Lower Rent Burden for Small and Medium Duty-Free Shops

Multiple Arrival-Area Stores Without Competition

Higher Margins Lead to Improved Profitability

Duty-free shops under major distribution conglomerates such as Lotte, Shilla, Shinsegae, and Hyundai faced poor business performance last year due to a downturn in the industry, while the small and medium-sized enterprise Gyeongbokgung Duty-Free Shop continued to post profits, resulting in a mixed outlook. Unlike large companies, Gyeongbokgung operates duty-free shops in both arrival and departure areas, increasing margins, and has relatively lower rental costs, leading to higher profitability.

Gyeongbokgung Duty Free Shop at Gimhae International Airport Departure Hall. Provided by Gyeongbokgung Duty Free Shop

Gyeongbokgung Duty Free Shop at Gimhae International Airport Departure Hall. Provided by Gyeongbokgung Duty Free Shop

According to the Financial Supervisory Service's electronic disclosure system on the 17th, Gyeongbokgung Duty-Free Shop's sales last year increased by 5.6% year-on-year to 213.5 billion KRW. Operating profit decreased by 28.4% from 19 billion KRW the previous year to 13.6 billion KRW, but it maintained a profit exceeding 10 billion KRW for three consecutive years since turning profitable with 10 billion KRW in 2022.

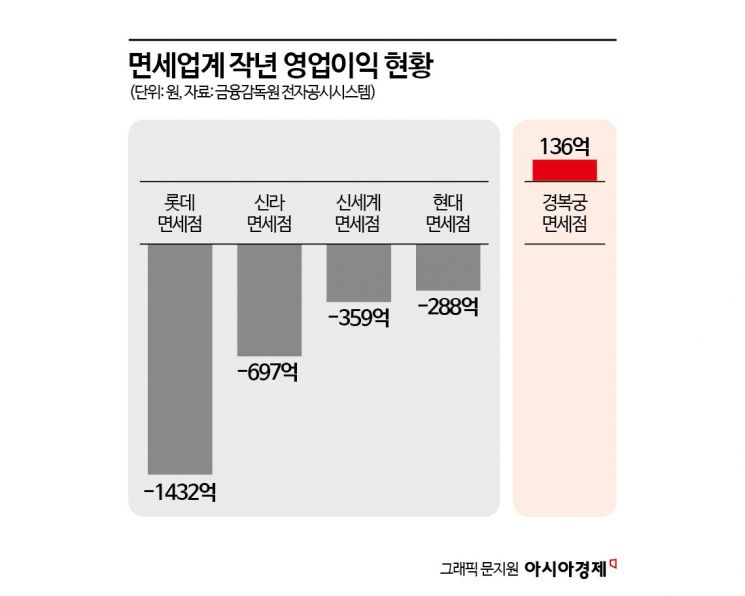

This contrasts with large corporate duty-free shops, which recorded operating losses ranging from several hundred billion to up to one trillion KRW due to factors such as a decrease in domestic customers caused by high exchange rates, economic downturn in China?their main market?rental cost burdens, and estimated liabilities arising from changes in ordinary wage standards following a Supreme Court ruling in December last year. The total operating losses of four duty-free companies last year amounted to 280 billion KRW, with Lotte Duty-Free at 143.2 billion KRW, Shilla Duty-Free at 69.7 billion KRW, Shinsegae Duty-Free at 35.9 billion KRW, and Hyundai Duty-Free at 28.8 billion KRW.

Gyeongbokgung Duty-Free Shop is under Entas, a food service specialist company operating brands such as Korean cuisine Gyeongbokgung, Japanese cuisine Sapporo, and Chinese cuisine Paljinhyang. As of last year, it operated duty-free shops in the arrival and departure areas of Incheon International Airport Terminals 1 and 2, the arrival area of Gimhae Airport, and the departure area of Cheongju Airport. Industry insiders believe that securing multiple arrival-area duty-free business rights, which large corporations cannot enter, contributed to the improved performance of Gyeongbokgung Duty-Free Shop.

An industry insider explained, "Arrival-area duty-free shops are visited by travelers who missed the chance to purchase gifts either when departing or at overseas destinations and see it as their last opportunity," adding, "In departure-area duty-free shops with multiple operators, cutthroat competition is inevitable to attract consumers, but in arrival-area shops where only small and medium-sized duty-free shops operate, higher margins still lead to sales, resulting in higher profitability."

In fact, the cost of goods sold as a proportion of Gyeongbokgung Duty-Free Shop's sales was 52% in 2021 but dropped to an average of 49% from 2022 through last year. In comparison, the cost ratio of the listed company Hotel Shilla ranges from 57% to 60%, about 10 percentage points higher. Simply put, selling a product priced at 1 million KRW yields about 100,000 KRW more in margin. Gyeongbokgung Duty-Free Shop is also expected to see continued performance growth after acquiring the duty-free business rights for the departure area of Gimhae Airport, which officially began operations in February.

Another factor behind the strong performance is the relatively lower rental fees paid to Incheon International Airport Corporation compared to duty-free shops under large corporations. With fixed costs set relatively low and high product sales, profit margins increase. Gyeongbokgung Duty-Free Shop paid 70.3 billion KRW in rent in 2023 and 75.3 billion KRW last year. In contrast, the listed company Hotel Shilla's rent increased from 471.9 billion KRW in 2023 to 704 billion KRW in one year. This amount includes rent for hotels operated under lease, such as Shilla Stay, as well as duty-free shop rent. Considering that Shilla Duty-Free began operating the Incheon Airport duty-free shop in the second half of 2023, it is estimated that about 200 billion KRW was spent on duty-free shop rent last year, at least twice the amount paid by Gyeongbokgung Duty-Free Shop.

Incheon Airport duty-free shop rent is calculated by multiplying the expected average spending per customer by the number of airport users. For small and medium-sized duty-free operators, the base rate is lower than that of large corporate duty-free shops due to relatively weaker scale, business experience, and brand symbolism. Additionally, after winning the business rights, large duty-free shops must pay a certain rental deposit in cash, whereas small and medium-sized enterprises can issue a guarantee certificate instead, reducing the entry burden.

An industry insider said, "As COVID-19 prolongs and the industry worsens, it is difficult even to meet the conservatively estimated average spending per customer," but added, "While it is true that the industry voices concerns about rental fee burdens, it is a sensitive issue due to the positions of related government departments and stakeholders," refraining from further comment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.