Financial Supervisory Service Announces

Foreign Securities Investment Trends for March 2025

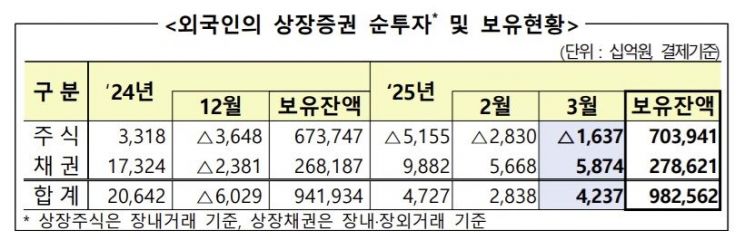

Foreign investors continued to sell domestic stocks in March, marking eight consecutive months of net selling.

According to the Financial Supervisory Service's 'Foreign Securities Investment Trends in March 2025' on the 18th, foreign investors net sold 1.637 trillion KRW worth of listed stocks last month, continuing the trend for eight months straight.

By market, they net sold 1.124 trillion KRW in the KOSPI and 513 billion KRW in the KOSDAQ. By region, they net sold 2.4 trillion KRW in Asia and 200 billion KRW in the Middle East. Conversely, they net bought 800 billion KRW in the Americas.

By country, Singapore recorded the largest net selling at 2.601 trillion KRW. Norway and the Netherlands followed with net sales of 626 billion KRW and 219 billion KRW, respectively. In terms of net buying, the United Kingdom led with 652 billion KRW, followed by the United States (574 billion KRW) and the Cayman Islands (505 billion KRW).

As of the end of March, the balance of listed stocks held by foreign investors stood at 703.941 trillion KRW, accounting for 27.3% of the total market capitalization. By country, the United States held the largest share at 282.7 trillion KRW, representing 40.2% of all foreign holdings. Europe followed with 218.8 trillion KRW (31.1%), Asia with 102.5 trillion KRW (14.6%), and the Middle East with 11.5 trillion KRW (1.6%).

In bonds, foreign investors continued net investment for the second consecutive month in March, following February. Last month, they net purchased 14.309 trillion KRW worth of listed bonds. Of this, 8.435 trillion KRW was received from matured bonds, resulting in a total net investment of 5.874 trillion KRW.

By region, Asia recorded the highest net investment at 2.9 trillion KRW, followed by the Middle East with 800 billion KRW and the Americas with 400 billion KRW. In terms of holdings, Asia led with 126.3 trillion KRW, accounting for 45.3% of the total, followed by Europe with 95.6 trillion KRW (34.3%).

Foreign investors mainly invested in government bonds (4.6 trillion KRW) and monetary stabilization bonds (1.2 trillion KRW). As of the end of last month, they held 252.6 trillion KRW (90.7%) in government bonds and 25.9 trillion KRW (9.3%) in special bonds.

By remaining maturity, net investment was made in bonds with maturities over 5 years (6 trillion KRW) and between 1 to 5 years (800 billion KRW). Conversely, bonds with less than 1 year to maturity saw a net redemption of 900 billion KRW. As of the end of last month, foreign investors held 65.4 trillion KRW (23.5%) in bonds with less than 1 year remaining, 87.4 trillion KRW (31.4%) in bonds with 1 to 5 years remaining, and 125.8 trillion KRW (45.1%) in bonds with over 5 years remaining.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)