Foreign Media Highlight Brazil's Trade Gains

FT: "China Turns to Brazil for Soybean Imports"

WSJ: "Low Likelihood of US Raising Tariffs on Brazil"

There is growing analysis in foreign media that Brazil is likely to be the biggest winner in the US-China trade war. The Financial Times (FT) reported on the 13th (local time) that "As China engages in a trade war with the US, it is turning its eyes to Brazil, the largest economy in Latin America, to import a variety of goods from soybeans to beef from regions other than the US." During the first trade war between the Trump administration and China in 2018, China expanded its supply chain to South America, and it is expected to shift its focus from US farms to Brazil, Argentina, and others.

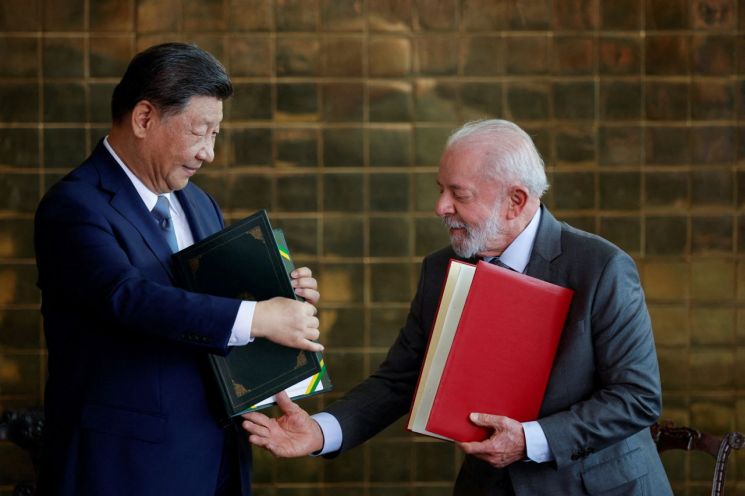

Last November, Brazilian President Luiz In?cio Lula da Silva and Chinese President Xi Jinping participated in the signing of a bilateral agreement. Photo by Reuters Yonhap News

Last November, Brazilian President Luiz In?cio Lula da Silva and Chinese President Xi Jinping participated in the signing of a bilateral agreement. Photo by Reuters Yonhap News

According to FT, the share of the US in China's food imports plummeted from 20.7% in 2016 to 13.5% in 2023, while Brazil's share expanded from 17.2% to 25.2% during the same period. Last year, Brazil exported 72.52 million tons of soybeans to China, an amount that has increased by 280% since 2010 and accounts for 73% of Brazil's total soybean exports. The US only exported 2,721 tons of soybeans to China last year.

In response, US farmers are urging the Trump administration to negotiate with China. Caleb Ragland, president of the US Soybean Association, sent an open letter to President Trump stating, "The agricultural economy is much weaker than during the first term. Since the first trade war, we have lost about 10% market share in China and have never regained it," urging, "Please reach an agreement with China. A deal is urgent." Jim Sutter, CEO of the US Soybean Export Council, also expressed concerns, saying, "During the first trade war, Brazilian soybeans were sold at about 20% higher prices than US soybeans. This led to large-scale investments in Brazil's agricultural sector and weakened the US's infrastructure and reliability-based competitiveness," warning that the US would be less competitive compared to Brazil.

On the 8th, Reuters also reported, "The tariff war initiated by Trump has caused significant pain to the US's long-time allies and close trading partners, including the European Union (EU), Japan, and South Korea, but it has given hope to competitors such as Brazil, India, Turkey, and Kenya." In particular, Brazil, an agricultural powerhouse subject to the lowest mutual tariff rate of 10%, is expected to benefit from the retaliatory tariffs exchanged between the US and China. Besides soybeans, beef, chicken, corn, sorghum, and wheat, which China imports in large quantities from the US, are also affected by tariffs.

Additionally, on the 1st, The Wall Street Journal (WSJ) published an article titled "Brazil is likely to be the biggest winner in the US-China trade war," stating, "China is already purchasing large quantities of Brazilian agricultural products such as soybeans, and all Brazilian suppliers, from cotton to chicken, are rejoicing over the China boom," and "Brazil is also rich in iron ore and oil, ready to supply raw materials to China."

As a result, Brazil's benchmark stock index, the Bovespa Index, has risen 9% this year, and the Brazilian real is also strong. Furthermore, Brazil is the largest shoe producer outside Asia, and due to lower tariffs than China (145%), there are expectations that light industrial products such as shoes will be massively exported to the US. WSJ forecasted, "Since the US consistently records a trade surplus in trade with Brazil, US tariffs on Brazil are unlikely to rise sharply," and predicted, "Brazil is likely to be the biggest beneficiary of the US-China trade war."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.