Credit Card Fee Rates for Top-Tier General Hospitals Raised to 2.25%

Management Struggles Worsen as Patient Numbers and Treatments Drop Due to Medical-Government Conflicts

"Preferential Fee Rates Should Be Applied Considering the Public Nature of Medical Institutions"

As credit card companies once again raised the credit card payment fee rates for large general hospitals, hospitals are demanding a reduction in the fee rates considering the public nature of medical institutions. This is because hospitals, already struggling with operations due to last year's medical-government conflicts, find it difficult to continue bearing credit card fee costs that exceed 10 billion KRW in some cases.

According to the hospital industry on the 16th, major credit card companies such as BC, Shinhan, Woori, and Hyundai raised the credit card fee rates applied to large general hospitals from an average of 2.2% to 2.25% starting last month.

An official from a top-tier general hospital in Seoul said, "At the end of February, we received consecutive notifications from credit card companies about a 0.05 percentage point increase in fee rates," adding, "We have yet to recover the reduced number of patients and medical treatments following the medical-government conflicts, and hospitals are facing additional annual credit card fee costs amounting to hundreds of millions of KRW."

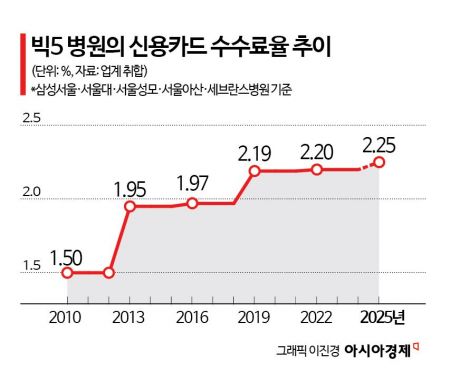

Before the credit card fee restructuring in 2012, medical institutions uniformly applied an industry-specific fee rate of 1.5%. However, since then, the fee rates have varied according to sales volume, with large general hospitals seeing increases to 1.95% in 2013, 1.97% in 2016, 2.19% in 2019, and 2.2% in 2022. This rate is already close to the credit card fee cap of 2.3% set by financial authorities and is higher than the approximately 2% fees applied in department stores, large marts, and the automobile industry.

Accordingly, in 2023, one top-tier general hospital spent 14.1 billion KRW solely on card fees, and the total card fees for the Big 5 hospitals (Samsung Seoul, Seoul National University, Seoul St. Mary's, Seoul Asan, Severance) reached 52.4 billion KRW. Even last year, when medical treatments sharply declined due to the medical-government conflicts, these five hospitals' card fee costs amounted to 45.5 billion KRW, averaging 9.1 billion KRW each.

The problem lies in the fact that medical fees such as consultation, surgery, and hospitalization charges are set according to health insurance rates, so unlike other industries, hospitals cannot pass on the increased card fees to consumers by including them in medical fees.

Another hospital official explained, "Even when medical revenues exceed trillions of KRW, the high proportion of labor costs, along with rapidly increasing expenses for pharmaceuticals, treatments, and operational management, make it difficult for most general hospitals to achieve net profit margins of 2-3%. We are in a situation where we have to tighten our belts, so card fee costs are a significant burden."

Therefore, hospitals are requesting preferential treatment for credit card fee rates, considering the public and special nature of medical institutions. They argue that applying card fees to patients' medical expenses as if they were department store purchases is unreasonable.

Ra Byunghak, General Secretary of the Financial Officers Association of Top-tier General Hospitals (Head of Finance Team at Catholic Medical Center), stated, "Last year, the Big 5 hospitals bore card fee costs of 45.5 billion KRW at a 2.20% fee rate. Compared to applying a 1.5% fee rate, this means an additional total expenditure of 14.6 billion KRW, or nearly 3 billion KRW per hospital," adding, "A portion of the health insurance premiums paid by the public is accruing as profits to credit card companies."

At the National Assembly level, there is sympathy for the hospital industry's demands. Lee Sujin, a member of the Health and Welfare Committee from the Democratic Party, proposed a bill last year mandating the application of statutory preferential credit card fee rates (0.5-1.5%) to medical institutions including hospitals and clinics. She plans to push for maximum discussion on this matter in the Legislative and Judiciary Committee's bill review subcommittee in the first half of this year.

Lee emphasized, "In an aging society, hospitals, which are essential to the public and people's lives, need the application of preferential credit card fee rates to strengthen financial soundness and provide high-quality medical services to the public."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)