Despite the Rate Cut, Fixed Rates Remain Unusually Cheaper

Banks Keep Additional Margins High on Variable Rates Under Financial Authorities' Guidance

Fixed Rates Expected to Remain Advantageous Even After Phase 3 DSR Implementation in July

Despite the common belief that variable interest rates are cheaper than fixed interest rates when rates are falling, a higher proportion of borrowers are choosing fixed rates. This is because financial authorities have issued administrative guidance to banks to increase the proportion of purely fixed-rate loans, leading banks to artificially keep variable rates high by raising the additional margins applied to variable rates. Even if the base interest rate is lowered in the future, fixed rates are still expected to be advantageous when the third phase of the Debt Service Ratio (DSR) regulation is implemented starting this July.

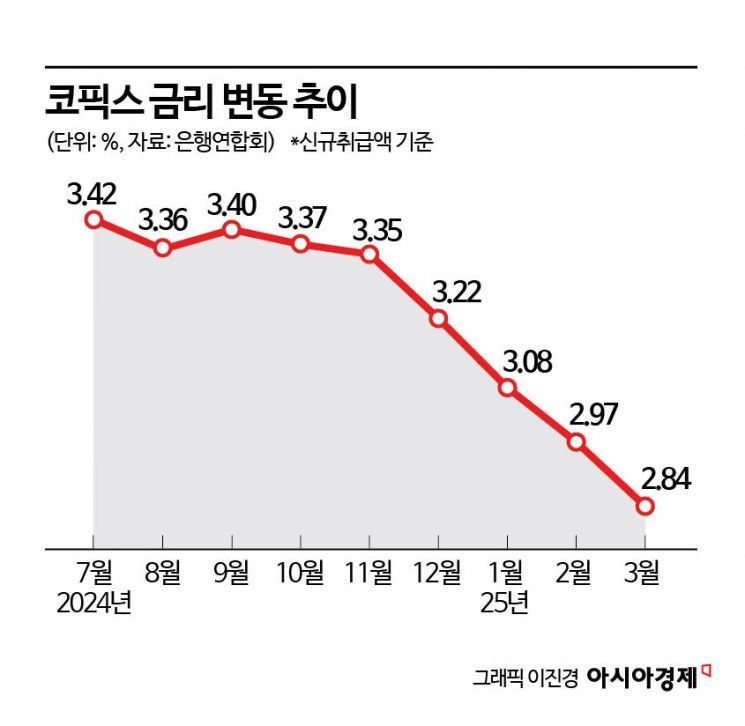

According to the Korea Federation of Banks on the 18th, the COFIX (Cost of Funds Index) based on new loan amounts in March fell by 0.13 percentage points from the previous month to 2.84%, marking a decline for six consecutive months. COFIX is an index calculated as the weighted average of interest rates applied when eight banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup, IBK Industrial Bank, SC First, and Korea Citibank) raise funds, and it serves as the benchmark for variable interest rates on mortgage loans in the banking sector. The COFIX rate dropped to the 2% range for the first time in two and a half years since August 2022 (2.96%) last month and has remained in the 2% range for two consecutive months.

With the decline in the COFIX rate, commercial banks began reflecting the COFIX rate in new mortgage loan variable rates starting from the 16th. Accordingly, the 6-month variable mortgage loan rate at KB Kookmin Bank dropped from 4.32?5.72% to 4.19?5.59%, and the jeonse deposit loan rate also decreased from 4.06?5.46% to 3.93?5.33%. Woori Bank's 6-month variable mortgage loan rate also fell from 4.20?5.70% to 4.07?5.57%.

Despite the decline in COFIX rates lowering variable mortgage loan rates, the upper and lower bounds of fixed-rate loan products remain lower than those of variable-rate products. KB Kookmin Bank's fixed-rate mortgage loan rates stand at 3.68?5.08%, which is 0.51 percentage points lower at both ends compared to variable rates. The fixed-rate jeonse deposit loan rates are also 3.40?4.80%, 0.53 percentage points lower at both ends. Hana Bank's 6-month variable mortgage loan rates range from 4.198?4.998%, while fixed rates (5-year fixed or hybrid) range from 3.452?4.252%, with fixed rates being 0.746 percentage points lower at both ends.

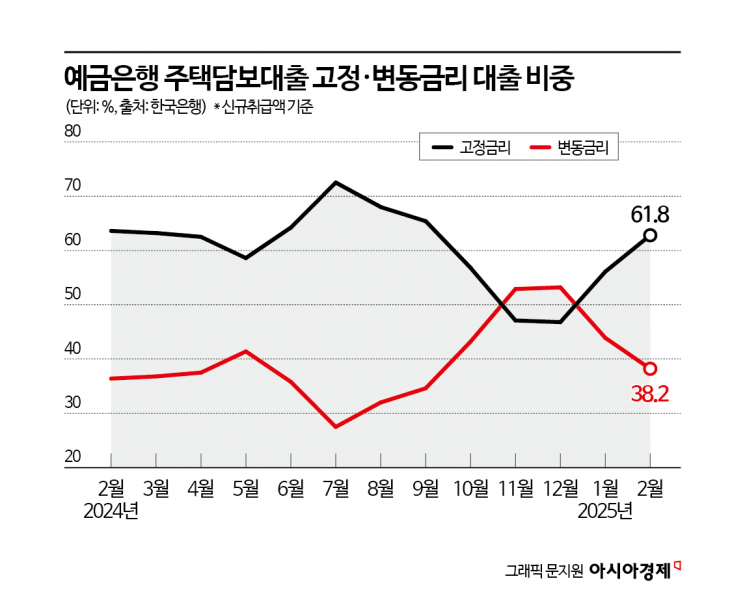

The reason fixed rates remain cheaper than variable rates despite the onset of a full-scale interest rate cut is due to the financial authorities' administrative guidance since last year to increase the proportion of 'pure fixed-rate' loans. Consequently, commercial banks have artificially raised the additional margins on variable rates to encourage borrowers to choose fixed rates. Additionally, K Bank, Kakao Bank, and NH Nonghyup Bank discontinued sales of hybrid mortgage loan products (5 years fixed, then variable) last year. Woori Bank also eliminated hybrid rate products starting February. On the other hand, fixed-rate products are increasing. Shinhan Bank and IBK Industrial Bank launched 10-year fixed-rate products in August and December last year, respectively. iM Bank also recently introduced a 5-year fixed-rate mortgage loan product.

In fact, the proportion of borrowers choosing fixed rates is steadily increasing. According to the Bank of Korea, as of the end of February, the proportion of purely fixed-rate loans among total household loans was 61.8%, up 5.7 percentage points from 56.1% in the previous month.

Even after the third phase of the DSR regulation is implemented in July, fixed rates are expected to remain cheaper. The stress DSR is a system that adds an additional interest rate to variable-rate loans to account for the possibility that borrowers' repayment ability may decline due to interest rate increases during the loan period. Due to this characteristic, the high additional margins on variable rates are further increased by the stress rate applied under the third phase of DSR. Currently, under the second phase, only 50% of the basic stress rate is applied, but from July, when the third phase is implemented, 100% (1.5 percentage points) will be applied.

An official from a commercial bank said, "Since the lower bound of fixed rates is in the 3% range, significantly lower than variable rates, the proportion of customers choosing fixed rates is much higher. If you plan to take out a mortgage loan, it is advantageous to first choose a 5-year fixed-rate product, and since early repayment fees have been reduced by more than half, refinancing later when variable rates drop further will be beneficial."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.