Non-performing Loans at Top 5 Banks Surge by Over KRW 1 Trillion in One Year

Delinquency Rate Hits Highest Level Since 2017

Banks Tighten Lending Standards and Accelerate Bad Loan Sales to Manage Soundness

As the number of individual business owners and small and medium-sized enterprises (SMEs) going out of business increases due to high inflation and economic recession, non-performing loans in the banking sector are also rising accordingly. Both the loan volume and delinquency rates are increasing simultaneously. In particular, fixed non-performing loans classified as bad debts and non-performing loans known as "empty-can loans" have significantly increased. With non-performing loans in the banking sector expected to rise further, banks are raising lending standards to manage soundness, making it even more difficult for companies with low credit ratings to secure financing.

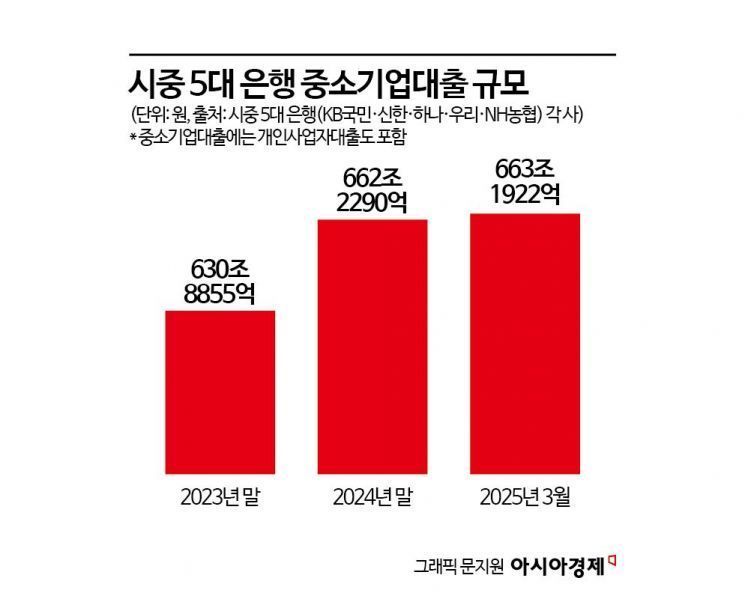

According to the banking sector on the 14th, as of the end of March 2025, the total loans to SMEs (including individual business loans) by the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) amounted to KRW 663.1922 trillion. This represents an increase of about KRW 23 trillion compared to one year earlier (March 2024).

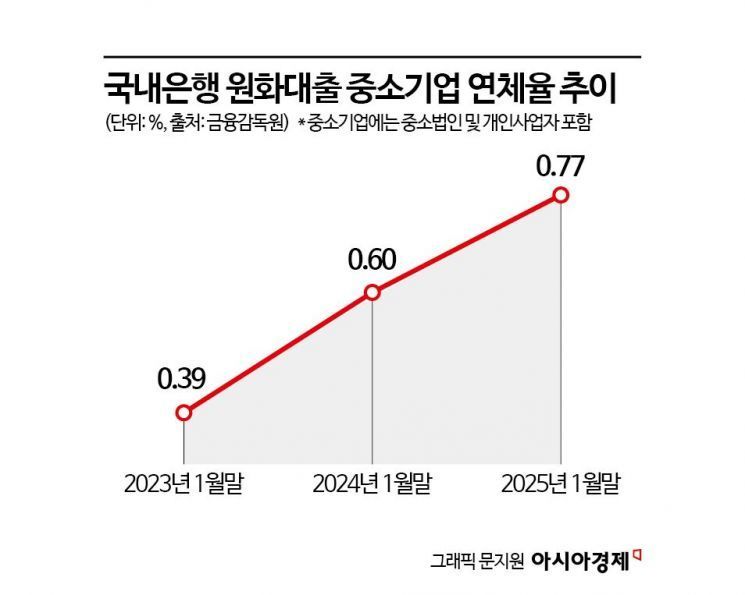

Not only the loan volume but also the delinquency rate is on the rise. According to the Financial Supervisory Service, as of the end of January this year, the delinquency rate for won-denominated loans (based on principal and interest overdue for more than one month) for SMEs at domestic banks was 0.77%, up 0.15 percentage points from the end of the previous month. Compared to one year ago, the end of January 2024 (0.60%), it increased by 0.17 percentage points, and compared to two years ago, the end of January 2023 (0.39%), it has nearly doubled.

The quality of loans has also deteriorated. As of the end of last year, fixed non-performing loans at the five major commercial banks totaled KRW 5.5807 trillion, increasing by more than KRW 1 trillion in one year. At the end of 2023, fixed non-performing loans at the five major banks were KRW 4.4943 trillion, representing about a 24% increase in one year. Fixed non-performing loans are a representative indicator of bank soundness and refer to loans overdue for more than three months. Financial institutions classify loans into five categories based on asset soundness: normal, precautionary, fixed, doubtful, and estimated loss. Among these, fixed, doubtful, and estimated loss are collectively called fixed non-performing loans.

Non-performing loans that are so-called "empty-can loans," where banks cannot even collect interest, also increased by more than KRW 1 trillion during the same period. At the end of last year, non-performing loans at the five major commercial banks amounted to KRW 4.3736 trillion, up 24.2% from KRW 3.5208 trillion at the end of the previous year (2023). Non-performing loans refer to loans overdue for more than three months or loans with no interest income due to legal management, etc.

With non-performing loans expected to increase further, red flags have been raised regarding the soundness management of the banking sector. Domestically, sluggish domestic demand due to economic recession and, externally, increased exchange rate volatility due to the U.S.'s tariff war warnings are contributing factors. Therefore, despite strong net profits in the first quarter of this year, soundness management in the banking sector is expected to become more stringent. Hyejin Park, a researcher at Daishin Securities, analyzed, "The rise in delinquency rates has been significant since the beginning of this year, with the SME loan delinquency rate reaching 0.77% in January. It is understood that it rose even further in February, marking the highest level since 2017."

Typically, from April, when the first quarter's financial statements are finalized, corporate credit reassessment begins, and companies with downgraded credit ratings are expected to face higher lending thresholds.

The banking sector is accelerating efforts to strengthen corporate loan management and sell non-performing loans. Hana Bank has included industries such as the secondary battery sector, which is directly exposed to increased corporate loan default risks, in its key management sectors through credit checks and audits to reduce loan concentration. KB Kookmin Bank plans to sell non-performing loans worth up to KRW 600 billion in the first half of this year alone.

An official from the banking sector said, "Since last year, we have been acutely aware of the seriousness of SME loan delinquency rates," adding, "We are making efforts to write off and sell non-performing loans to manage soundness while supporting SMEs and individual business owners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)