Outstanding Balance of Derivative-Linked Securities Hits Lowest Level Since 2014

Impact of Hong Kong H-Index Incident Leads to Decline in ELS Demand and Issuance

The outstanding balance of derivative-linked securities fell to 82 trillion won last year, marking the lowest level since 2014. This decline was primarily influenced by reduced demand for equity-linked securities (ELS) following the fallout from the Hong Kong H-Index incident. In addition, the maturity of ELS products linked to the H-Index contributed to a 2.6% investment loss.

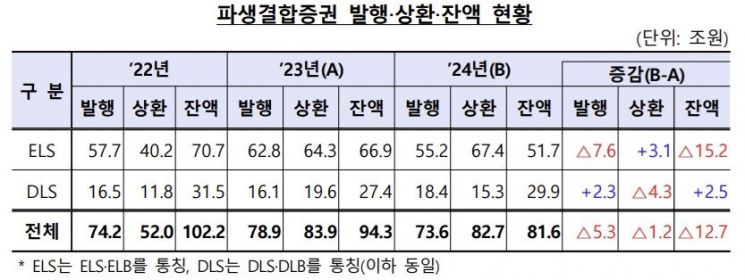

According to the Financial Supervisory Service's "2024 Status of Issuance and Management of Derivative-Linked Securities by Securities Companies" released on the 22nd, the outstanding balance of derivative-linked securities (including ELS, ELB, DLS, DLB, etc.) stood at 81.6 trillion won last year, a decrease of 12.7 trillion won from the previous year and the lowest level since 2014, when it was 84.1 trillion won. The total amount issued was 73.6 trillion won, down 5.3 trillion won year-on-year. Redemption volume also fell by 1.2 trillion won to 82.7 trillion won.

The main reason for the record-low outstanding balance was the impact of the Hong Kong H-Index. The incident led to a sustained contraction in demand for ELS. In addition, the suspension of sales by major banks contributed to a decrease in both the issuance and outstanding balance of ELS.

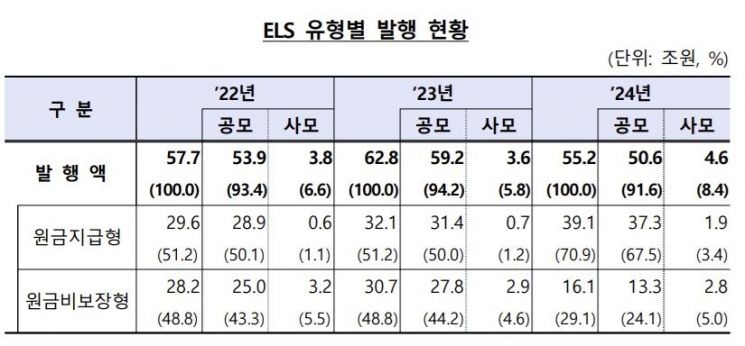

In detail, the amount of ELS issued at the end of last year was 55.2 trillion won, a decrease of 7.6 trillion won from the previous year, marking the lowest level between 2022 and 2024.

There was a significant increase in single-stock ELS. Last year, the total issuance of single-stock ELS reached 31.6 trillion won, up 16.5 percentage points from the previous year. In contrast, index-linked ELS totaled 19.6 trillion won, down 15.8 percentage points year-on-year.

By underlying asset, ELS products utilizing KOSPI200 accounted for the largest share at 18.6 trillion won. This was followed by S&P500 (13 trillion won), Euro Stoxx 50 (11.8 trillion won), and Nikkei 225 (3.5 trillion won). The Financial Supervisory Service explained, "Due to the ripple effect of the H-Index incident, the proportion of overseas indices such as the S&P500 has decreased, while the share of KOSPI200 has increased significantly."

Last year, the redemption amount for ELS reached 67.4 trillion won, up 3.1 trillion won from the previous year. The maturity redemption volume increased by 16 trillion won year-on-year due to the maturity of ELS products linked to the H-Index. In contrast, the volume of early redemptions, which is relatively high for index-linked ELS, decreased by 12.9 trillion won to 24.4 trillion won due to a decline in issuance.

As of the end of last year, the outstanding balance of ELS stood at 51.7 trillion won, a 22.7% decrease from 66.9 trillion won in the previous year. Principal-protected products increased by 10.5 trillion won to 41.7 trillion won. In contrast, non-principal-protected products, which are heavily reliant on bank sales, fell by 25.8 trillion won to 9.9 trillion won.

The issuance of derivative-linked securities (DLS) amounted to 18.4 trillion won last year, up 2.3 trillion won from 16.1 trillion won the previous year. Of this, principal-protected issuance accounted for 14.4 trillion won, representing the majority.

By underlying asset, interest rate-linked products accounted for the largest share at 13.3 trillion won, followed by credit (2.7 trillion won), foreign exchange (1.5 trillion won), and commodities (100 billion won).

Redemptions totaled 15.3 trillion won, a decrease of 4.3 trillion won from 19.6 trillion won the previous year.

The outstanding balance increased by 2.5 trillion won year-on-year to 29.9 trillion won. Of this, principal-protected products accounted for the majority at 23.7 trillion won.

Regarding the management of funds raised from the issuance of derivative-linked securities, the amount hedged in-house among outstanding balances was 55.2 trillion won, down 4.2 trillion won from the previous year. Back-to-back hedges totaled 26.4 trillion won, with foreign financial institutions accounting for 20 trillion won, or 75.9% of the total counterparties.

As of the end of last year, the valuation of hedge assets (assets managed with funds raised from derivative-linked securities) stood at 81.7 trillion won, exceeding the liability valuation of 81.4 trillion won by 300 billion won. Bonds accounted for 75.2 trillion won, or 92.1% of hedge assets, followed by deposits and savings at 7 trillion won (8.5%) and cash at 1.2 trillion won (1.4%).

Last year, both the profits and returns for investors who redeemed derivative-linked securities, including ELS and DLS, declined. This was due to concentrated maturities of ELS products linked to the H-Index, which resulted in realized losses. The annualized investment return for ELS was -2.6%, reversing from a 6.2% gain in the previous year to a loss. DLS returns also fell to 2.5%, down from 3.5% in 2023.

The Financial Supervisory Service stated, "With increased volatility in global stock markets this year, there are concerns over potential investment losses in ELS, so we will strengthen monitoring of ELS issuance trends and related matters." The agency added, "We will also enhance investor awareness by providing more guidance on the credit risks of securities companies issuing derivative-linked bonds, which have recently seen an increase in issuance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.