CATL LFP Dominates with High Safety in ESS Market

Korean ESS Sector Attracts Attention as CATL Accelerates Entry

The reason why the entry of Chinese battery company Ningde Shidai (CATL) into Korea is threatening is that it is highly likely to dominate the domestic energy storage system (ESS) sector by leveraging its technological prowess and liquidity. ESS, which is sensitive to fires, prefers prismatic lithium iron phosphate (LFP) batteries that offer better efficiency and safety compared to ternary batteries. In this market, CATL has virtually established a 'monopoly system.' In the domestic industry, where performance slumps due to the chasm (temporary demand stagnation) have prolonged, government subsidy policies are expected to act as a key variable.

According to a comprehensive evaluation from the battery industry on the 16th, CATL, which is about to establish a Korean corporation, is expected to expand its business mainly in the domestic ESS LFP battery sector. Since its early days when it was spun off from ATL's automotive battery division in 2011 and established as a company, CATL has focused on LFP batteries and is recognized for its long commercialization experience, technological capabilities, and price competitiveness.

CATL LFP Gains Attention in ESS Market Where Safety Is a Key Issue

Even when the industry's focus shifted to ternary (NCM, NCA) batteries from 2015 due to electric vehicle demand, CATL simultaneously developed LFP technology, concentrating on cell design and improving low-temperature performance. Later, it compensated for the energy density weakness by adopting cell-to-pack (CTP) technology, which installs cells directly into packs without modules, and gained global attention by supplying batteries for Tesla Model 3 produced in China in 2020. It is currently supplying LFP batteries to major automakers such as Ford in 2022 and BMW in 2023, and is reportedly in talks to supply LFP batteries to Hyundai Motor Company as well.

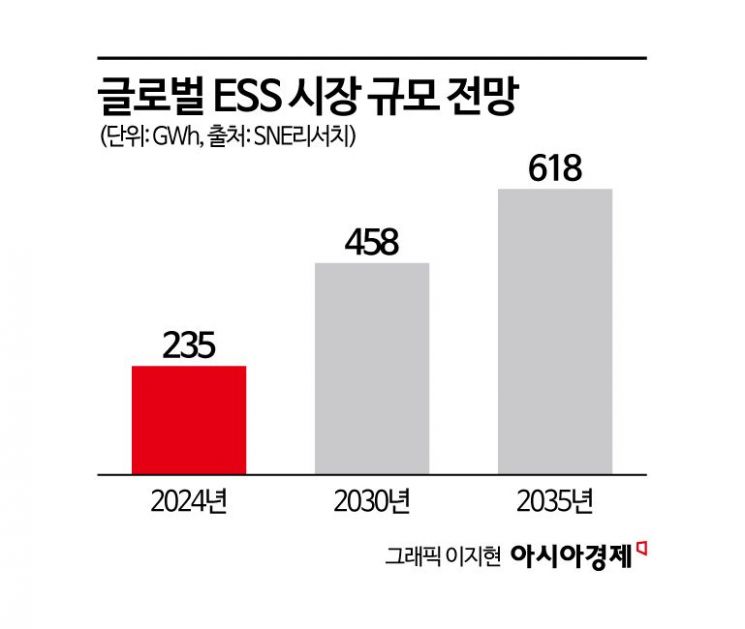

CATL's establishment of a Korean corporation is drawing more attention as it coincides with the full-scale launch of domestic ESS construction projects. Following the confirmation of the 11th Basic Plan for Electricity Supply and Demand in February this year, the government plans to order the largest-ever ESS construction project of 540 MW within this month.

ESS has frequently experienced fire accidents due to complex causes such as high-temperature environments, rapid charging and discharging, and internal battery defects. For this reason, prismatic LFP batteries, which have superior heat resistance and structural safety compared to the less stable ternary batteries, have rapidly emerged. CATL holds global competitiveness in this sector. Tesla also equips some models with CATL's prismatic LFP batteries. On the other hand, the three domestic battery companies?LG Energy Solution, Samsung SDI, and SK On?do not mass-produce prismatic LFP products. An industry insider said, "Chinese battery companies have overcome the disadvantage of high resistance in ultra-wide prismatic batteries," adding, "In the ESS business, Chinese companies' LFP competitiveness is significantly ahead of domestic companies."

CATL Armed with Ammunition... Focus on Government Subsidies

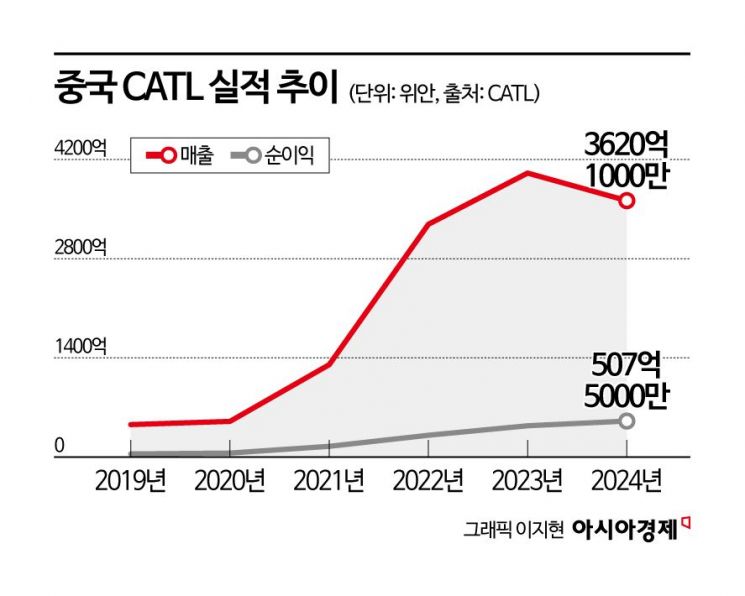

Not only technological prowess but also abundant liquidity and additional fundraising plans are CATL's weapons. This enables low-price offensives and large-scale investments. CATL plans to raise more than $5 billion (about 7.145 trillion KRW) by July through listing on the Hong Kong stock market.

Its profit scale is also rapidly growing. In the last second quarter, sales reached 84.7 billion yuan (about 16.5 trillion KRW), up 6.2% year-on-year, and net profit surged 32.9% to 13.93 billion yuan. The facility utilization rate, which was about 90% in the fourth quarter of last year, has risen to 100%, indicating a boom in both production and sales, according to company officials. In contrast, the domestic industry, except for LG Energy Solution, is expected to post losses in the thousands of billions of won in the first quarter.

However, the industry consensus is that CATL, which started as a sales corporation without production facilities, will find it difficult to achieve large-scale order results or dominate the domestic market in the short term. Without cooperation with domestic suppliers, research and development (R&D) support or subsidy benefits are virtually impossible, and import dependence on Chinese products is also subject to restraint under the policy of localization of materials, parts, and equipment. According to the Advanced National Strategic Industry Act, tax credits of up to 25% require investment in production facilities as a prerequisite.

Professor Moon Hak-hoon of the Future Electric Vehicle Department at Osan University said, "The import ratio of cathode and anode materials from China by the three domestic battery companies exceeds 70%," adding, "Given the possibility of trade disputes, it will be difficult for our government to block the entry of Chinese companies." He further added, "A plan should be prepared to protect the domestic industry by providing differentiated subsidies according to battery performance and characteristics."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.