iM Securities analyzed on April 22 that the recent sharp decline of the US dollar may reflect market concerns or warnings regarding the policies of the Donald Trump administration.

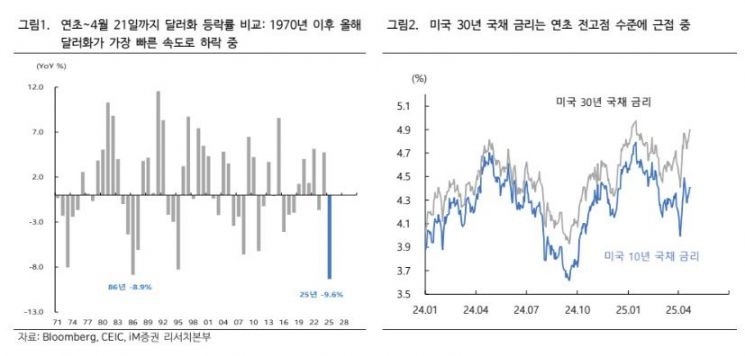

Park Sanghyun, a researcher at iM Securities, stated, "The dollar is plummeting uncontrollably, with the dollar index having dropped about 5.3% since the announcement of reciprocal tariffs on April 2, marking a nearly 10% plunge so far this year." He explained, "From the beginning of this year to April 21, the decline in the dollar is the steepest for this period since the early 1970s."

He noted, "The sharp decline of the dollar is significant in that it signals a global exodus of capital from US assets," adding that "the phenomenon of global funds exiting the US, which had already materialized in stocks and bonds immediately after the reciprocal tariff announcement, is being reinforced once again."

He further emphasized, "In fact, global capital outflows are intensifying not only in equities but also in the US Treasury market, which is a focal point for financial markets. As a result, long-term rates such as the US 10-year Treasury yield, which had been stabilizing, are now rising again."

Researcher Park explained that the dollar's sharp decline could be interpreted as a kind of warning from the financial markets to the Trump administration.

He said, "The main factor behind the dollar's plunge may be market concerns or warnings about the Trump administration's policies. Despite market worries, the administration is pushing ahead with high reciprocal tariffs, which simultaneously trigger recession and inflation risks, causing the market to lose confidence in Trump’s policies."

He continued, "The deepening rift in US-China relations, rather than a search for compromise, is also fueling concerns about a heavy burden on the US economy and financial markets, while simultaneously exerting downward pressure on the dollar. In addition, although it was already anticipated, President Trump’s moves to undermine Jerome Powell, the Federal Reserve Chair, are also negative factors for both the financial markets and the dollar."

He added, "There are also concerns that the US may demand currency appreciation at the G20 finance ministers' meeting and in individual reciprocal tariff negotiations with Japan and South Korea, which is further fueling dollar-weakening sentiment. President Trump has implicitly suggested the possibility of a currency war, following high reciprocal tariffs, by listing 'eight major non-tariff unfair practices' and naming 'currency manipulation' as the first."

Researcher Park concluded, "If President Trump continues to pursue policies that run counter to financial market sentiment and atmosphere, and if US-China tensions escalate further, it will be difficult for the dollar’s weakness to end early. This raises the risk of a prolonged 'Sell USA' phenomenon or could lead to heightened volatility in the financial markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.