

Experts believe that continued uncertainty over U.S. tariffs, ongoing U.S.-China tensions, concerns about a global economic downturn, and expectations of a rate cut by the U.S. Federal Reserve (Fed) will drive gold prices even higher. Investment bank Goldman Sachs forecasts that gold prices could reach $3,700 this year, and possibly $4,000 by the middle of next year. Hwang also stated, "As long as the Fed maintains an easing monetary policy stance, the record-breaking gold price rally is expected to continue," and announced an upward revision of this year's gold price target from $3,300 to $3,600 per ounce.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)