Travel Demand Rises, but Performance Declines

Package Tours Shunned as Independent Travelers Increase

Mid- to High-Priced Packages and Digital Transformation as Breakthroughs

In the first quarter of this year, demand for overseas travel increased, but the performance of major travel agencies actually declined. Analysts attribute this to a combination of factors: a rise in independent travelers who are turning away from package tours, a high exchange rate, and rising airfares, all of which have eroded the profitability of travel agencies.

On the 27th, ahead of the Chuseok holiday, the duty-free area of Terminal 1 at Incheon International Airport is bustling with travelers. Photo by Kang Jinhyung aymsdream@

On the 27th, ahead of the Chuseok holiday, the duty-free area of Terminal 1 at Incheon International Airport is bustling with travelers. Photo by Kang Jinhyung aymsdream@

Package Tour Agencies Hit Hard by Growth in Independent Travel

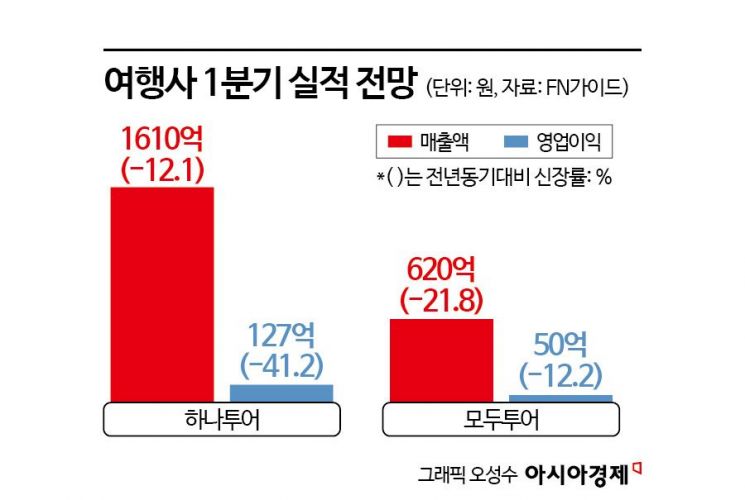

According to market analysis firm FnGuide on April 20, Hana Tour's consolidated sales for the first quarter are expected to reach KRW 161 billion, with operating profit at KRW 12.7 billion. These figures represent a year-on-year decrease of 12.1% and 41.2%, respectively. Modetour is also projected to see a decline, with sales of KRW 62 billion and operating profit of KRW 5 billion, down 21.8% and 12.2%, respectively, compared to the same period last year.

Statistics from the Korea Tourism Organization show that the number of outbound travelers in January and February this year reached 5,598,550, an increase of 6% from the previous year. However, the number of package tour customers sent abroad by major travel agencies decreased. Hana Tour's package tour customers in the first quarter numbered 563,432, a 4.4% drop from last year, while Modetour's figure was 252,290, down 23.5%.

By country, the decline in package tour customers was particularly pronounced for Southeast Asia, Japan, and the South Pacific. Hana Tour's first-quarter customer numbers for Japan and the South Pacific were 145,000 and 23,000, respectively, representing decreases of 11.0% and 32.3% compared to the same period last year. The spread of online travel agencies (OTAs) and low-cost carriers (LCCs), along with a preference for independent travel among younger generations, are cited as reasons for the drop in demand for Japan. Southeast Asia also saw a decrease to 283,000, down 8.1% year-on-year. In contrast, China and Europe saw increases of 64.1% and 12.1%, reaching 54,000 and 37,000 travelers, respectively. Notably, the rebound in travel to China was driven by the temporary visa waiver policy implemented in November last year.

An industry insider commented, "Travel agencies focused on package tours are being hit hard by the rise in independent travelers," adding, "As competition with OTAs intensifies, it is necessary to develop differentiated strategies."

Travel Agencies Seeking Breakthroughs

Hana Tour is pursuing a strategy to increase the average transaction value by focusing on mid- to high-priced packages such as 'Hana Pack 2.0·3.0,' which emphasize 'No Shopping, No Tips.' Last year, mid- to high-priced packages accounted for 29% of its total, more than triple the 8% share in 2019. The company is also strengthening independent travel combination products such as 'Airtel' and 'My Way Travel' to target younger generations.

The company is also accelerating its digital transformation. Last year, Hana Tour's online sales (based on customer numbers) increased by 37% compared to the previous year. Through digital platforms such as 'Hana Open Chat,' 'Hana ON Planner,' and 'Hana Live,' the company is expanding its customer touchpoints.

Hana Tour is also making overseas investments to expand outbound travel. By investing in a local travel agency in Singapore and linking with its Japanese subsidiary (Hana Tour Japan), the company is expanding its global customer network and accelerating its entry into new markets, including Southeast Asia.

Hana Tour aims to achieve sales of KRW 900 billion and operating profit of at least KRW 140 billion by 2027, with a target operating margin of over 15%. To this end, it has aggressively revised its financial strategy. At the board meeting on April 15, the company decided to cancel all of its treasury shares, which account for 3.4% of the total. It also plans to use 50% of its annual net profit through 2027 for shareholder returns, including dividends and share buybacks. The payout ratio is set at 30-40%, with share buybacks and cancellations accounting for 10-20%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.