Global Shipowners Likely to Turn to Korea as They Avoid China

Shipping Industry Faces Challenges... Freight Rate Increase Inevitable

Port Entry Fees to Be Imposed in October... Industry Says "Wait and See"

The U.S. government's decision to impose port entry fees on Chinese shipping companies and Chinese-made vessels is expected to benefit our shipbuilding industry. This is because global shipowners are increasingly likely to cancel orders for Chinese vessels or exclude China from new ship orders. However, the shipping industry is concerned as the imposition of port entry fees is expected to lead to an overall increase in shipping rates, and they will have to reorganize the transportation routes of their Chinese vessels.

According to the domestic shipbuilding industry on the 17th, there is growing anticipation that Korean shipbuilders could gain a secondary benefit from the U.S. imposing port entry fees on China. Although global shipowners and shipping companies tend to be conservative and do not easily change their business partners, there is now a long-term incentive to avoid Chinese shipbuilders. Earlier, the U.S. Trade Representative (USTR) announced that starting October 14, port entry fees would be imposed on Chinese shipping companies, shipping companies operating Chinese-made vessels, and automobile carriers built abroad entering U.S. ports.

Export containers are loaded onto a ship at Busan North Port. The photo is not directly related to the article. Photo by Kang Jin-hyung

Export containers are loaded onto a ship at Busan North Port. The photo is not directly related to the article. Photo by Kang Jin-hyung

Last month, when the U.S. was reviewing the policy to impose port entry fees on Chinese vessels, a U.S. company canceled an order for a Chinese vessel. ExxonMobil postponed a newbuilding contract for a liquefied natural gas bunkering vessel (LNGBV) that was scheduled to be built at a Chinese shipyard. A representative from a domestic shipbuilder said, "When the demand for vessel replacement arises, there will be a situation where orders cannot be placed with China," adding, "Although policy changes are possible, some orders may be temporarily put on hold or redirected to Korea or Japan."

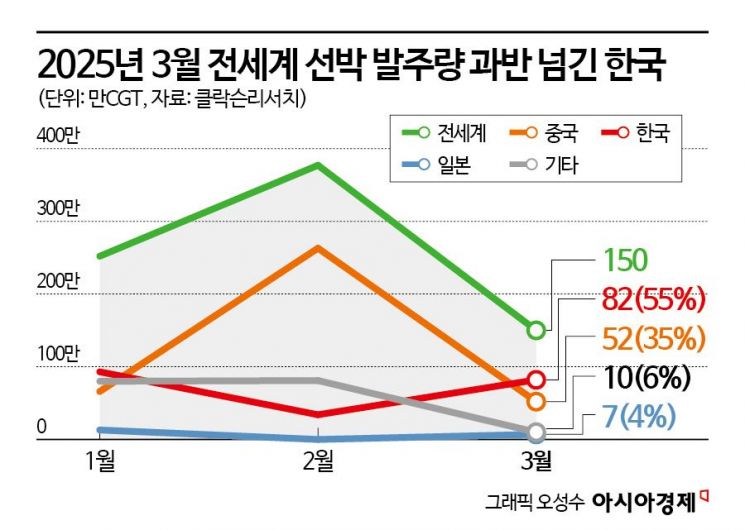

Korea has recently entered a recovery phase in global ship orders. According to Clarkson Research, a British shipbuilding and shipping market research firm, last month’s global ship orders totaled 1.5 million CGT (58 vessels), with Korea securing 55% of that, or 820,000 CGT, ranking first. Park Jin-ho, a policy advisor to the Korean Ministry of National Defense, suggested in the Pacific Forum’s publication 'PacNet' of the U.S. think tank Center for Strategic and International Studies (CSIS) on the 14th that Korea and the U.S. should cooperate in the shipbuilding sector.

On the other hand, the domestic shipping industry is somewhat uneasy about concerns over rising freight rates. An industry insider said, "Freight rate increases are a burden for shippers," adding, "Along with tariffs, this creates another barrier, which could worsen profitability."

However, Korean shipping companies are expected to be less affected as their operation scale of Chinese-made vessels is smaller compared to Europe. As of the end of last year, HMM owned a total of 83 container ships (including charters and owned vessels over one year old), of which only 5 were Chinese-made. SM Line has about 2 Chinese-made vessels out of a total of 14.

Companies owning Chinese-made vessels plan to respond by changing routes and other measures. A Pan Ocean representative said, "Bulk carriers have a somewhat higher proportion of Chinese-made vessels, but not many go to the U.S.," adding, "We will try to use Korean-made or non-Chinese vessels as much as possible." A representative from Hyundai Glovis, which mainly transports Hyundai vehicles, explained, "Port entry fees are imposed on automobile carriers built not only in China but also abroad, so all automobile carriers are under the same conditions," and added, "We are closely monitoring the situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.