CBAM to Be Fully Implemented Next Year

Blast Furnace-Based Steel Products to Take Direct Hit

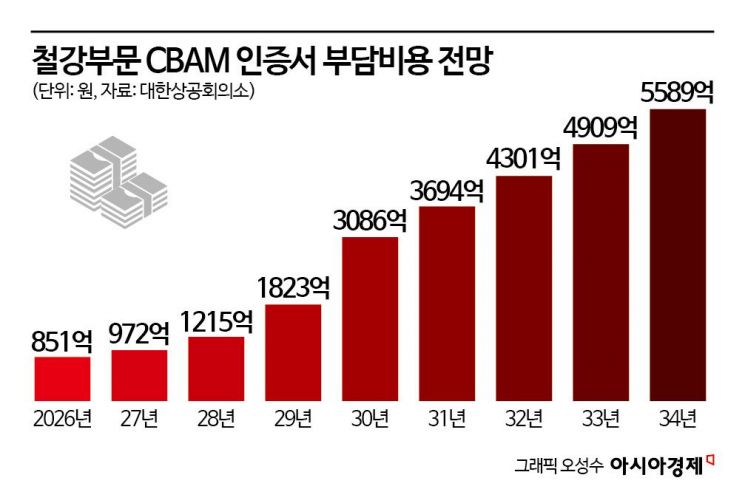

Carbon Cost to Reach 3 Trillion Won by 2034

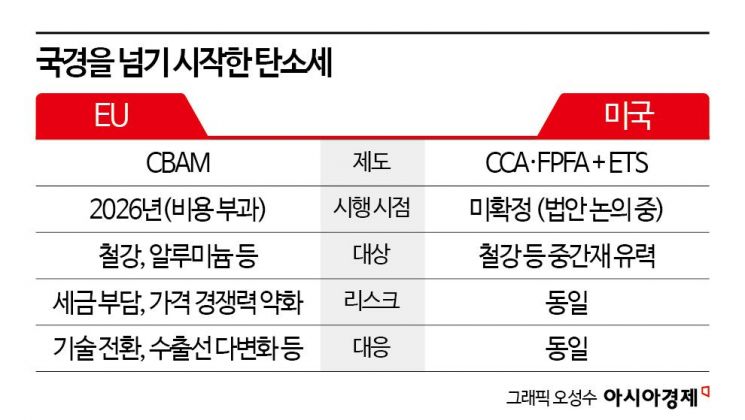

US Also Moves to Strengthen 'Carbon Standards'

Steel Industry Accelerates Eco-Friendly Transition

As the Korean steel industry faces strengthened carbon regulations from the European Union (EU) and the United States, additional impacts on high-carbon products such as hot-rolled steel sheets, steel pipes, and thick plates are expected. Following weakened price competitiveness due to the US-originated tariff war, there are calls for a structural change in domestic steel export strategies amid increasing tax burdens.

According to the steel industry on the 18th, the EU will operate a transition period for the Carbon Border Adjustment Mechanism (CBAM) until the end of this year and will fully implement the system starting January next year. CBAM is a system that imposes carbon costs on high-carbon industrial products such as steel and aluminum at the same level as European domestic companies. Until this year, only carbon emission reporting obligations applied, but from next year, actual costs must be borne.

The products that will be directly hit are blast furnace-based products, which emit 4 to 5 times more carbon than electric arc furnace products. The problem is that about 70% of domestic steel production uses the blast furnace method. Among these, plate products such as hot-rolled steel sheets, thick plates, galvanized steel sheets, and color-coated steel sheets are considered core items and also have a high export share within the EU. Once the EU’s CBAM is fully implemented, these products are likely to see weakened price competitiveness due to the carbon tax burden.

According to the report "Impact and Implications of CBAM Introduction on the Steel Industry" released last year by the Korea Chamber of Commerce and Industry’s Sustainable Growth Initiative (SGI), if CBAM is fully implemented, the carbon costs that the Korean steel industry will have to bear in the EU over 10 years are expected to reach at least 3 trillion won. The estimated burden in the first year, next year, is 85.1 billion won, but it is expected to increase to more than 550 billion won by 2034.

The US government is also showing moves to strengthen carbon regulations in response to the EU. The Democratic Party has proposed the Clean Competition Act (CCA), which corresponds to a carbon tax, while the Republican Party has introduced the Foreign Pollution Fee Act (FPFA). At the state level, states such as California, Massachusetts, and Washington operate their own carbon emissions trading systems (ETS). The US, which has supported subsidies for eco-friendly facilities through the Inflation Reduction Act (IRA), is highly likely to apply carbon standards to imported products in the future.

The industry views automotive steel sheets, structural steel, and thick plates, which have a large export share to the US, as potential targets of regulation. These products also mainly rely on blast furnace-based production methods, so if US carbon regulations are strengthened in the future, a decline in price competitiveness due to tax burdens will be inevitable.

Exports to the US are already being hit by tariff effects. In March, Korean steel exports to the US were 250,000 tons, and aluminum was 96,844 tons, down 14.9% and 4.7% respectively compared to the same month last year. This is partly interpreted as an effect of the Trump administration’s second term ending duty-free benefits within quotas and reintroducing a 25% tariff on steel products starting from the 12th of last month. In addition, the EU has also strengthened and implemented steel safeguards (emergency import restrictions) from this month, raising concerns about a decrease in export volume.

The domestic steel industry is responding by accelerating the transition to eco-friendly production processes. POSCO and Hyundai Steel are developing hydrogen reduction steelmaking and carbon capture and storage (CCUS) technologies, and are increasing investments in expanding electric arc furnace use and developing high-value-added low-carbon products. They are also working with the government to establish emission measurement systems and international certification frameworks.

Within the domestic steel industry, carbon regulations are emerging as a new trade variable alongside tariffs, and export strategies are expected to undergo a major transformation. An industry official said, "Companies need thorough preparation to maintain export volumes," adding, "We are closely monitoring changes in carbon standards in major countries such as the US." Another official said, "It is an era where survival requires not only simple regulatory responses but also structural transformation to low-carbon technologies and diversification of export destinations in parallel."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)